Thursday, July 26th 2018

AMD Reports Second Quarter 2018 Financial Results

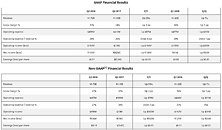

AMD (NASDAQ:AMD) today announced revenue for the second quarter of 2018 of $1.76 billion, operating income of $153 million, net income of $116 million and diluted earnings per share of $0.11. On a non-GAAP basis, operating income was $186 million, net income was $156 million and diluted earnings per share was $0.14.

"We had an outstanding second quarter with strong revenue growth, margin expansion and our highest quarterly net income in seven years," said Dr. Lisa Su, AMD president and CEO. "Most importantly, we believe our long-term technology bets position us very well for the future. We are confident that with the continued execution of our product roadmaps, we are on an excellent trajectory to drive market share gains and profitable growth."Q2 2018 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the third quarter of 2018, AMD expects revenue to be approximately $1.7 billion, plus or minus $50 million, an increase of approximately 7 percent year-over-year, and non-GAAP gross margin to increase to approximately 38 percent, driven by the sales growth of Ryzen and EPYC products, partially offset by lower sales of GPU products in the blockchain market.

"We had an outstanding second quarter with strong revenue growth, margin expansion and our highest quarterly net income in seven years," said Dr. Lisa Su, AMD president and CEO. "Most importantly, we believe our long-term technology bets position us very well for the future. We are confident that with the continued execution of our product roadmaps, we are on an excellent trajectory to drive market share gains and profitable growth."Q2 2018 Results

- Revenue was $1.76 billion, up 53 percent year-over-year and 7 percent quarter-over-quarter. The year-over-year increase was driven by higher revenue in both the Computing and Graphics and Enterprise, Embedded and Semi-Custom business segments. The sequential increase was driven by higher revenue in the Enterprise, Embedded and Semi-Custom segment.

- Gross margin grew to 37 percent, up 3 percentage points year-over-year, driven by the ramp of new products. On a sequential basis, gross margin was up 1 percentage point primarily driven by a richer mix of revenue in the Enterprise, Embedded and Semi-Custom segment.

- On a GAAP basis, operating income was $153 million compared to an operating loss of $1 million a year ago and operating income of $120 million in the prior quarter.

- Net income was $116 million compared to a net loss of $42 million a year ago and net income of $81 million in the prior quarter. Diluted earnings per share was $0.11, compared to a loss per share of $0.04 a year ago and diluted earnings per share of $0.08 in the prior quarter.

- On a non-GAAP basis, operating income was $186 million compared to operating income of $23 million a year ago and $152 million in the prior quarter.

- Non-GAAP net income was $156 million compared to a net loss of $7 million a year ago and net income of $121 million in the prior quarter. Non-GAAP diluted earnings per share was $0.14, compared to a loss per share of $0.01 a year ago and diluted earnings per share of $0.11 in the prior quarter.

- Cash, cash equivalents and marketable securities were $983 million at the end of the quarter.

- Computing and Graphics segment revenue was $1.09 billion, up 64 percent year-over-year and down 3 percent quarter-over-quarter. Year-over-year revenue growth was driven by strong sales of Radeon products and continued growth of Ryzen products. The quarter-over-quarter decline was primarily related to lower revenue from GPU products in the blockchain market.

- Client processor average selling price (ASP) was lower year-over-year and quarter-over-quarter primarily due to lower desktop processor ASP, partially offset by higher mobile processor ASP.

- GPU ASP increased year-over-year driven by Radeon products for the channel and datacenter. GPU ASP increased quarter-over-quarter driven by GPU sales for datacenter.

- Operating income was $117 million, compared to operating income of $7 million a year ago and operating income of $138 million in the prior quarter. The year-over-year operating income improvement was primarily driven by higher revenue. The quarter-over-quarter operating income decline was primarily due to lower revenue and higher operating expenses.

- Enterprise, Embedded and Semi-Custom segment revenue was $670 million, up 37 percent year-over-year and 26 percent quarter-over-quarter primarily due to higher semi-custom and server revenue.

- Operating income was $69 million, compared to operating income of $16 million a year ago and operating income of $14 million in the prior quarter. The year-over-year and quarter-over-quarter increases were primarily due to higher revenue.

- All Other operating loss was $33 million compared with operating losses of $24 million a year ago and $32 million in the prior quarter.

- At Computex 2018, AMD showcased the next-generation of leadership CPU and GPU products including the first public demonstrations of:

o The 12nm "Zen+"-based 2nd Generation Ryzen ThreadripperTM CPU, featuring an industry-leading 32-cores and 64-threads of HEDT computing power, scheduled to launch in Q3 2018.

o The 7nm Radeon "Vega" architecture-based GPU for servers and workstations that is planned to launch later in 2018. - One year after its market debut, AMD EPYC datacenter processor sales continue to accelerate, with new platform deployments and commitments from industry leaders:

o HPE launched two new AMD EPYC platforms, including the ProLiant DL325 Gen10 server delivering two-socket performance in a one-socket server.

o Cisco launched the first ever AMD-based UCS server, with EPYC processors powering Cisco's highest density offering with 128% more cores, 50% more servers and 20% more storage per rack compared to their existing rack offerings.

o Tencent Cloud now offers an EPYC processor-based SA1 Cloud instance, delivering exceptional performance at a lower total cost of ownership compared to other solutions. - The National Institute for Nuclear Physics in Italy selected the AMD EPYC 7351 processor to power its high-performance computing cluster.

- AMD announced unprecedented adoption of its AMD Ryzen PRO processors with Radeon Vega graphics, with new commercial notebooks and desktops now available from Dell, HP and Lenovo.

- AMD continued to expand its offerings for gamers:

o AMD announced that Radeon FreeSync technology is now supported across Samsung's QLED TV family, bringing the ultimate 4K gaming experience to large-screen TVs.

o PowerColor unveiled the Radeon RX Vega56 Nano Edition graphics card, enabling enthusiast 4K gaming in small form factor PCs.

o At E3, AMD announced an expanded partnership with Ubisoft to leverage DirectX12 technology to optimize their next-generation games for Radeon GPU users, including the highly anticipated "Tom Clancy's Division 2" title.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the third quarter of 2018, AMD expects revenue to be approximately $1.7 billion, plus or minus $50 million, an increase of approximately 7 percent year-over-year, and non-GAAP gross margin to increase to approximately 38 percent, driven by the sales growth of Ryzen and EPYC products, partially offset by lower sales of GPU products in the blockchain market.

14 Comments on AMD Reports Second Quarter 2018 Financial Results

And it's sadly ignored somewhat. People are still used to the old paradigm of gpu vs gpu.

I'm kind of this way in general, I guess.. and look at whole technology packages. Which is why I stick with Intel too.

since nvidia in stock clearance mode now, with lowered price and bundling

on my country the price is still high as during mining craze in 2017

When you spend a year selling cards that dont compete with the opponents high end (580 VS 1080), then release a partially competent competitor over a year later, the old card V card paradigm is still very relevant.

edit: Mind you, I stick to mostly single player games. I can see the e-sports argument.

Next issue, very important for me because of PCSX2 and PPSSPP - OpenGL on Windows is completely broken: github.com/PCSX2/pcsx2/issues/1552 and slow as hell, even compered to Intel. I think current Linux Mesa drivers for AMD GPUs are much much better than AMD proprietary drivers for Windows which is quite sad - community done what AMD cannot, maybe they should open Windows drivers?

At this point while Nvidia has Pascal parts to move although they aren't in any "discount mode" to move them out. All such SKU's are still well above MSRP's, many by 20%. Offer a 128Gb SSD to me is not even enticing, as it only good for say a windows boot drive for something else I might have to build. Nvidia is in not in any hurry to dilute their pricing synthesis built on the mining boon. They 're more than willing to holding the prices high so they can use that to justify again another (higher) MSRP structure for Volta (or whatever it will be).

Nvidia will be trickling out over the upcoming months what's basically "Paper Launches" for each version, while then 2 weeks later release Founders Editions for it. Then perhaps 2-3 week after that the AIB partner start in "dribs and drabs" getting card into the market.

Just got an XFX RX580 GTS 8Gb (std. 1366Mhz) for $230 -AR $20 yesterday at Amazon shipped free. I think AMD will be working with their AIB's over next 4-6 weeks to slowly move prices down. But, honestly don't believe any such generic 8Gb cards will get close to $200 any point soon. I kind-of want to believe AMD has some plan... but want to hold their card close, something can do that now that they have such a condensed operation, tight-lips including at GloFo.

Anyone who thinks AMD isn't giving Intel's bottom-line a thumping needs to review this info, then review Intel's report. Yeah..