Tuesday, April 30th 2019

AMD Reports First Quarter 2019 Financial Results- Gross margin expands to 41%, up 5 percentage points year-over-year

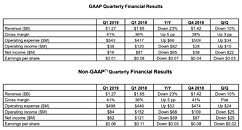

AMD today announced revenue for the first quarter of 2019 of $1.27 billion, operating income of $38 million, net income of $16 million and diluted

earnings per share of $0.01. On a non-GAAP(*) basis, operating income was $84 million, net income was $62 million and diluted earnings per share was $0.06.

"We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year," said Dr. Lisa Su, AMD president and CEO. "We look forward to the upcoming launches of our next-generation 7nm PC, gaming

and datacenter products which we expect to drive further market share gains and financial growth."Q1 2019 Results

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below. For the second quarter of 2019, AMD expects revenue to be approximately $1.52 billion, plus or minus $50 million, an increase of approximately 19 percent sequentially and a decrease of approximately 13 percent year-over-year. The sequential increase is expected to be driven by growth across all businesses. The year-over-year decrease is expected to be primarily driven by lower graphics channel sales, negligible blockchain-related GPU revenue and lower semi-custom revenue. AMD expects nonGAAP gross margin to be approximately 41 percent in the second quarter of 2019.

earnings per share of $0.01. On a non-GAAP(*) basis, operating income was $84 million, net income was $62 million and diluted earnings per share was $0.06.

"We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year," said Dr. Lisa Su, AMD president and CEO. "We look forward to the upcoming launches of our next-generation 7nm PC, gaming

and datacenter products which we expect to drive further market share gains and financial growth."Q1 2019 Results

- Revenue was $1.27 billion, down 23 percent year-over-year primarily due to lower revenue in the Computing and Graphics segment. Revenue was down 10 percent quarter-over-quarter primarily due to lower client processor sales.

- Gross margin was 41 percent, up 5 percentage points year-over-year, primarily driven by the ramp of Ryzen and EPYC processor and datacenter GPU sales. Gross margin was up 3 percentage points quarter-over-quarter primarily due to a charge in the fourth quarter of 2018 related to older technology licenses. Non-GAAP gross margin was flat quarter-over-quarter.

- Operating income was $38 million compared to operating income of $120 million a year ago and $28 million in the prior quarter. Non-GAAP operating income was $84 million compared to operating income of $152 million a year ago and $109 million in the prior quarter. The year-over-year decline was primarily due to lower revenue and operating income in the Computing and Graphics segment.

- Net income was $16 million compared to net income of $81 million a year ago and $38 million in the prior quarter. Non-GAAP net income was $62 million compared to net income of $121 million a year ago and $87 million in the prior quarter.

- Diluted earnings per share was $0.01, compared to diluted earnings per share of $0.08 a year ago and $0.04 in the prior quarter. Non-GAAP diluted earnings per share was $0.06, compared to diluted earnings per share of $0.11 a year ago and $0.08 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.2 billion at the end of the quarter.

- Computing and Graphics segment revenue was $831 million, down 26 percent year-over-year and 16 percent quarter-over-quarter. Revenue was lower year-over-year primarily due to lower graphics channel sales, partially offset by increased client processor and datacenter GPU sales. The quarter-over-quarter decline was primarily due to lower client processor sales.

- Client processor average selling price (ASP) was up year-over-year driven by Ryzen processor sales. Client ASP was down slightly quarter-over-quarter due to a decrease in mobile processor ASP

- GPU ASP increased year-over-year primarily driven by datacenter GPU sales. GPU ASP was up sequentially driven by improved product mix.

- Operating income was $16 million, compared to operating income of $138 million a year ago and operating income of $115 million in the prior quarter. The year-over-year and quarter-over-quarter operating income decreases were primarily due to lower revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $441 million, down 17 percent yearover-year and up 2 percent sequentially. The year-over-year revenue decrease was primarily due to lower semi-custom product revenue, partially offset by higher server sales. The quarter-over-quarter increase was primarily driven by higher semi-custom revenue.

- Operating income was $68 million, compared to operating income of $14 million a year ago and an operating loss of $6 million in the prior quarter. The year-over-year and sequential improvements were primarily driven by a $60 million licensing gain associated with the company's joint venture with THATIC.

- All Other operating loss was $46 million compared with operating losses of $32 million a year ago and $81 million in the prior quarter. The prior quarter included a $45 million charge related to older technology licenses.

- Google announced at the Game Developers Conference that it has selected high-performance, custom AMD RadeonTM datacenter GPUs and AMD software developer tools for its Stadia nextgeneration game streaming platform. Also at the conference, AMD announced a number of updates to its software tools to help game developers accelerate game design and foster innovation.

- Amazon Web Services announced broader availability of AMD EPYC processor-based service and launched three new EPYC processor-powered EC2 instance families, including the first T3-series instances.

- Sony Interactive Entertainment released new details about its upcoming next-generation game console, which will be powered by a custom AMD chip based on the "Zen 2" CPU and "Navi" GPU architectures.

- Apple announced updates to its 21.5-inch iMac and 27-inch iMac computers, which for the first time offer "Radeon Pro Vega" graphics cards. The 21.5-inch iMac with Radeon Vega 12 GPUs delivers up to 80 percent faster graphics performance than the previous generation. The 27-inch iMac with

- Radeon Vega 10 GPUs delivers up to 50 percent faster graphics performance.

- OEMs announced new systems based on the expanded lineup of consumer and commercial mobile processors from AMD.

- HP and Lenovo announced commercial PCs powered by the 2nd Gen AMD Ryzen PRO mobile processors with Radeon Vega Graphics and AMD AthlonTM PRO mobile processors with Radeon Vega Graphics. At HP Reinvent, the company announced the HP ProBook 445R G6 and HP ProBook 455R G6, powered by 2nd Gen Ryzen mobile processors, and the HP ProDesk 405 G4 Desktop Mini powered by 2nd Gen Ryzen PRO processors. For consumers, HP announced the latest HP ENYY x360 13 and 15, both featuring 2nd Gen Ryzen mobile processors.

- Lenovo announced the IdeaPad S540 and IdeaPad S340 powered by 2nd Gen Ryzen mobile processors.

- Multiple customers began shipping new 2nd Gen AMD Ryzen mobile-powered laptops, including the new ASUS FX505 and 705DY TUF Gaming notebooks, with additional systems coming throughout 2019.

- AMD announced the new AMD Ryzen Embedded R1000 SoC, growing the AMD Ryzen embedded family of processors. The SoC will be used in numerous embedded applications from customers like Advantech, IBASE, ASRock, Kontron, MEN and others. It will also power the upcoming Atari VCS entertainment system.

- Demonstrating its commitment to workplace equality, AMD was included in the 2019 Bloomberg Gender-Equality Index and received a perfect score of 100 on the Human Rights Campaign Foundation's 2019 Corporate Equality Index.

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below. For the second quarter of 2019, AMD expects revenue to be approximately $1.52 billion, plus or minus $50 million, an increase of approximately 19 percent sequentially and a decrease of approximately 13 percent year-over-year. The sequential increase is expected to be driven by growth across all businesses. The year-over-year decrease is expected to be primarily driven by lower graphics channel sales, negligible blockchain-related GPU revenue and lower semi-custom revenue. AMD expects nonGAAP gross margin to be approximately 41 percent in the second quarter of 2019.

42 Comments on AMD Reports First Quarter 2019 Financial Results- Gross margin expands to 41%, up 5 percentage points year-over-year

Unfortunatelly, it won't be much better, up to 15% in best case

LOL "won't be much better, up to 15% in best case" while Intel getting CPUs gen by gen by a 5% jump.

A potential 15% increase is still MUCH better than Intel was dishing out with each chip refresh while requiring a new board for it too.

Sometimes even a 5% increase wasn't truly realized - Even a 7% increase beats what Intel had been doing.

On Navi raytracing- Lisa didn't want to say- more info only near launch

VERY Nice! :respect:

Buuut it's all kind of moot right now. Gotta see them in the wild for a bit before anyone can really say how much of an upgrade they are. What is for certain is that from the original launch of Zen, AMD has gained an astonishing amount of ground. And it's starting to show. Even if Zen 2 only offers 15% over Zen+, that's still enough to keep them moving and surely enough to keep expanding profits and market share. This in turn leads to more R&D which leads to more significant performance increases, not to mention the need for more competition from Intel. To me, it would still be a good thing, for everyone.

AMD has made some big moves, to be sure. But I think where they have really been excelling is in the 'slow and steady' game. It's easy to look at what they've been up to and not think much of them. There are legitimate arguments to be had there. But that's also why they're succeeding. "One rung at a time" has been their MO. They put enough skin in the game to keep playing and snatching up some smaller victories, as well as a few key ones... which is really another way of saying they've focused on staying in the black as a way of advancing their position in the market. And it seems to be working. To play with the big boys when you're not nearly as big, you have to leverage effectively. As the saying goes "When you do something right, people won't know you've done anything at all." As long as you're making profits, you can always have growth. Whether it's a little or a lot, that's a good thing... but only when there is also sustainability.

You could think of it like this. Say they dumped more R&D in to their CPU's (or even their GPU's - like so many seem to expect,) reaching for that showstopper. The problem I think a lot of people don't see there is that R&D doesn't scale linearly with profitability in pretty much any area of tech. It's a balancing act. A major cost that needs to be offset as quickly as possible. The longer it takes to pick up, the more dire and limiting the situation becomes. Better to spend the money you know will make you money than go all in on what turns out to be a flop... or, just as bad, come out with the best thing ever and make no money on it because people aren't willing to pay enough to offset the huge cost difference. It is very hard to generate large performance increases without drastically increasing the price point. Every now and then R&D comes up with a silver bullet and a way to make it affordable to make turns up right in time, but that is the exception. Usually, to make a big move like that, you need to be able to afford being in the red for a good long time, with plenty of other revenue sources far ahead enough to make up a net profit. Very, very unlikely for any company to pull this off. Even if they CAN do it, it's almost never the best move in the long run. At best you take greater risks to ultimately arrive at the same point. On the surface it sounds like a no-brainer, but it's a total hail mary in practice. You see these flashes in the pan with new tech all of the time. Stuff takes off for a while, but ultimately dies because the progress made wasn't sustainable and production was never really affordable. So as the interest and excitement died off, so did the people behind the tech.

Honestly, a modestly respectable uptick with Zen 2 is exactly what I expect from them. They're simply tending to their little Zen garden. Most reasonable people, I think, don't expect any more or less. It's easy to look at the performance and say "whatever" but when you look at the numbers, you see it's actually working amazingly well for them. And people actually like their products. The niches for them continue to grow. Nobody ever thought this would happen in the beginning. From where they started till now, they've reached a point where they're becoming real contenders. A power move would be a total waste of everything they've built. Why fix what isn't broken? I'd love a supercharged Ryzen 3000, but more than that I would like to see AMD continue to pursue long-term stability and establish themselves in a way that continues to allow for a level of steady growth that the competition has been lacking in for too long now. Can't climb a mountain in an afternoon. Keep on chuggin along, setting and meeting expectations, while bringing a little something new to the table every time. Not every new launch can or should be a total revolution. It just needs to be another step forward, and one that leads to many more steps forward. That's how you do it. It's a little different from Intel's crab walk in that every launch is opening doors for them. A very good thing to see in any tech-driven industry. It's not always about who's got the best stuff. It's about who's consistently moving forward. To take and hold those positions you have to put in the time to grind-out a foundation... a way of developing and releasing tech that continues to raise the bar sufficiently and secure profits/market. One big move is not nearly enough to make that happen, and often has the opposite effect.

Basically, their next move is likely still going to be on the safe side... something they know they will profit and grow from. Zen 2 won't and doesn't need to be their Intel killer. That's never been how they've operated.

Their GPU's are a different story. But I think that too is a calculated choice. They're not taking any risks or stretching themselves thin. This may change if they ever get on top of the CPU game. Barring that I think they'll continue to float by and let Nvidia have their empire. Not much in it for them right now. I think not pursuing that is part of the reason they're more successful. They'd no doubt be hurting quite a lot right about now if they acted any differently. It's enough for them to not be a total failure, which for the most part, I think they've accomplished. GPU market changes have set them back a little, but it looks like they must've anticipated that. And what they have put forth there has been reasonably successful in my eyes - for what it is. Maybe not as much as people have hoped, but not less so than AMD expected.

Not saying anything... I just watched way too much star wars as a kid.

Proceed with topic.

Gross margin makes it to the article title (how much am I not surprised...?)?

That's still very poor compared to Intel. Long way to go.

But sure: by asking lower prices, AMD is in fact lowering Intel's margins. Intel is few % down, AMD is few % up. But it's still 57% vs 41%.

As a result, Intel is making a lot of money and AMD is not making any.

And remember: Zen is all about gross margin. They should beat Intel here - especially since the Blues are also making other, less profitable products.

In other words: Zen CPUs are way too cheap.In a particular store... Intel's revenue is still 10x larger and stable. AMD revenue is dropping quickly. 1st gen Ryzen lineup was more expensive than 2nd gen.It's expected to be a slower GPU, so hard to imagine it costing more...Workstation CPU with IGP - to compete with Xeon G lineup.

This is very interesting IMO.

Oc potential could be higher and efficiency should be better. Also, we should see more cores coming to the mainstream and we might even see more than a 15% increase from 2700x to a 12-core 5ghz model in per core performance!

If there's a 16-core I might even skip that for a better gaming 12-core with higher boost clocks, though 16-cores is better for streaming and recording, so I'm excited either way!

120$b vs 38$b? That's a huuuuuge difference. And why is it so big?

Radeon vii is nice, but is mostly to keep up appearances and Zen+ will mostly sell better in laptops, not so much desktops where lots of people already had Zen processors.

At least AMD is nowhere near the levels of bulldozer and fiji-asco!

Also, they do have 18-20m a year sold PS5 APU contract starting 2H 2020.

Huawei Launches 2U 4-node Taishan X6000 V2 Server with Kunpeng 920 Arm Processor

aws.amazon.com/ec2/amd/

Even if Intel wants to make more 28 Xeons- their Yield are very low compared to tiny AMD's chiplets.

P.S: Did you see the power usage of the new XEON 8280? even agains EPYC 32C is very High, now consider 7nm EPYC.

Putting different chiplets in a package is an interesting option, but again: more likely for workstations. They could combine 3 faster CPU chiplets and one GPU or FPGA.

In a server you're less limited by space and cooling, so it's better (more flexible) to go full CPU in the package and add whatever PCIe cards you need.

With mixed chiplets it'll be very hard to use 100% of CPU and sockets are very expensive.Amazon offers some instances based on EPYC. We don't know how many CPUs they actually bought, so we don't know how big the stab could be.

Amazon says EPYC instances are 10% cheaper for the same performance. Well, in some loads there are, in some they aren't.

Phoronix tested this not long ago:

www.phoronix.com/scan.php?page=article&item=amazon-ec2-m5a&num=1

Of course that's for tasks that use all the CPU potential available.

AMD is yet to show a server CPU that matches Xeons on single-core performance. This may happen with Zen2, but don't hold your breath.Suggesting that income is not a huge deal is rather brave. Would you say that on a recruiting interview? :)

AMD is not making a lot of money - that's a fact.

And it's not obvious whether 7nm will help that or not. It's still an expensive process. We roughly now how much Apple pays TSMC for a chip. If AMD's rates are similar, they'll have to raise prices compared to Zen+.True. But they still haven't got to neither revenue nor margins they had in the K10 period (~2010).Roughly 10% difference (in line with AWS instance cost difference - shocking isn't it? :P).

I'm not sure if I'd call that "very high", but certainly it's an advantage of the more modern architecture.

Now when you look at large scale Data Center- this is big, before even looking at 64C Rome.