TSMC Could Build Six GigaFabs in Arizona

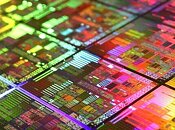

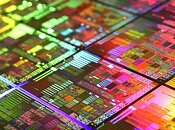

Taiwan Semiconductor Manufacturing Company (TSMC), one of the largest manufacturers of silicon, is seemingly making plans to build as many as six of its US-based fabs in Arizona. According to the unconfirmed report coming from UDN, TSMC could be building its Arizona-based factories for much larger capacities. Based on TSMC's classifications, the MegaFab-class of factories is the one with 25,000 WSPM output. According to the report, TSMC plans to build six additional facilities in the area where the Arizona fab is, and have a GigaFab-class (even larger type) factory present on US soil. Currently, the company operates six GigaFabs and all of them are based in Taiwan.

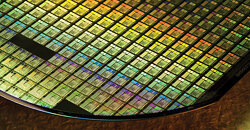

The GigaFab class factory is supposed to have over 100,000 WSPM output, and by building one in the US, TSMC could get much closer to big customers like Apple, NVIDIA, and AMD. Reports are saying that TSMC's primary target is 3 nm node production on 12-inch (300 mm) wafers. All six of the supposed facilities are expected to output more than 100,000 wafers at their peak, making it one of the largest projects TSMC has ever done. The Arizona location is supposed to serve as a "mega fab" facility and it is supposed to start manufacturing silicon in 2024. This information is, of course, just a rumor so you should take it with a grain of salt, as this type of information is usually only known by top-level management.

The GigaFab class factory is supposed to have over 100,000 WSPM output, and by building one in the US, TSMC could get much closer to big customers like Apple, NVIDIA, and AMD. Reports are saying that TSMC's primary target is 3 nm node production on 12-inch (300 mm) wafers. All six of the supposed facilities are expected to output more than 100,000 wafers at their peak, making it one of the largest projects TSMC has ever done. The Arizona location is supposed to serve as a "mega fab" facility and it is supposed to start manufacturing silicon in 2024. This information is, of course, just a rumor so you should take it with a grain of salt, as this type of information is usually only known by top-level management.