Wednesday, October 25th 2017

AMD Reports Third Quarter 2017 Financial Results

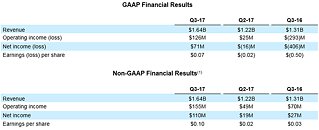

AMD (NASDAQ:AMD) today announced revenue for the third quarter of 2017 of $1.64 billion, operating income of $126 million and net income of $71 million, and diluted earnings per share of $0.07. On a non-GAAP(1) basis, operating income was $155 million, net income was $110 million, and diluted earnings per share was $0.10.

"Strong customer adoption of our new high-performance products drove significant revenue growth and improved financial results from a year ago," said Dr. Lisa Su, AMD president and CEO. "Our third quarter new product introductions and financial execution mark another important milestone as we establish AMD as a premier growth company in the technology industry."Q3 2017 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"Strong customer adoption of our new high-performance products drove significant revenue growth and improved financial results from a year ago," said Dr. Lisa Su, AMD president and CEO. "Our third quarter new product introductions and financial execution mark another important milestone as we establish AMD as a premier growth company in the technology industry."Q3 2017 Results

- Revenue was $1.64 billion, up 26 percent year-over-year, primarily driven by higher revenue in the Computing and Graphics segment (CG). Revenue was up 34 percent sequentially, driven by the Enterprise Embedded and Semi-Custom segment (EESC) revenue seasonality and higher revenue in CG. In the quarter, AMD closed a patent licensing transaction which positively impacted revenue in the segments.

- On a GAAP basis, gross margin was 35 percent, up 30 percentage points year-over-year primarily due to a $340 million charge related to our GLOBALFOUNDRIES Wafer Supply Agreement (WSA) in the year ago period (WSA charge). In addition, the gross margin increase was primarily driven by the benefit from IP related revenue and a richer revenue mix from CG partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Gross margin was up 2 percentage points sequentially primarily driven by the benefit from IP related revenue, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Operating income was $126 million compared to an operating loss of $293 million a year ago and operating income of $25 million in the prior quarter. Net income was $71 million compared to net losses of $406 million a year ago and $16 million in the prior quarter. Diluted earnings per share was $0.07 compared to losses per share of $0.50 a year ago and $0.02 in the prior quarter.

- On a non-GAAP(1) basis, gross margin was 35 percent, up 4 percentage points year-over-year primarily driven by the benefit from IP related revenue and a richer revenue mix from CG, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Gross margin was up 2 percentage points sequentially primarily driven by the benefit from IP related revenue, partially offset by costs associated with the WSA for certain wafers purchased at another foundry. Operating income was $155 million compared to $70 million a year ago and $49 million in the prior quarter. Net income was $110 million compared to $27 million a year ago and $19 million in the prior quarter. Diluted earnings per share was $0.10 compared to $0.03 a year ago and $0.02 in the prior quarter.

- Cash, cash equivalents, and marketable securities were $879 million at the end of the quarter, compared to $844 million in the prior quarter.

- Computing and Graphics segment revenue was $819 million, up 74 percent year-over-year primarily driven by strong sales of Radeon graphics and Ryzen desktop processors.

- Client average selling price (ASP) increased significantly year-over-year, due to higher desktop processor ASP driven by Ryzen processor sales.

- GPU ASP increased significantly year-over-year.

- Operating income was $70 million, compared to an operating loss of $66 million a year ago. The year-over-year improvement was primarily driven by higher revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $824 million, approximately flat year-over-year primarily driven by lower semi-custom SoC sales, mostly offset by IP related and EPYC processor revenue.

- Operating income was $84 million, compared to $136 million a year ago. The year-over-year decrease was primarily due to higher costs partially offset by the net benefit of IP related items.

- All Other operating loss was $28 million compared with an operating loss of $363 million a year ago. The year-over-year difference in operating loss was primarily related to the WSA charge in the year ago period.

- AMD continued driving innovation and competition into the consumer and commercial PC markets with new Ryzen processors:

- Ryzen Threadripper processors launched for the High End Desktop and workstation markets. Available in 8-, 16- and 12-core variants, Threadripper processors are available from over 90 retailers, OEMs, and system integrators worldwide, including in the Alienware Area-51 Threadripper Edition gaming PC, BOXX APEXX 4 6301 and NextComputing Edge TR workstations.

- Ryzen 3 CPUs offer exceptional responsiveness and performance at mainstream pricing, completing the Ryzen mainstream desktop lineup.

- Ryzen PRO desktop solutions have received broad support from top global commercial PC suppliers, including Dell, HP, and Lenovo.

- AMD expanded its graphics offerings with new consumer, professional, and embedded graphics solutions:

- Launched the "Vega" architecture-based Radeon RX Vega family of GPUs, marking a return to the enthusiast-class gaming segment. These new "Vega" architecture-based GPUscombine cutting-edge capabilities with 8GB of HBM2 memory to deliver up to 13.7 TFLOPS of peak performance.

- Launched the Radeon Pro WX 9100 professional graphics card, delivering up to 12.3 TFLOPS of peak single precision compute performance.

- Launched the Embedded Radeon E9170 Series GPU, which delivers up to 3X the performance-per-watt over previous generations, and is targeted at digital casino games, thin clients, medical displays, digital and retail signage, and industrial systems(2).

- With new announcements from Amazon Web Services (AWS), and Tencent, AMD enterprise solutions have now been chosen by five of the "Super 7" datacenter and cloud services companies. Previously announced collaborations include Alibaba, Baidu and Microsoft Azure.

- Amazon Web Services selected AMD Radeon Pro MxGPU technology for the new Graphics Design instance type on Amazon AppStream 2.0, which allows users to run graphics-accelerated applications at a fraction of the cost of using graphics workstations.

- Tencent announced plans to use AMD EPYC 7000 series server processors in their datacenters.

- Atari disclosed that a customized AMD processor featuring Radeon graphics technology will power the upcoming Ataribox game console, which is targeted for global launch in spring 2018.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

43 Comments on AMD Reports Third Quarter 2017 Financial Results

Here in Brazil Ryzen 7 1700 is even cheaper than USA and EUROPE, this never ever happened in the history of my country.

They are trying to gain market based on prices, but shareholders are not very happy, if you see AMD stock decreased after the financial results.

You have to remember AMD is still investing heavily in R&D, as they should, but the fruits of which sometimes take years.

camelcamelcamel.com/AMD-FX-8370-Octa-core-Processor-FD8370FRHKHBX/product/B01798X7D2

Look at this, feb 2016 $239, this CPU should be $320 CPU, but if AMD chose this price the CPU wont sale at all. Cause with $320 you could buy an i7.

So yes, they have to live in the margin.

Anyway, very nice results. It just shows how many Ryzens were sold. A lot. Much better value for the money compared to Intel. That's why (or at least was one reason) AMD (ATI) cards sold better then nowadays: they had better value for the money in most GPU categories (nowadays it's only competitive in mid range). It's every users' interest to get better, so we will see better products on both sides, in both the CPU and GPU sections. And X1X is just coming, which should sell much better than PS4 Pro. Ryzen update may come in early 2018. Promising times for AMD.

It isn't great - it's ok.

GTX1080 is a great card at a bad pricepoint, it is too expensive.

Nvidia should launch 1070ti at 1070 -10 usd price, 1070 at 1060 6gb + 20-35 usd, 1080 at -20 usd. and we're talking a lineup worth praising.

but at the moment the only reasonably priced nvidia cards at 1060 3gb,1050 and 1080ti.

Their cards are great but prices are too high, the 2015 GTX9 series performance per dollar isn't changed that much and shows rather bad value but we have mining which distorts everything.

I'm happy with a 450 usd(value conversion - tax etc from europe) vega 64 :)

Game developed on consoles with AMD GPU architecture runs better on PC's with AMD GPU architecture!

Shock Horror!!!

AMD doing well is good for all, regardless which brand some people seem to worship.

BTW, every multi platform title is developed on consoles with AMD GPU architecture... :D

:laugh::roll::laugh:

Grow up. One game does not a good GPU make. AMD drug their feet far too long on vega, and even if vega finally catches pascal, volta will be ready to release by then. So they were good in destiny 2. So what? I could post a game with vega 64 not matching the 1070 and say nvidia still cant touch 1080 performance, and it would be just as valid as your claim.

Overall, VEGA fails to match the performance of 18 month old pascals overall in game performance. And pulls significantly more power/creates far more heat, while costing more then the nvidia parts ($650 for vega 64 VS $550 for 1080, yeah great deal there bud :rolleyes:) And are often only available as part of a "bundle" to boot.

AMD dropped the ball on vega. The time has passed, the major sales window for huge vega shipments sailed already. Hopefully AMD can get NAVI right with all the money from ryzen.

And will admit that vega 56 is looking a lot better. Just last week, the only available models were going for $550+, compared to $450 for 1070s. It seems price and availability changed dramatically at some point.

Vega 64 still isnt very competitive with the 1080, IMO. Still too expensive for proper performing ones. and heck, we STILL dont have any custom VEGA cards, and custom coolers would help a lot with 64's heat problem.

I still stand by my statement that AMD bungled the launch hard, and missed the boat on sales due to their issues.

Forza 7 benchmarks are here: www.computerbase.de/2017-09/forza-7-benchmark/

Evil Within 2: www.pcgameshardware.de/The-Evil-Within-2-Spiel-61047/Specials/The-Evil-Within-2-Techink-Test-Benchmarks-1241032/

Vega 64 is not so competitive against the 1080. However, in the UK, the Vega64 is cheaper than the cheapest 1080. They perform the same right now, ofc the Vega64 has much more hunger for power in default. But the Vega56 beats the 1070 by nearly 10 in 1440P.

And I forgot to mention Battlefront 2, which is expected to run better on AMD.

"AMD reported a gross margin, or percentage of sales remaining after deducting the cost of production, of 35 percent. That compares with more than 60 percent at Intel and 58 percent at graphics-chip maker Nvidia Corp."

On the plus side, it was the first reported profit in 5 quarters. With the cryptocurrency insanity this year I'd kind of hoped for more from AMD. They also predicted lower numbers for Q4, which is concerning for the holidays. I'm amazed AMD has hung in there as well as they have with a David & Goliath R+D situation with Intel and Nvidia.

it could be a 1060 price without any concerns for nvidia when it comes to making money, it could be absolutely awesome PRODUCT while the card is Great ;)

Card uses little power, perfect balance of performance vs watt.

Drop the price 20-40 bucks and it'd be a no brainer and would make a Vega from a decent card to a bad card :-)