Annual Notebook Shipment for 2021 Projected to Reach 240 Million Units, Though Demand in 4Q21 Remains Contingent on Market Trends, Says TrendForce

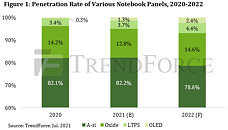

As growing vaccination rates worldwide starting in July lead to a gradual easing of lockdowns, the overall demand for notebook computers has also experienced a corresponding slowdown, with Chromebook demand dropping by as much as 50%, according to TrendForce's latest investigations. However, factors such as a wave of replacement demand for commercial notebooks in Europe and North America due to the return to physical workplaces, as well as brands' aggressive efforts to rush out their 4Q21 shipments ahead of time due to global port congestions, became the primary drivers of notebook demand in 3Q21. Hence, annual notebook shipment for 2021 will likely reach 240 million units, a 16.4% YoY increase.

TrendForce further indicates that 4Q21 will welcome both the gradual release of new models equipped with Intel's next-gen CPUs and a wave of replacement demand for notebooks featuring Windows 11. Even so, overall notebook shipment in 4Q21 will depend on the status of the COVID-19 pandemic and the demand for commercial notebooks. As vaccinations become even more widespread in 2022, pandemic-related spending is expected to decline as a result. TrendForce therefore expects global notebook shipment to decline by 7-8% YoY next year and reach approximately 220 million units, although this still represents a growth of 60 million units over the shipment volume for 2019, prior to the emergence of the pandemic.

TrendForce further indicates that 4Q21 will welcome both the gradual release of new models equipped with Intel's next-gen CPUs and a wave of replacement demand for notebooks featuring Windows 11. Even so, overall notebook shipment in 4Q21 will depend on the status of the COVID-19 pandemic and the demand for commercial notebooks. As vaccinations become even more widespread in 2022, pandemic-related spending is expected to decline as a result. TrendForce therefore expects global notebook shipment to decline by 7-8% YoY next year and reach approximately 220 million units, although this still represents a growth of 60 million units over the shipment volume for 2019, prior to the emergence of the pandemic.