Global Ranking of Top 10 SSD Module Makers for 2020 Shows 15% YoY Drop in Annual Shipment, Says TrendForce

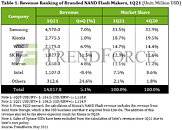

The emergence of the COVID-19 pandemic led to severe delays in manufacturing and logistics. In particular, governments worldwide began implementing border restrictions in 2Q20 to combat the ongoing health crisis, leading to a sudden decline in order volumes for channel-market SSDs, according to TrendForce's latest investigations. Annual shipment of SSDs to the channel (retail) market reached 111.5 million units in 2020, a 15% YoY decrease. In terms of market share by shipment, Kingston, ADATA, and Kimtigo once again occupied the top three spots, respectively.

Looking at the channel market for SSDs as a whole, NAND Flash suppliers (among which Samsung possessed the largest market share) accounted for around 35% of the total shipments in 2020, while SSD module makers accounted for the other 65%. The top 10 module makers accounted for 71% of channel-market SSD shipments from all SSD module makers. Taken together, these figures show that the market remained relatively oligopolistic in 2020. However, it should be noted that TrendForce's ranking of SSD module makers for 2020 takes account of only products bound for the channel market and under brands owned by the module makers themselves; NAND Flash suppliers were therefore excluded from the top 10 ranking.

Looking at the channel market for SSDs as a whole, NAND Flash suppliers (among which Samsung possessed the largest market share) accounted for around 35% of the total shipments in 2020, while SSD module makers accounted for the other 65%. The top 10 module makers accounted for 71% of channel-market SSD shipments from all SSD module makers. Taken together, these figures show that the market remained relatively oligopolistic in 2020. However, it should be noted that TrendForce's ranking of SSD module makers for 2020 takes account of only products bound for the channel market and under brands owned by the module makers themselves; NAND Flash suppliers were therefore excluded from the top 10 ranking.