Tuesday, January 22nd 2013

AMD Reports 2012 Fourth Quarter and Annual Results

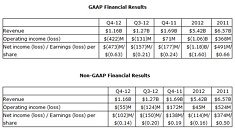

AMD today announced revenue for the fourth quarter of 2012 of $1.16 billion, an operating loss of $422 million, and a net loss of $473 million, or $0.63 per share. The company reported a non-GAAP operating loss of $55 million and a non-GAAP net loss of $102 million, or $0.14 per share.

For the year ended December 29, 2012, AMD reported revenue of $5.42 billion, an operating loss of $1.06 billion and a net loss of $1.18 billion, or $1.60 per share. The full year non-GAAP operating income was $45 million and non-GAAP net loss was $114 million, or $0.16 per share."AMD continues to evolve our operating model and diversify our product portfolio with the changing PC environment," said Rory Read, AMD president and CEO. "Innovation is the core of our long-term growth. The investments we are making in technology today are focused on leveraging our distinctive IP to drive growth in ultra low power client devices, semi-custom SoCs and dense servers. We expect to deliver differentiated and groundbreaking APUs to our customers in 2013 and remain focused on transforming our operating model to the business realities of today."

Quarterly Financial Summary

● Gross margin was 15 percent. Non-GAAP gross margin was 39 percent, a sequential increase of 8 percent. Q3 2012 gross margin of 31 percent was adversely impacted by an inventory write-down of approximately $100 million. Fourth quarter gross margin was positively impacted by the sales of higher priced desktop microprocessors.

● Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.2 billion at the end of the quarter.

● AMD announced restructuring actions and operational efficiencies in Q4 2012, resulting in a net restructuring charge of $90 million in the quarter, which includes costs related to actions taken in Q4 2012 as well as an estimate of the expected costs related to Q1 2013 workforce reductions.

● Computing Solutions segment revenue decreased 11 percent sequentially and 37 percent year-over-year. The sequential and year-over-year decreases were primarily driven by lower microprocessor unit volume shipments.

- Operating loss was $323 million, compared with an operating loss of $114 million in Q3 2012 and operating income of $165 million in Q4 2011. Q4 2012 operating loss increased $209 million sequentially primarily due to the impact of a Lower of Cost or Market (LCM) charge related to the GLOBLFOUNDRIES Inc. (GF) take-or-pay obligation of $273 million. The charge was previously expected to be $165 million.

- Microprocessor ASP increased sequentially and decreased year-over-year.

● Graphics segment revenue decreased 5 percent sequentially and 15 percent year-over-year. Graphics processor unit (GPU) revenue decreased sequentially and year-over-year due to lower unit volume shipments.

- Operating income was $22 million, compared with $18 million in Q3 2012 and $27 million in Q4 2011.

- GPU ASP was flat sequentially and increased year-over-year.

Recent Highlights

● AMD executive Devinder Kumar was named Chief Financial Officer. Kumar has been with AMD more than 28 years, serving as corporate controller of the company since 2001 and as senior vice president since 2006.

● AMD successfully amended its Wafer Supply Agreement (WSA) with GF, solidifying the company's new operating model and better aligning with PC market dynamics.

● AMD announced a collaboration with ARM that builds on the company's rich IP portfolio, including deep 64-bit processor knowledge and industry-leading AMD SeaMicro Freedom Supercomputing Fabric, to offer the most flexible and complete processingsolutions for the modern data center. AMD will design 64-bit ARM technology-based processors in addition to its x86 processors for multiple markets, starting with cloud and data center servers.

● At the International Consumer Electronics Show (CES), AMD highlighted its 2013 client product offerings and customer adoption momentum including:

- Demonstrated working silicon of the company's first true system-on-chip (SoC) APUs, codenamed "Temash" and "Kabini," which will be the industry's first quad-core x86 SoCs and target the tablet and entry-level mobile markets respectively;

- Introduced the new A-series APU codenamed "Richland," which delivers visual performance increases ranging from 20 to 40 percent compared with the previous generation of AMD A-Series APUs;

- VIZIO joined AMD's customer portfolio and introduced a new portfolio of AMD-based platforms, including an 11.6" APU-powered tablet with a 1080p touch screen along with two high-performance ultrathin notebooks and an impressive 24" All-in-One (AiO) system.

● AMD launched several new AMD Opteron processors based on the "Piledriver" core architecture during the quarter. The new AMD Opteron 6300 Series processors strike a balance between performance, scalability and cost effectiveness to help lower total cost of ownership (TCO). The new AMD Opteron 4300 Series and 3300 Series also launched.

● AMD announced the AMD Open 3.0 platform, a radical rethinking of the server motherboard designed to create simplified, energy efficient servers that better meet the demands of the modern data center. AMD's new platform is compliant with the standards developed by the Open Compute Project and is designed to reduce data center power consumption and cost while increase performance and flexibility.

● AMD introduced new members of the Guinness World Record-setting AMD FX family of central processing units (CPUs) based on the "Piledriver" core, expanding its offerings that deliver fully unlocked and customizable experiences for performance desktop PC users. The AMD FX 8350 delivers performance increases of 15 percent at mainstream price points and has been overclocked at to 8.67 GHz to-date.

● AMD introduced the AMD Radeon HD 8000M Series of low-power mobile GPUs, the first mainstream notebook GPUs to be offered with the award-winning AMD Graphics Core Next (GCN) Architecture. Notebooks are already available featuring the new graphics solution, including several ultrathin notebooks.

● Nintendo launched the next-generation Wii U console, powered by custom AMD Radeon HD graphics technology.

● AMD introduced the "Never Settle" Bundle which packaged the holiday season's biggest PC gaming titles, including "Far Cry 3" along with "Hitman: Absolution" and "Sleeping Dogs", with the purchase of select AMD Radeon HD 7000 Series graphics cards. AMD also released the "Never Settle" version of its AMD Catalyst Driver, providing owners of AMD Radeon graphics cards with massive performance improvements in many of their favorite games.

● AMD launched the AMD FirePro S10000, the industry's most powerful server graphics card, designed for high-performance computing (HPC) workloads and graphics intensive applications. The AMD FirePro S10000 is the first professional-grade card to exceed one teraFLOPS (TFLOPS) of double-precision floating-point performance, helping to ensure optimal efficiency for HPC calculations.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to decrease 9 percent, plus or minus three percent, sequentially for the first quarter of 2013.

For the year ended December 29, 2012, AMD reported revenue of $5.42 billion, an operating loss of $1.06 billion and a net loss of $1.18 billion, or $1.60 per share. The full year non-GAAP operating income was $45 million and non-GAAP net loss was $114 million, or $0.16 per share."AMD continues to evolve our operating model and diversify our product portfolio with the changing PC environment," said Rory Read, AMD president and CEO. "Innovation is the core of our long-term growth. The investments we are making in technology today are focused on leveraging our distinctive IP to drive growth in ultra low power client devices, semi-custom SoCs and dense servers. We expect to deliver differentiated and groundbreaking APUs to our customers in 2013 and remain focused on transforming our operating model to the business realities of today."

Quarterly Financial Summary

● Gross margin was 15 percent. Non-GAAP gross margin was 39 percent, a sequential increase of 8 percent. Q3 2012 gross margin of 31 percent was adversely impacted by an inventory write-down of approximately $100 million. Fourth quarter gross margin was positively impacted by the sales of higher priced desktop microprocessors.

● Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.2 billion at the end of the quarter.

● AMD announced restructuring actions and operational efficiencies in Q4 2012, resulting in a net restructuring charge of $90 million in the quarter, which includes costs related to actions taken in Q4 2012 as well as an estimate of the expected costs related to Q1 2013 workforce reductions.

● Computing Solutions segment revenue decreased 11 percent sequentially and 37 percent year-over-year. The sequential and year-over-year decreases were primarily driven by lower microprocessor unit volume shipments.

- Operating loss was $323 million, compared with an operating loss of $114 million in Q3 2012 and operating income of $165 million in Q4 2011. Q4 2012 operating loss increased $209 million sequentially primarily due to the impact of a Lower of Cost or Market (LCM) charge related to the GLOBLFOUNDRIES Inc. (GF) take-or-pay obligation of $273 million. The charge was previously expected to be $165 million.

- Microprocessor ASP increased sequentially and decreased year-over-year.

● Graphics segment revenue decreased 5 percent sequentially and 15 percent year-over-year. Graphics processor unit (GPU) revenue decreased sequentially and year-over-year due to lower unit volume shipments.

- Operating income was $22 million, compared with $18 million in Q3 2012 and $27 million in Q4 2011.

- GPU ASP was flat sequentially and increased year-over-year.

Recent Highlights

● AMD executive Devinder Kumar was named Chief Financial Officer. Kumar has been with AMD more than 28 years, serving as corporate controller of the company since 2001 and as senior vice president since 2006.

● AMD successfully amended its Wafer Supply Agreement (WSA) with GF, solidifying the company's new operating model and better aligning with PC market dynamics.

● AMD announced a collaboration with ARM that builds on the company's rich IP portfolio, including deep 64-bit processor knowledge and industry-leading AMD SeaMicro Freedom Supercomputing Fabric, to offer the most flexible and complete processingsolutions for the modern data center. AMD will design 64-bit ARM technology-based processors in addition to its x86 processors for multiple markets, starting with cloud and data center servers.

● At the International Consumer Electronics Show (CES), AMD highlighted its 2013 client product offerings and customer adoption momentum including:

- Demonstrated working silicon of the company's first true system-on-chip (SoC) APUs, codenamed "Temash" and "Kabini," which will be the industry's first quad-core x86 SoCs and target the tablet and entry-level mobile markets respectively;

- Introduced the new A-series APU codenamed "Richland," which delivers visual performance increases ranging from 20 to 40 percent compared with the previous generation of AMD A-Series APUs;

- VIZIO joined AMD's customer portfolio and introduced a new portfolio of AMD-based platforms, including an 11.6" APU-powered tablet with a 1080p touch screen along with two high-performance ultrathin notebooks and an impressive 24" All-in-One (AiO) system.

● AMD launched several new AMD Opteron processors based on the "Piledriver" core architecture during the quarter. The new AMD Opteron 6300 Series processors strike a balance between performance, scalability and cost effectiveness to help lower total cost of ownership (TCO). The new AMD Opteron 4300 Series and 3300 Series also launched.

● AMD announced the AMD Open 3.0 platform, a radical rethinking of the server motherboard designed to create simplified, energy efficient servers that better meet the demands of the modern data center. AMD's new platform is compliant with the standards developed by the Open Compute Project and is designed to reduce data center power consumption and cost while increase performance and flexibility.

● AMD introduced new members of the Guinness World Record-setting AMD FX family of central processing units (CPUs) based on the "Piledriver" core, expanding its offerings that deliver fully unlocked and customizable experiences for performance desktop PC users. The AMD FX 8350 delivers performance increases of 15 percent at mainstream price points and has been overclocked at to 8.67 GHz to-date.

● AMD introduced the AMD Radeon HD 8000M Series of low-power mobile GPUs, the first mainstream notebook GPUs to be offered with the award-winning AMD Graphics Core Next (GCN) Architecture. Notebooks are already available featuring the new graphics solution, including several ultrathin notebooks.

● Nintendo launched the next-generation Wii U console, powered by custom AMD Radeon HD graphics technology.

● AMD introduced the "Never Settle" Bundle which packaged the holiday season's biggest PC gaming titles, including "Far Cry 3" along with "Hitman: Absolution" and "Sleeping Dogs", with the purchase of select AMD Radeon HD 7000 Series graphics cards. AMD also released the "Never Settle" version of its AMD Catalyst Driver, providing owners of AMD Radeon graphics cards with massive performance improvements in many of their favorite games.

● AMD launched the AMD FirePro S10000, the industry's most powerful server graphics card, designed for high-performance computing (HPC) workloads and graphics intensive applications. The AMD FirePro S10000 is the first professional-grade card to exceed one teraFLOPS (TFLOPS) of double-precision floating-point performance, helping to ensure optimal efficiency for HPC calculations.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to decrease 9 percent, plus or minus three percent, sequentially for the first quarter of 2013.

40 Comments on AMD Reports 2012 Fourth Quarter and Annual Results

And if I said it was a "few grand" before 14k is a "few grand". Ive always said 14k sir.

www.techpowerup.com/forums/showpost.php?p=2353122&postcount=4

www.techpowerup.com/forums/showthread.php?p=2348818&highlight=14k#post2348818

www.techpowerup.com/forums/showthread.php?p=2153612&highlight=14k#post2153612

www.techpowerup.com/forums/showpost.php?p=1911250&postcount=14

Anyway my past screw ups don't have anything to do with this thread. I was grazed the subject as someone said it (AMD) was a good investment. I was just giving an example of how its not. Lets get back on topic.

I think of AMD as a great company all-around, the problem is their competitors are heavy hitters.