Thursday, November 17th 2016

GPU Q3'16 Shipments Increase 20.4% Over Q2'2016; NVIDIA Up, AMD and Intel Down

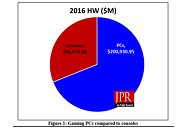

The latest data from Jon Peddie Research regarding the PC market are just in, and while the PC market has been in a slow, yet steady decline over the past few years, two sections of it that are seemingly swimming against the current are the gaming and data center businesses. The PC market rose by 8.09% quarter-to-quarter, but decreased 5.37% year-to-year, with the quarter-to-quarter gain being largely due to gaming as well as data center sales. Of these, the gaming market is the most consumer-driven, and if anyone doubted that the PC was the platform of choice for gaming, this quarter's results will correct that misconception.

The gaming market is uplifting the entire PC market (even if not enough to staunch the bleeding), and has overwhelmed the console market, being over twice its market value. PC suppliers are seeing growth in gaming desktops and notebooks, with overall GPU shipments increasing 20.4% from last quarter. Discrete GPUs were in 34.84% of PCs, which is up 7.06%, desktop graphics add-in boards (AIBs) that use discrete GPUs increased 38.16% quarter-to-quarter, and more notebooks than tablets were sold for the first time in three years.It is interesting to note that the average number of GPUs per system has grown from 1.2 GPUs in 2001 to 1.46 GPUs in 2016 - certainly driven more from integrated graphics on Intel's microprocessors and AMD's APUs (99% of Intel's non-server processors have graphics, and over 66% of AMD's non-server processors contain integrated graphics) than by Crossfire and SLI technologies. Total discrete GPUs (desktop and notebook) shipments for the industry increased 35.6% quarter to quarter, and increased 10.1% year-over-year, with sales of discrete GPUs fluctuating due to a variety of factors, such as new product introductions (we're still waiting for AMD's high-performance discrete GPUs), and the influence of integrated graphics.When it comes to market share, Nvidia's increased 2.2% quarter-to-quarter (0.4% year-over-year), Intel lost 1.6% quarter-to-quarter, and AMD's overall share decreased 0.6% quarter-to-quarter. However, these market share numbers don't tell the full story, since all of the companies increased their graphics chips shipments.AMD's shipments of desktop heterogeneous GPU/CPUs, (i.e., APUs), for desktops decreased 10% quarter to quarter, shipments were up 19.1% in notebooks, desktop discrete GPUs increased 34.7% quarter-to-quarter, and notebook discrete shipments increased 23.0%, with AMD's total PC graphics shipments increasing 15.4% from the previous quarter. Intel's desktop processor embedded graphics (EPGs) shipments increased 4.1% quarter-to-quarter, notebook processors increased by 18.8%, and total PC graphics shipments increased 17.7% from last quarter. Finally, in what amounts to one of the best quarters in the companies' history, Nvidia's desktop discrete GPU shipments were up 39.8% quarter-to-quarter, the company's notebook discrete GPU shipments increased 38.7%, and total PC graphics shipments increased a staggering 39.3% quarter-to-quarter.

Source:

Jon Peddie Research

The gaming market is uplifting the entire PC market (even if not enough to staunch the bleeding), and has overwhelmed the console market, being over twice its market value. PC suppliers are seeing growth in gaming desktops and notebooks, with overall GPU shipments increasing 20.4% from last quarter. Discrete GPUs were in 34.84% of PCs, which is up 7.06%, desktop graphics add-in boards (AIBs) that use discrete GPUs increased 38.16% quarter-to-quarter, and more notebooks than tablets were sold for the first time in three years.It is interesting to note that the average number of GPUs per system has grown from 1.2 GPUs in 2001 to 1.46 GPUs in 2016 - certainly driven more from integrated graphics on Intel's microprocessors and AMD's APUs (99% of Intel's non-server processors have graphics, and over 66% of AMD's non-server processors contain integrated graphics) than by Crossfire and SLI technologies. Total discrete GPUs (desktop and notebook) shipments for the industry increased 35.6% quarter to quarter, and increased 10.1% year-over-year, with sales of discrete GPUs fluctuating due to a variety of factors, such as new product introductions (we're still waiting for AMD's high-performance discrete GPUs), and the influence of integrated graphics.When it comes to market share, Nvidia's increased 2.2% quarter-to-quarter (0.4% year-over-year), Intel lost 1.6% quarter-to-quarter, and AMD's overall share decreased 0.6% quarter-to-quarter. However, these market share numbers don't tell the full story, since all of the companies increased their graphics chips shipments.AMD's shipments of desktop heterogeneous GPU/CPUs, (i.e., APUs), for desktops decreased 10% quarter to quarter, shipments were up 19.1% in notebooks, desktop discrete GPUs increased 34.7% quarter-to-quarter, and notebook discrete shipments increased 23.0%, with AMD's total PC graphics shipments increasing 15.4% from the previous quarter. Intel's desktop processor embedded graphics (EPGs) shipments increased 4.1% quarter-to-quarter, notebook processors increased by 18.8%, and total PC graphics shipments increased 17.7% from last quarter. Finally, in what amounts to one of the best quarters in the companies' history, Nvidia's desktop discrete GPU shipments were up 39.8% quarter-to-quarter, the company's notebook discrete GPU shipments increased 38.7%, and total PC graphics shipments increased a staggering 39.3% quarter-to-quarter.

6 Comments on GPU Q3'16 Shipments Increase 20.4% Over Q2'2016; NVIDIA Up, AMD and Intel Down

That is all.

So the down+up+up+up+up=down?

And all the ups were from selling gpus by themselves.

This does not compute

Almost all shipments were increasing with all major vendors, only AMDs apus were decreasing. I presume you messed it with that table with all vendors. Its just tells that nvidias market share increased so it sell more quarter-to-quarter than competition.