Tuesday, January 28th 2020

AMD Reports Fourth Quarter and Annual 2019 Financial Results

AMD (NASDAQ:AMD) today announced revenue for the fourth quarter of 2019 of $2.13 billion, operating income of $348 million, net income of $170 million and diluted earnings per share of $0.15. On a non-GAAP basis, operating income was $405 million, net income was $383 million and diluted earnings per share was $0.32. For fiscal year 2019, the company reported revenue of $6.73 billion, operating income of $631 million, net income of $341 million and diluted earnings per share of $0.30. On a non-GAAP basis, operating income was $840 million, net income was $756 million and diluted earnings per share was $0.64.

"2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history," said Dr. Lisa Su, AMD president and CEO. "We delivered significant margin expansion and increased profitability as we gained market share with our Ryzen and EPYC processors. Our focused execution and the investments we made in our high-performance computing roadmaps position us well for continued growth in 2020 and beyond."Q4 2019 Results

Computing and Graphics segment revenue was $1.66 billion, up 69 percent year-over-year and 30 percent compared to the prior quarter driven primarily by strong sales of Ryzen processors and Radeon gaming GPUs.

2019 Annual Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement".

For the first quarter of 2020, AMD expects revenue to be approximately $1.8 billion, plus or minus $50 million, an increase of approximately 42 percent year-over-year and a decrease of approximately 15 percent sequentially. The year-over-year increase is expected to be driven by strong growth of Ryzen, EPYC and Radeon product sales. The sequential decrease is driven primarily by negligible semi-custom revenue which continues to soften in advance of the ramp of next generation products, in addition to seasonality. AMD expects non-GAAP gross margin to be approximately 46 percent in the first quarter of 2020.

For the full year 2020, AMD expects revenue growth of approximately 28 to 30 percent over 2019 driven by strength across all businesses. AMD expects non-GAAP gross margin to be approximately 45 percent for 2020.

"2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history," said Dr. Lisa Su, AMD president and CEO. "We delivered significant margin expansion and increased profitability as we gained market share with our Ryzen and EPYC processors. Our focused execution and the investments we made in our high-performance computing roadmaps position us well for continued growth in 2020 and beyond."Q4 2019 Results

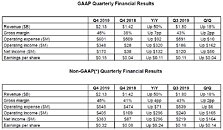

- Revenue of $2.13 billion was up 50 percent year-over-year primarily driven by the Computing and Graphics segment. Revenue was up 18 percent compared to the prior quarter as a result of higher revenue in the Computing and Graphics segment partially offset by lower revenue in the Enterprise, Embedded and Semi-Custom segment.

- Gross margin was 45 percent compared to 38 percent a year ago and 43 percent in the prior quarter. Non-GAAP gross margin was 45 percent compared to 41 percent a year ago and 43 percent in the prior quarter. Gross margin improvements were primarily driven by the ramp of 7 nm products.

- Operating income was $348 million compared to $28 million a year ago and operating income of $186 million in the prior quarter. Non-GAAP operating income was $405 million compared to $109 million a year ago and $240 million in the prior quarter. Operating income improvements were primarily driven by revenue growth and the ramp of higher margin products.

- Net income was $170 million compared to $38 million a year ago and net income of $120 million in the prior quarter. Non-GAAP net income was $383 million compared to $87 million a year ago and $219 million in the prior quarter.

- Diluted earnings per share was $0.15 compared to $0.04 a year ago and $0.11 in the prior quarter. Non-GAAP diluted earnings per share was $0.32 compared to $0.08 a year ago and $0.18 in the prior quarter.

- Cash, cash equivalents and marketable securities were $1.50 billion at the end of the quarter as compared to $1.21 billion at the end of the prior quarter.

- Principal debt was reduced by $524 million resulting in a GAAP loss of $128 million.

- Free cash flow was $400 million in the quarter compared to $79 million a year ago and $179 million in the prior quarter.

Computing and Graphics segment revenue was $1.66 billion, up 69 percent year-over-year and 30 percent compared to the prior quarter driven primarily by strong sales of Ryzen processors and Radeon gaming GPUs.

- Operating income was $360 million compared to $115 million a year ago and $179 million in the prior quarter. Operating income improvements were primarily driven by higher revenue from Ryzen processor sales.

- Client processor average selling price (ASP) was up year-over-year and sequentially driven by Ryzen processor sales.

- GPU ASP was up year-over-year and sequentially primarily driven by higher channel sales.

- Operating income was $45 million compared to an operating loss of $6 million a year ago and operating income of $61 million in the prior quarter. The year-over-year improvement was primarily driven by higher EPYC processor revenue. The decrease compared to the prior quarter was due to lower semi-custom sales.

2019 Annual Results

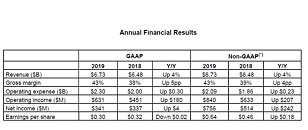

- Revenue of $6.73 billion was up 4 percent year-over-year driven by higher revenue in the Computing and Graphics segment partially offset by lower revenue in the Enterprise, Embedded and Semi-Custom segment.

- Gross margin was 43 percent compared to 38 percent and non-GAAP gross margin was 43 percent compared to 39 percent in the prior year. Gross margin expansion was primarily driven by Ryzen and EPYC products.

- Operating income was $631 million compared to $451 million and non-GAAP operating income was $840 million compared to $633 million in the prior year. The operating income improvement was primarily driven by higher revenue and gross margin expansion.

- Net income was $341 million compared to $337 million and non-GAAP net income was $756 million compared to $514 million in the prior year.

- Diluted earnings per share was $0.30 compared to $0.32 in 2018. Non-GAAP diluted earnings per share was $0.64 compared to $0.46 in the prior year.

- Cash, cash equivalents and marketable securities were $1.50 billion at the end of the year compared to $1.16 billion at the end of 2018.

- Principal debt was reduced by $965 million resulting in a GAAP loss of $176 million.

- Free cash flow was $276 million for the year compared to negative $129 million in 2018.

- AMD announced new mobile processors for upcoming ultrathin, gaming and mainstream laptops from Acer, Asus, Dell, HP, Lenovo and other OEMs.

- The AMD Ryzen 4000 Series Mobile Processor family includes the world's highest performance and only 8 core processor available for ultrathin laptops. Built on the groundbreaking 7 nm-based "Zen 2" architecture and featuring optimized high-performance Radeon graphics, the 4000 Series provides incredible performance and power efficiency.

- AMD announced the AMD Athlon 3000 Series Mobile Processor family, bringing consumers more choice and enabling modern computing experiences for mainstream notebooks.

- The first AMD Ryzen 4000 Series and Athlon 3000 Series powered laptops are expected to be available starting in Q1 2020, with more than 100 systems expected to launch throughout 2020.

- AMD unveiled new high-performance desktop processors designed to deliver the best experiences for gamers and creators.

- AMD introduced the world's most powerful desktop processors, the 3rd Gen AMD Ryzen Threadripper family, including the 24-core AMD Ryzen Threadripper 3960X, 32-core AMD Ryzen Threadripper 3970X and the world's first 64-core desktop processor, the AMD Ryzen Threadripper 3990X.

- AMD launched the AMD Ryzen 9 3950X, the fastest and most powerful 16-core consumer desktop processor.

- AMD continued to expand its presence in the data center and high-performance computing markets with new AMD EPYC processor customers and platforms.

- AWS and Microsoft Azure announced new cloud instances for high-performance computing powered by 2nd Gen EPYC processors.

- New supercomputers powered by 2nd Gen AMD EPYC processors include the Expanse system at the San Diego Supercomputer Center and the latest extension of France's GENCI Joliot-Curie supercomputer.

- Fujitsu, Gigabyte, HPE, Penguin, Synopsys and Tyan announced new platforms based on 2nd Gen AMD EPYC processors, bringing the total number of AMD EPYC processor-powered platforms to more than 100.

- AMD expanded its gaming and professional graphics card offerings:

- AMD unveiled the AMD Radeon RX 5600 Series for ultimate 1080p gaming, including the AMD Radeon RX 5600 XT, the AMD Radeon RX 5600 and the AMD Radeon RX 5600M for laptop PCs. The AMD Radeon RX 5600 Series offers up to 20 percent faster performance on average across select AAA games compared to competitive offerings.

- AMD announced the AMD Radeon RX 5500 XT graphics card. Built on the AMD RDNA architecture and industry-leading 7 nm process technology, the AMD Radeon RX 5500 XT provides up to 13 percent faster performance on average in today's top AAA games than the competition.

- Apple announced the latest Apple MacBook Pro, featuring the new AMD Radeon Pro 5500M and 5300M mobile GPUs. Leveraging the powerful AMD RDNA architecture, AMD Radeon Pro 5000M series GPUs deliver groundbreaking levels of graphics performance for video editing, 3D content creation and macOS-based game development.

- AMD launched the world's first 7 nm professional PC workstation graphics card for 3D designers, architects and engineers, the AMD Radeon Pro W5700 graphics card. The Radeon Pro W5700 harnesses the high-performance, energy-efficient AMD RDNA architecture to deliver new levels of performance.

AMD's outlook statements are based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement".

For the first quarter of 2020, AMD expects revenue to be approximately $1.8 billion, plus or minus $50 million, an increase of approximately 42 percent year-over-year and a decrease of approximately 15 percent sequentially. The year-over-year increase is expected to be driven by strong growth of Ryzen, EPYC and Radeon product sales. The sequential decrease is driven primarily by negligible semi-custom revenue which continues to soften in advance of the ramp of next generation products, in addition to seasonality. AMD expects non-GAAP gross margin to be approximately 46 percent in the first quarter of 2020.

For the full year 2020, AMD expects revenue growth of approximately 28 to 30 percent over 2019 driven by strength across all businesses. AMD expects non-GAAP gross margin to be approximately 45 percent for 2020.

57 Comments on AMD Reports Fourth Quarter and Annual 2019 Financial Results

AMD stock price is at a level that assumes enormous growth way beyond AMD forecasts.

This growth isn't happening. That's why stock drops.

It's quite disturbing that people on this forum think AMD is booming and will soon dominate the market.

You have the official figures. Read them.

2019 as a whole was very similar to 2018. AMD grew by 4% (BTW: Intel was +2%).

Just helping you with the source, not sure why everyone is excited. AMD had a nice boost last year, but it will be short lived imo. Super niche market, not many people upgrade CPU's that often, and hardly any profit on next gen consoles, otherwise Nvidia would have won that contract. Add in GPU drivers are still crap and they can't even get Freesync to work properly still after all this time on navi...

I really hate the way the stock market is, as it's really really bad for a lot of companies.

They are technically booming, as they've gone from almost being dead to increasing their market share on a daily basis. However, there's no way they're going to dominate anything except maybe the DIY market, which obviously is a tiny part of the whole market. But it's clearly not just people here, as if it was, AMD's share price wouldn't have broken record after record in the past couple of months.

I do expect the new 4000-series mobile parts to take some market share, maybe 10-15%? However, it's most likely to be the kind of people that hangs out here that will start buying them, or people that have no clue and just want an affordable laptop.

But since we're getting so many stock news, maybe staff should add some explanation? Instead of just reposting fragments from other sites. :)I mentioned that in a discussion recently.

AMD focused on a very specific niche. Almost all Ryzen 3000 owners had another Zen already. Many upgrade with each generation.

With that in mind, obviously, revenue will be pretty much constant year-to-year.

2020 may be the year when AMD becomes serious in high-end mobile segment, which is great, but these clients replace a PC every 3-4 years on average (especially enterprises).

That's why high margins are so important for Intel.But what do you mean by AMD being punished?

I'm not sure you know how stocks work. :) I'd love to help.

OK, so AMD lost 4% today. What do you think that means? Why would AMD care?AMD already has ~15% of mobile market.

Results are always compared to company's own forecasts and market expectations.

2019 results are neutral at best.

But the real problem (and reason stock is down) are lowered 2020 estimates.

Yes, AMD grows and will continue to grow. That's good.

But from the stock valulation point of view, that growth is too slow. And people start to notice AMD struggles to win markets other than their core niche (enthusiasts).

Remember: stock price isn't just a random number that goes up/down then a company looks good/bad. It's calculated based on forecasts.

AMD on the other hand has been killing it in that one market segment that brings the least money.

It also looks like AMD's server businesses is going nowhere even with a hugely superior platform. They should be swimming in cash with a product like EPYC , but is seems no one is buying.

A shame really, but hey, once they go out of business we'll be able to buy a 10 core Intel for $2000 and an entry level GPU for $1000. Can't wait.

EPYC doesn't work because it only offers performance. This will not change unless AMD changes.

And to some extent, this is what ones gets with an altitude like: "out CPUs are fine - it's the software that isn't made properly".

AMD's biggest obstacle is getting the big PC manufacturers to push AMD chips but I don't see that happening. Most people just buy what they are familiar with and have had a good experience with.

But stock price is about future, not past.AMD's product simply isn't attractive. They can't sell it. It has nothing to do with people buying what they know (which is true as well). But if that was the only important factor, we would be buying the same brands we're used to.

And yet new companies emerge from time to time. New ones. AMD isn't new - it should be easier for them.

If AMD doesn't know how to grow as a CPU supplier, they should simply get an exclusivity deal with a large and popular OEM.

Given they were not only supply constrained, TSMC 7nm, but also having arguably the most important part (notebooks) of the market relatively unaddressed ~ the +30% topline number is really good, in a rather sluggish global economy. What's the equivalent you're seeing from competitors namely Intel & Nvidia?

This is comparable spec. as well, so it makes no sense to me, especially as it was from the same hardware provider.I might not "know much" about the stock market, but you clearly know nothing about Intel's MDF and how that works in favour of selling Intel hardware for everything from the board and server markers, to the distribution and retail/B2B chain. Intel spends boatloads of cash to make sure everyone pushes their products, whereas AMD has pretty much zero MDF. This is why a lot of AMD products don't sell, as there's no extra incentive to sell AMD over Intel.

- Principal debt was reduced by $965 million resulting in a GAAP loss of $176 million.

- Free cash flow was $276 million for the year compared to negative $129 million in 2018.

The funny thing is with the increase in the share price and sales the last quarter was:- Principal debt was reduced by $524 million resulting in a GAAP loss of $128 million.

- Free cash flow was $400 million in the quarter compared to $79 million a year ago and $179 million in the prior quarter.

What this points to is exponential growth of wealth in the company on a quarterly basis. I seriously believe that AMD based laptops are where they will make a huge splash in 2020 with their new chips. I actually commend AMD for the products there are producing to compete with Intel and Nvidia with such paltry (by comparison) value and equity.