Wednesday, October 25th 2017

AMD Reports Third Quarter 2017 Financial Results

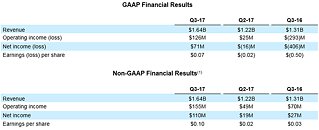

AMD (NASDAQ:AMD) today announced revenue for the third quarter of 2017 of $1.64 billion, operating income of $126 million and net income of $71 million, and diluted earnings per share of $0.07. On a non-GAAP(1) basis, operating income was $155 million, net income was $110 million, and diluted earnings per share was $0.10.

"Strong customer adoption of our new high-performance products drove significant revenue growth and improved financial results from a year ago," said Dr. Lisa Su, AMD president and CEO. "Our third quarter new product introductions and financial execution mark another important milestone as we establish AMD as a premier growth company in the technology industry."Q3 2017 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"Strong customer adoption of our new high-performance products drove significant revenue growth and improved financial results from a year ago," said Dr. Lisa Su, AMD president and CEO. "Our third quarter new product introductions and financial execution mark another important milestone as we establish AMD as a premier growth company in the technology industry."Q3 2017 Results

- Revenue was $1.64 billion, up 26 percent year-over-year, primarily driven by higher revenue in the Computing and Graphics segment (CG). Revenue was up 34 percent sequentially, driven by the Enterprise Embedded and Semi-Custom segment (EESC) revenue seasonality and higher revenue in CG. In the quarter, AMD closed a patent licensing transaction which positively impacted revenue in the segments.

- On a GAAP basis, gross margin was 35 percent, up 30 percentage points year-over-year primarily due to a $340 million charge related to our GLOBALFOUNDRIES Wafer Supply Agreement (WSA) in the year ago period (WSA charge). In addition, the gross margin increase was primarily driven by the benefit from IP related revenue and a richer revenue mix from CG partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Gross margin was up 2 percentage points sequentially primarily driven by the benefit from IP related revenue, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Operating income was $126 million compared to an operating loss of $293 million a year ago and operating income of $25 million in the prior quarter. Net income was $71 million compared to net losses of $406 million a year ago and $16 million in the prior quarter. Diluted earnings per share was $0.07 compared to losses per share of $0.50 a year ago and $0.02 in the prior quarter.

- On a non-GAAP(1) basis, gross margin was 35 percent, up 4 percentage points year-over-year primarily driven by the benefit from IP related revenue and a richer revenue mix from CG, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Gross margin was up 2 percentage points sequentially primarily driven by the benefit from IP related revenue, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Operating income was $155 million compared to $70 million a year ago and $49 million in the prior quarter. Net income was $110 million compared to $27 million a year ago and $19 million in the prior quarter. Diluted earnings per share was $0.10 compared to $0.03 a year ago and $0.02 in the prior quarter.

- Cash, cash equivalents, and marketable securities were $879 million at the end of the quarter, compared to $844 million in the prior quarter.

- Computing and Graphics segment revenue was $819 million, up 74 percent year-over-year primarily driven by strong sales of Radeon graphics and Ryzen desktop processors.

- Client average selling price (ASP) increased significantly year-over-year, due to higher desktop processor ASP driven by Ryzen processor sales.

- GPU ASP increased significantly year-over-year.

- Operating income was $70 million, compared to an operating loss of $66 million a year ago. The year-over-year improvement was primarily driven by higher revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $824 million, approximately flat year-over-year primarily driven by lower semi-custom SoC sales, mostly offset by IP related and EPYC processor revenue.

- Operating income was $84 million, compared to $136 million a year ago. The year-over-year decrease was primarily due to higher costs partially offset by the net benefit of IP related items.

- All Other operating loss was $28 million compared with an operating loss of $363 million a year ago. The year-over-year difference in operating loss was primarily related to the WSA charge in the year ago period.

- AMD continued driving innovation and competition into the consumer and commercial PC markets with new Ryzen processors:

- Ryzen Threadripper processors launched for the High End Desktop and workstation markets. Available in 8-, 16- and 12-core variants, Threadripper processors are available from over 90 retailers, OEMs, and system integrators worldwide, including in the Alienware Area-51 Threadripper Edition gaming PC, BOXX APEXX 4 6301 and NextComputing Edge TR workstations.

- Ryzen 3 CPUs offer exceptional responsiveness and performance at mainstream pricing, completing the Ryzen mainstream desktop lineup.

- Ryzen PRO desktop solutions have received broad support from top global commercial PC suppliers, including Dell, HP, and Lenovo.

- AMD expanded its graphics offerings with new consumer, professional, and embedded graphics solutions:

- Launched the "Vega" architecture-based Radeon RX Vega family of GPUs, marking a return to the enthusiast-class gaming segment. These new "Vega" architecture-based GPUscombine cutting-edge capabilities with 8GB of HBM2 memory to deliver up to 13.7 TFLOPS of peak performance.

- Launched the Radeon Pro WX 9100 professional graphics card, delivering up to 12.3 TFLOPS of peak single precision compute performance.

- Launched the Embedded Radeon E9170 Series GPU, which delivers up to 3X the performance-per-watt over previous generations, and is targeted at digital casino games, thin clients, medical displays, digital and retail signage, and industrial systems(2).

- With new announcements from Amazon Web Services (AWS), and Tencent, AMD enterprise solutions have now been chosen by five of the "Super 7" datacenter and cloud services companies. Previously announced collaborations include Alibaba, Baidu and Microsoft Azure.

- Amazon Web Services selected AMD Radeon Pro MxGPU technology for the new Graphics Design instance type on Amazon AppStream 2.0, which allows users to run graphics-accelerated applications at a fraction of the cost of using graphics workstations.

- Tencent announced plans to use AMD EPYC 7000 series server processors in their datacenters.

- Atari disclosed that a customized AMD processor featuring Radeon graphics technology will power the upcoming Ataribox game console, which is targeted for global launch in spring 2018.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

43 Comments on AMD Reports Third Quarter 2017 Financial Results

This shows AMD has a path forward. :toast:

I get your point but I still think it's daft.

It costs Intel more to make it's processors than AMD, because Coffee Lake's larger dies don't yield well at all, as you can see by the low stock

www.techpowerup.com/reviews/AMD/Radeon_RX_Vega_64/11.html for Call of Duty IW.

Or maybe they just foresee consoles dying *any day now*. Not sure of that myself.

I heard the 630 Intel GFX (in my Kaby Lake) is equivalent to a 740. Xbox is roughly a 750/r7 260x or something. Not sure the Switch's Tegra is even as good as that.

It was AMD who was the perfect partner who could realize both technology's (An APU rather then CPU + GPU) for a competetive price.

I believe AMD was making exactly a 1 $ margin per sold APU on both current consoles. This does'nt sound like very much but this gives the guarantee developers are spending time on AMD GPU's and maximizing AMD's GPU platform, which indirectly works for the PC market as well. The PS4 got sold for more then 60 million times, that equals to 60 million dollar for AMD at least. I'm not sure what the Xbox did here, but the profit sounds reasonable.

AMD needs a good reputation on their GPU hardware. When you got most developpers who create games working on your APU's it means that more and more games will be optimized for AMD hardware as we speak. This is why there's bin a 50% performance increase on Vega 56/64 cards with games since the last driver update.