Thursday, April 16th 2020

TSMC Reports Q1-2020 Financial Results with $4.51NTD EPS

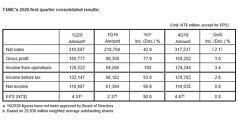

TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$310.60 billion, net income of NT$116.99 billion, and diluted earnings per share of NT$4.51 (US$0.75 per ADR unit) for the first quarter ended March 31, 2020. Year-over-year, first quarter revenue increased 42.0% while net income and diluted EPS both increased 90.6%. Compared to fourth quarter 2019, first quarter results represented a 2.1% decrease in revenue and a 0.8% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $10.31 billion, which increased 45.2% year-over-year and decreased 0.8% from the previous quarter. Gross margin for the quarter was 51.8%, operating margin was 41.4%, and net profit margin was 37.7%. In the first quarter, shipments of 7-nanometer accounted for 35% of total wafer revenue and 10-nanometer process technology contributed 0.5% while 16-nanometer accounted for 19%. Advanced technologies, defined as 16-nanometer and more advanced technologies, accounted for 55% of total wafer revenue."Our first quarter business declined less than seasonality, due to the increase in HPC-related demand and the continued ramp of 5G smartphones," said Wendell Huang, VP and Chief Financial Officer of TSMC. "Moving into second quarter 2020, we expect our revenue to be flattish, as weaker mobile product demand is expected to be balanced by continued 5G deployment and HPC-related product launches. Based on our current business outlook, management expects the overall performance for second quarter 2020 to be as follows":

In US dollars, first quarter revenue was $10.31 billion, which increased 45.2% year-over-year and decreased 0.8% from the previous quarter. Gross margin for the quarter was 51.8%, operating margin was 41.4%, and net profit margin was 37.7%. In the first quarter, shipments of 7-nanometer accounted for 35% of total wafer revenue and 10-nanometer process technology contributed 0.5% while 16-nanometer accounted for 19%. Advanced technologies, defined as 16-nanometer and more advanced technologies, accounted for 55% of total wafer revenue."Our first quarter business declined less than seasonality, due to the increase in HPC-related demand and the continued ramp of 5G smartphones," said Wendell Huang, VP and Chief Financial Officer of TSMC. "Moving into second quarter 2020, we expect our revenue to be flattish, as weaker mobile product demand is expected to be balanced by continued 5G deployment and HPC-related product launches. Based on our current business outlook, management expects the overall performance for second quarter 2020 to be as follows":

- Revenue is expected to be between US$10.1 billion and US$10.4 billion; And, based on the exchange rate assumption of 1 US dollar to 30.0 NT dollars,

- Gross profit margin is expected to be between 50% and 52%;

- Operating profit margin is expected to be between 39% and 41%

1 Comment on TSMC Reports Q1-2020 Financial Results with $4.51NTD EPS

Yea I know they are spending boatloads of $$ on new factories, R&D & all that, but just sayin...