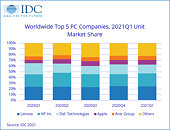

Worldwide Enterprise WLAN Market Continued Strong Growth in Second Quarter 2021, According to IDC

Growth rates remained strong in the enterprise segment of the wireless local area networking (WLAN) market in the second quarter of 2021 (2Q21) as the market increased 22.4% on a year-over-year basis to $1.7 billion, according to the International Data Corporation (IDC) Worldwide Quarterly Wireless LAN Tracker. In the consumer segment of the WLAN market, revenues declined 5.7% in the quarter to $2.3 billion, giving the combined enterprise and consumer WLAN markets year-over-year growth of 4.6% in 2Q21.

The growth in the enterprise-class segment of the market builds on a strong first quarter of 2021 when revenues increased 24.6% year over year. For the first half of 2021, the market increased 23.5% compared to first two quarters of 2020. Compared to the second quarter of 2019, 2Q21 revenues increased 10.8%, indicating that demand in the enterprise WLAN is strong.

The growth in the enterprise-class segment of the market builds on a strong first quarter of 2021 when revenues increased 24.6% year over year. For the first half of 2021, the market increased 23.5% compared to first two quarters of 2020. Compared to the second quarter of 2019, 2Q21 revenues increased 10.8%, indicating that demand in the enterprise WLAN is strong.