Global Chip Shortage Takes Another Toll... Now Your Home Router?

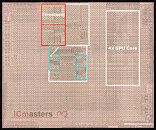

The global supply of semiconductor processors has been at risk lately. Starting from GPUs to CPUs, the demand for both has been much greater than the available supply. Manufacturing companies, such as TSMC, have been expanding capacities, however, they have not yet been able to satisfy the demand. We have seen the results of that demand in a form of the scarcity of the latest generation of graphics cards, covering NVIDIA's GeForce RTX 3000 series Ampere, and AMD' Radeon RX 6000 series Big Navi graphics cards. Consumers have had a difficult time sourcing them and they have seen artificial price increase that is much higher than their original MSRP.

However, it doesn't seem like the situation will improve. According to the latest reporting from Bloomberg, the next victim of global chip shortage is... you guessed it, your home internet router. The cited sources have noted that the waiting list to get a batch of ordered routers has doubled the waiting time, from the regular 30 weeks to 60-week waiting time. This represents a waiting list that is more than a year long. With the global COVID-19 pandemic still going strong, there is an increased need for better home router equipment, and delays can only hurt broadband providers that supply routers. Taiwan-based router manufacturer Zyxel Communications, notes that the company has seen massive demand for their equipment. Such a massive demand could lead to insufficient supply, which could increase prices of routers well above their MSRP and bring scarcity of them as well.

However, it doesn't seem like the situation will improve. According to the latest reporting from Bloomberg, the next victim of global chip shortage is... you guessed it, your home internet router. The cited sources have noted that the waiting list to get a batch of ordered routers has doubled the waiting time, from the regular 30 weeks to 60-week waiting time. This represents a waiting list that is more than a year long. With the global COVID-19 pandemic still going strong, there is an increased need for better home router equipment, and delays can only hurt broadband providers that supply routers. Taiwan-based router manufacturer Zyxel Communications, notes that the company has seen massive demand for their equipment. Such a massive demand could lead to insufficient supply, which could increase prices of routers well above their MSRP and bring scarcity of them as well.