Tuesday, January 28th 2020

AMD Reports Fourth Quarter and Annual 2019 Financial Results

AMD (NASDAQ:AMD) today announced revenue for the fourth quarter of 2019 of $2.13 billion, operating income of $348 million, net income of $170 million and diluted earnings per share of $0.15. On a non-GAAP basis, operating income was $405 million, net income was $383 million and diluted earnings per share was $0.32. For fiscal year 2019, the company reported revenue of $6.73 billion, operating income of $631 million, net income of $341 million and diluted earnings per share of $0.30. On a non-GAAP basis, operating income was $840 million, net income was $756 million and diluted earnings per share was $0.64.

"2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history," said Dr. Lisa Su, AMD president and CEO. "We delivered significant margin expansion and increased profitability as we gained market share with our Ryzen and EPYC processors. Our focused execution and the investments we made in our high-performance computing roadmaps position us well for continued growth in 2020 and beyond."Q4 2019 Results

Computing and Graphics segment revenue was $1.66 billion, up 69 percent year-over-year and 30 percent compared to the prior quarter driven primarily by strong sales of Ryzen processors and Radeon gaming GPUs.

2019 Annual Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement".

For the first quarter of 2020, AMD expects revenue to be approximately $1.8 billion, plus or minus $50 million, an increase of approximately 42 percent year-over-year and a decrease of approximately 15 percent sequentially. The year-over-year increase is expected to be driven by strong growth of Ryzen, EPYC and Radeon product sales. The sequential decrease is driven primarily by negligible semi-custom revenue which continues to soften in advance of the ramp of next generation products, in addition to seasonality. AMD expects non-GAAP gross margin to be approximately 46 percent in the first quarter of 2020.

For the full year 2020, AMD expects revenue growth of approximately 28 to 30 percent over 2019 driven by strength across all businesses. AMD expects non-GAAP gross margin to be approximately 45 percent for 2020.

"2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history," said Dr. Lisa Su, AMD president and CEO. "We delivered significant margin expansion and increased profitability as we gained market share with our Ryzen and EPYC processors. Our focused execution and the investments we made in our high-performance computing roadmaps position us well for continued growth in 2020 and beyond."Q4 2019 Results

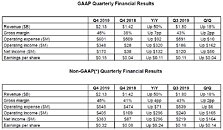

- Revenue of $2.13 billion was up 50 percent year-over-year primarily driven by the Computing and Graphics segment. Revenue was up 18 percent compared to the prior quarter as a result of higher revenue in the Computing and Graphics segment partially offset by lower revenue in the Enterprise, Embedded and Semi-Custom segment.

- Gross margin was 45 percent compared to 38 percent a year ago and 43 percent in the prior quarter. Non-GAAP gross margin was 45 percent compared to 41 percent a year ago and 43 percent in the prior quarter. Gross margin improvements were primarily driven by the ramp of 7 nm products.

- Operating income was $348 million compared to $28 million a year ago and operating income of $186 million in the prior quarter. Non-GAAP operating income was $405 million compared to $109 million a year ago and $240 million in the prior quarter. Operating income improvements were primarily driven by revenue growth and the ramp of higher margin products.

- Net income was $170 million compared to $38 million a year ago and net income of $120 million in the prior quarter. Non-GAAP net income was $383 million compared to $87 million a year ago and $219 million in the prior quarter.

- Diluted earnings per share was $0.15 compared to $0.04 a year ago and $0.11 in the prior quarter. Non-GAAP diluted earnings per share was $0.32 compared to $0.08 a year ago and $0.18 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.50 billion at the end of the quarter as compared to $1.21 billion at the end of the prior quarter.

- Principal debt was reduced by $524 million resulting in a GAAP loss of $128 million.

- Free cash flow was $400 million in the quarter compared to $79 million a year ago and $179 million in the prior quarter.

Computing and Graphics segment revenue was $1.66 billion, up 69 percent year-over-year and 30 percent compared to the prior quarter driven primarily by strong sales of Ryzen processors and Radeon gaming GPUs.

- Operating income was $360 million compared to $115 million a year ago and $179 million in the prior quarter. Operating income improvements were primarily driven by higher revenue from Ryzen processor sales.

- Client processor average selling price (ASP) was up year-over-year and sequentially driven by Ryzen processor sales.

- GPU ASP was up year-over-year and sequentially primarily driven by higher channel sales.

- Operating income was $45 million compared to an operating loss of $6 million a year ago and operating income of $61 million in the prior quarter. The year-over-year improvement was primarily driven by higher EPYC processor revenue. The decrease compared to the prior quarter was due to lower semi-custom sales.

2019 Annual Results

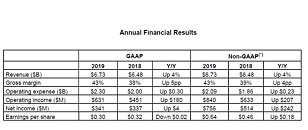

- Revenue of $6.73 billion was up 4 percent year-over-year driven by higher revenue in the Computing and Graphics segment partially offset by lower revenue in the Enterprise, Embedded and Semi-Custom segment.

- Gross margin was 43 percent compared to 38 percent and non-GAAP gross margin was 43 percent compared to 39 percent in the prior year. Gross margin expansion was primarily driven by Ryzen and EPYC products.

- Operating income was $631 million compared to $451 million and non-GAAP operating income was $840 million compared to $633 million in the prior year. The operating income improvement was primarily driven by higher revenue and gross margin expansion.

- Net income was $341 million compared to $337 million and non-GAAP net income was $756 million compared to $514 million in the prior year.

- Diluted earnings per share was $0.30 compared to $0.32 in 2018. Non-GAAP diluted earnings per share was $0.64 compared to $0.46 in the prior year.

- Cash, cash equivalents and marketable securities were $1.50 billion at the end of the year compared to $1.16 billion at the end of 2018.

- Principal debt was reduced by $965 million resulting in a GAAP loss of $176 million.

- Free cash flow was $276 million for the year compared to negative $129 million in 2018.

- AMD announced new mobile processors for upcoming ultrathin, gaming and mainstream laptops from Acer, Asus, Dell, HP, Lenovo and other OEMs.

- The AMD Ryzen 4000 Series Mobile Processor family includes the world's highest performance and only 8 core processor available for ultrathin laptops. Built on the groundbreaking 7 nm-based "Zen 2" architecture and featuring optimized high-performance Radeon graphics, the 4000 Series provides incredible performance and power efficiency.

- AMD announced the AMD Athlon 3000 Series Mobile Processor family, bringing consumers more choice and enabling modern computing experiences for mainstream notebooks.

- The first AMD Ryzen 4000 Series and Athlon 3000 Series powered laptops are expected to be available starting in Q1 2020, with more than 100 systems expected to launch throughout 2020.

- AMD unveiled new high-performance desktop processors designed to deliver the best experiences for gamers and creators.

- AMD introduced the world's most powerful desktop processors, the 3rd Gen AMD Ryzen Threadripper family, including the 24-core AMD Ryzen Threadripper 3960X, 32-core AMD Ryzen Threadripper 3970X and the world's first 64-core desktop processor, the AMD Ryzen Threadripper 3990X.

- AMD launched the AMD Ryzen 9 3950X, the fastest and most powerful 16-core consumer desktop processor.

- AMD continued to expand its presence in the data center and high-performance computing markets with new AMD EPYC processor customers and platforms.

- AWS and Microsoft Azure announced new cloud instances for high-performance computing powered by 2nd Gen EPYC processors.

- New supercomputers powered by 2nd Gen AMD EPYC processors include the Expanse system at the San Diego Supercomputer Center and the latest extension of France's GENCI Joliot-Curie supercomputer.

- Fujitsu, Gigabyte, HPE, Penguin, Synopsys and Tyan announced new platforms based on 2nd Gen AMD EPYC processors, bringing the total number of AMD EPYC processor-powered platforms to more than 100.

- AMD expanded its gaming and professional graphics card offerings:

- AMD unveiled the AMD Radeon RX 5600 Series for ultimate 1080p gaming, including the AMD Radeon RX 5600 XT, the AMD Radeon RX 5600 and the AMD Radeon RX 5600M for laptop PCs. The AMD Radeon RX 5600 Series offers up to 20 percent faster performance on average across select AAA games compared to competitive offerings.

- AMD announced the AMD Radeon RX 5500 XT graphics card. Built on the AMD RDNA architecture and industry-leading 7 nm process technology, the AMD Radeon RX 5500 XT provides up to 13 percent faster performance on average in today's top AAA games than the competition.

- Apple announced the latest Apple MacBook Pro, featuring the new AMD Radeon Pro 5500M and 5300M mobile GPUs. Leveraging the powerful AMD RDNA architecture, AMD Radeon Pro 5000M series GPUs deliver groundbreaking levels of graphics performance for video editing, 3D content creation and macOS-based game development.

- AMD launched the world's first 7 nm professional PC workstation graphics card for 3D designers, architects and engineers, the AMD Radeon Pro W5700 graphics card. The Radeon Pro W5700 harnesses the high-performance, energy-efficient AMD RDNA architecture to deliver new levels of performance.

AMD's outlook statements are based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement".

For the first quarter of 2020, AMD expects revenue to be approximately $1.8 billion, plus or minus $50 million, an increase of approximately 42 percent year-over-year and a decrease of approximately 15 percent sequentially. The year-over-year increase is expected to be driven by strong growth of Ryzen, EPYC and Radeon product sales. The sequential decrease is driven primarily by negligible semi-custom revenue which continues to soften in advance of the ramp of next generation products, in addition to seasonality. AMD expects non-GAAP gross margin to be approximately 46 percent in the first quarter of 2020.

For the full year 2020, AMD expects revenue growth of approximately 28 to 30 percent over 2019 driven by strength across all businesses. AMD expects non-GAAP gross margin to be approximately 45 percent for 2020.

57 Comments on AMD Reports Fourth Quarter and Annual 2019 Financial Results

Most investors would rather see AMD investing that money spent on paying down debt early thrown into R+D to make more products that will sell and generate more profit. Paying down the debt wont help you if you are not innovating to stay competitive. Same with intel buying back shares to keep the price up, that doesnt make long term profits or even short term profits. AMD's sales are not as high as expected, 2019 wasnt a boom year like 2018 was.

Ryzen 4000 and continued epyc sale swill keep the share price rising, but AMD is not going to be the crown jewel of the computing world for a long time yet.

AMD is once again suffering from consoles. They are wasting too much resource on consoles and making them with no or almost no profit.

They should focus on PC GPU and stop making consoles. Enough time for proving that it has no ROI

www.marketwatch.com/story/amd-stock-slides-as-outlook-falls-below-wall-street-view-2020-01-28

The reason less revenue from console, the current generation will repleaced by new consoles this year. So MS and Sony producing less current generation console. This means less chip sold by AMD to console marker. Less chip less means less revenue from console.

Current consoles are close to the end of their life-cycle, sales will never pick up again in any considerable manner from now on. As usual articles from finance/stock market sites are written by people that do not know or understand technology or whatever thing it is that the company they write about are involved in.

And No, AMD never won anything from consoles, before Ryzen and even at consoles best days, AMD were always losing. And now the success of Ryzen isn't fully reflected on earnings because of investment on consoles and building new consoles

As for revenue problems coming from consoles: most don't believe. Analysts directly asked AMD for separate console and server figures and they said "no".

-8.12% at the moment. Savage.AMD sets very low prices and they aren't making serious money from any segment.

Consoles provide a guaranteed cashflow.

And console sell and Apple OEM sell kept AMD afloat before Ryzen came, not gaming gpu. PC people dont buy AMD gpu.

They spend too much on developing consoles. And now they are working on PS5 and xboxs next console. They don't want to include console numbers alone so they don't get exposed that they are making losing investment and investors would try to prevent them from doing thatVery low margin on CPUs and GPUs but losing in consoles. Totally two different things

R+D has its limits, sure, but based on the storry state of RTG hardware and drivers (freesync STILL broken on navi 7 months later) and the far larger support group, from integration to customer support that intel boasts, AMD has plenty of areas that need more investment. Investors see that, again just an explanation of why investors were not buying up shares when the quarterly report came out.

As for intel/IBM, well, intel is putting mor einto share buyback instead of R+D, and look where it got them, and where they are going. Despite that, they are still HUGE compared to AMD, both in market share and revenue. IBM is a sad tale, but a great example of a dominant player falling asleep at the wheel.

2x the wafer orders will help, but that wont happen until Apple drops 7nm usage. Even then, it takes months for those chips being fabed to reach manufacturers and retailers, and wiht the chinese new year being extended by 2 weeks amid the croronavirus outbreak, it will take time before this strategy pays off any dividends, and that assumes the demand is there. We havent heard of EPYC shortages like we have Xeon shortages from intel.

AMD is on a slow boil, which is good, AMD is positioned to do quite well, but investors want it to get huge quick so they can make a profit and dump the shares. AMD isnt playing that game, hence why share prices went down instead of up.

Bulldozer should've not been released at all

Like I said I have no proof that AMD was selling their chips too cheaply but there is no proof that they weren't either. I imagine you could dig up some info on what the revenue was but I doubt you could find the profit made. A healthy profit is what a company needs to invest in R&D for the future and pay the overhead.

AMD admitted during a press conference that console segment has lower profit margin than PCs and servers.

Even if we come up with the most primitive and absurd estimation on profit, for instance let's say they made back 1$ for each chip sold that's still 100 million dollars, far from insignificant.

AMD made good money from consoles and more importantly it was a relatively constant and reliable stream of cash, few companies get that sort of privilege in this industry.

The most telling thing of all was that Intel and Nvidia weren't even interested in the console contracts because they both liked a high profit margin and they didn't see the console contracts as worth bothering with.

The only reason that these 2 firms preferred AMD over Intel and Nvidia is that AMD is making it so cheap. There is no earn for AMD in console business that's why they don't want to explain console numbers to investors . Too much effort and expense with no return.