Apr 6th, 2025 15:30 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- How I made an Ultimate Cooling Guide (18)

- The easiest way to connect the BOOTSEL test metal terminal and the GND terminal.... (0)

- What local LLM-s you use? (147)

- All Intel DG1 needs special bios? (30)

- Regarding Arctic's new Lineup of MAX fans! (1)

- TPU's F@H Team (20421)

- RX 9000 series GPU Owners Club (192)

- Clicks & Pops in Mic Audio due to buffer underruns. Please send help. (0)

- What are you playing? (23348)

- 9070XT or 7900XT (25)

Popular Reviews

- ASUS Prime X870-P Wi-Fi Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- PowerColor Radeon RX 9070 Hellhound Review

- Corsair RM750x Shift 750 W Review

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (124)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (92)

News Posts matching #Crypto

Return to Keyword Browsing

NVIDIA Explains How CUDA Libraries Bolster Cybersecurity With AI

Traditional cybersecurity measures are proving insufficient for addressing emerging cyber threats such as malware, ransomware, phishing and data access attacks. Moreover, future quantum computers pose a security risk to today's data through "harvest now, decrypt later" attack strategies. Cybersecurity technology powered by NVIDIA accelerated computing and high-speed networking is transforming the way organizations protect their data, systems and operations. These advanced technologies not only enhance security but also drive operational efficiency, scalability and business growth.

Accelerated AI-Powered Cybersecurity

Modern cybersecurity relies heavily on AI for predictive analytics and automated threat mitigation. NVIDIA GPUs are essential for training and deploying AI models due to their exceptional computational power.

Accelerated AI-Powered Cybersecurity

Modern cybersecurity relies heavily on AI for predictive analytics and automated threat mitigation. NVIDIA GPUs are essential for training and deploying AI models due to their exceptional computational power.

Apple M-Series CPUs Affected by "GoFetch" Unpatchable Cryptographic Vulnerability

A team of academic researchers has uncovered a critical vulnerability in Apple M-series CPUs targeting data memory-dependent prefetcher (DMP) that could allow attackers to extract secret encryption keys from Macs. The flaw, called GoFetch, is based on the microarchitecture design of the Apple Silicon, which means that it cannot be directly patched and poses a significant risk to users' data security. The vulnerability affects all Apple devices powered by M-series chips, including the popular M1 and M2 generations. The M3 generation can turn a special bit off to disable DMP, potentially hindering performance. The DMP, designed to optimize performance by preemptively loading data that appears to be a pointer, violates a fundamental requirement of constant-time programming by mixing data and memory access patterns. This creates an exploitable side channel that attackers can leverage to extract secret keys.

To execute the GoFetch attack, attackers craft specific inputs for cryptographic operations, ensuring that pointer-like values only appear when they have correctly guessed bits of the secret key. By monitoring the DMP's dereference behavior through cache-timing analysis, attackers can verify their guesses and gradually unravel the entire secret key. The researchers demonstrated successful end-to-end key extraction attacks on popular constant-time implementations of both classical and post-quantum cryptography, highlighting the need for a thorough reevaluation of the constant-time programming paradigm in light of this new vulnerability.

To execute the GoFetch attack, attackers craft specific inputs for cryptographic operations, ensuring that pointer-like values only appear when they have correctly guessed bits of the secret key. By monitoring the DMP's dereference behavior through cache-timing analysis, attackers can verify their guesses and gradually unravel the entire secret key. The researchers demonstrated successful end-to-end key extraction attacks on popular constant-time implementations of both classical and post-quantum cryptography, highlighting the need for a thorough reevaluation of the constant-time programming paradigm in light of this new vulnerability.

Reports Warn of Pirated Windows 10 ISOs Containing Dangerous Malware

According to a report published by Bleeping Computer last week and research conducted by the Doctor Web team, nefarious online organizations are distributing Windows 10 ISO files laced with extremely dangerous clipper malware variants. Microsoft ceased direct sales of licenses for its last gen operating system earlier this year, and a select bunch of folks are resorting to grabbing copies (for free) from pirate sources. The Doctor Web alert states: "(we) discovered a malicious clipper program in a number of unofficial Windows 10 builds that cybercriminals have been distributing via a torrent tracker. Dubbed Trojan.Clipper.231, this trojan app substitutes crypto wallet addresses in the clipboard with addresses provided by attackers. As of this moment, malicious actors have managed to steal cryptocurrency in an amount equivalent to about $19,000 (USD)."

It continues: "At the end of May 2023, a customer contacted Doctor Web with their suspicion that their Windows 10 computer was infected. The analysis our specialists carried out confirmed the presence of trojan applications in the system. These were Trojan.Clipper.231 stealer malware as well as the Trojan.MulDrop22.7578 dropper and Trojan.Inject4.57873 injector, which were used to launch the clipper. Doctor Web's virus laboratory successfully localized all these threats and neutralized them." It seems that hackers are hiding cryptocurrency hijackers within Extensible Firmware Interface (EFI) partitions, thus evading detection by antivirus software(s).

It continues: "At the end of May 2023, a customer contacted Doctor Web with their suspicion that their Windows 10 computer was infected. The analysis our specialists carried out confirmed the presence of trojan applications in the system. These were Trojan.Clipper.231 stealer malware as well as the Trojan.MulDrop22.7578 dropper and Trojan.Inject4.57873 injector, which were used to launch the clipper. Doctor Web's virus laboratory successfully localized all these threats and neutralized them." It seems that hackers are hiding cryptocurrency hijackers within Extensible Firmware Interface (EFI) partitions, thus evading detection by antivirus software(s).

Top US Crypto & Blockchain Investment Firm Heading to Britain

Andreessen Horowitz (a16z), a leading American venture capital firm is in the process of setting up its first international office (outside of its California base of operations) in the United Kingdom. One of their mission statements reads: "(we) invest in seed to venture to late-stage technology companies, across bio + healthcare, consumer, crypto, enterprise, fintech, games, and companies building toward American dynamism." News sites have reported on Facebook and Twitter being notable "safe" prospects for a16z's team in the past. The company is hedging its bets on the UK government's fairly lax approach to crypto and blockchain regulation, following crackdowns on the cryptocurrency industry in the US. News outlets point to a notable case where the North American financial watchdog/regulator is suing the world's largest cryptocurrency exchange, Binance, due to activities "placing investors' assets at significant risk." The new Andreessen Horowitz London office is marked for a late 2023 opening—Chris Dixon the head of crypto investing at a16z has written about his firm's decision to embrace a new market location: "While there is still work to be done, we believe that the UK is on the right path to becoming a leader in crypto regulation...The UK also has deep pools of talent, world-leading academic institutions, and a strong entrepreneurial culture."

He has also declared that the UK Prime Minister - Rishi Sunak - is very pleased about a16z setting up shop in the City of London (financial district). The UK leader's statement reads: "As we cement the UK's place as a science and tech superpower, we must embrace new innovations like Web3, powered by blockchain technology, which will enable start-ups to flourish here and grow the economy. That success is founded on having the right regulation and guardrails in place to protect consumers and foster innovation. While there's still work to do, I'm determined to unlock opportunities for this technology and turn the UK into the world's Web3 centre. That's why I am thrilled world-leading investor, Andreessen Horowitz, has decided to open their first international office in the UK - which is testament to our world-class universities and talent and our strong competitive business environment."

He has also declared that the UK Prime Minister - Rishi Sunak - is very pleased about a16z setting up shop in the City of London (financial district). The UK leader's statement reads: "As we cement the UK's place as a science and tech superpower, we must embrace new innovations like Web3, powered by blockchain technology, which will enable start-ups to flourish here and grow the economy. That success is founded on having the right regulation and guardrails in place to protect consumers and foster innovation. While there's still work to do, I'm determined to unlock opportunities for this technology and turn the UK into the world's Web3 centre. That's why I am thrilled world-leading investor, Andreessen Horowitz, has decided to open their first international office in the UK - which is testament to our world-class universities and talent and our strong competitive business environment."

Intel Discontinues Blockscale Crypto Mining ASICs

Today Intel announced that they would be discontinuing production of their Blockscale 1000 series of ASICs built for cryptocurrency mining. Blockscale was designed by the Custom Compute Group within what was Intel's AXG graphics division at the time, and launched to market back in April 2022 when the value of Bitcoin was still above $40K USD. Blockscale initially succeeded with efficiency and supply advantages over competing ASICs as Intel leveraged their manufacturing capacity to produce the chips, however the valuation of the crypto currency market experienced a major slump over the second half of 2022. Intel's AXG has also recently seen a major restructuring, though there have been no mentions of what the operable status is of the Custom Compute Group. Support for existing Blockscale customers is set to continue for some time. Intel has not announced any possible follow-up crypto ASIC generation, only saying, "We continue to monitor market opportunities."

Intel's Blockscale was rather late to the market as far as crypto mining ASICs go. Early mining ASICs began hitting the scene in mid-2012 as FPGAs started to reach their limits in efficiency, and investment funds began to funnel into crypto startups. Intel's interest in cryptocurrency hardware lagged behind even their contemporaries at NVIDIA and AMD, both of which had crypto-focused variants of consumer GPUs on the market as early as 2017 during the first major mining-induced hardware shortages. Intel hasn't mentioned whether the timing of Blockscale contributed to its short shelf life, but Bitcoin is on its way back up after the recent slump, shooting up to around $30K USD just prior to Intel's announcement.

Intel's Blockscale was rather late to the market as far as crypto mining ASICs go. Early mining ASICs began hitting the scene in mid-2012 as FPGAs started to reach their limits in efficiency, and investment funds began to funnel into crypto startups. Intel's interest in cryptocurrency hardware lagged behind even their contemporaries at NVIDIA and AMD, both of which had crypto-focused variants of consumer GPUs on the market as early as 2017 during the first major mining-induced hardware shortages. Intel hasn't mentioned whether the timing of Blockscale contributed to its short shelf life, but Bitcoin is on its way back up after the recent slump, shooting up to around $30K USD just prior to Intel's announcement.

NVIDIA Executive Says Cryptocurrencies Add Nothing Useful to Society

In an interview with The Guardian, NVIDIA's Chief Technical Officer (CTO) Michael Kagan added his remarks on the company and its cryptocurrency position. Being the maker of the world's most powerful graphics cards and compute accelerators, NVIDIA is the most prominent player in the industry regarding any computing application from cryptocurrencies to AI and HPC. In the interview, Mr. Kegan expressed his opinions and argued that newly found applications such as ChatGTP bring much higher value to society compared to cryptocurrencies. "All this crypto stuff, it needed parallel processing, and [Nvidia] is the best, so people just programmed it to use for this purpose. They bought a lot of stuff, and then eventually it collapsed, because it doesn't bring anything useful for society. AI does," said Kegan, adding that "I never believed that [crypto] is something that will do something good for humanity. You know, people do crazy things, but they buy your stuff, you sell them stuff. But you don't redirect the company to support whatever it is."

When it comes to AI and other applications, the company has a very different position. "With ChatGPT, everybody can now create his own machine, his own programme: you just tell it what to do, and it will. And if it doesn't work the way you want it to, you tell it 'I want something different," he added, arguing that the new AI applications have usability level beyond that of crypto. Interestingly, trading applications are also familiar to NVIDIA, as they had clients (banks) using their hardware for faster trading execution. Mr. Kegan noted: "We were heavily involved in also trading: people on Wall Street were buying our stuff to save a few nanoseconds on the wire, the banks were doing crazy things like pulling the fibers under the Hudson taut to make them a little bit shorter, to save a few nanoseconds between their datacentre and the stock exchange."

When it comes to AI and other applications, the company has a very different position. "With ChatGPT, everybody can now create his own machine, his own programme: you just tell it what to do, and it will. And if it doesn't work the way you want it to, you tell it 'I want something different," he added, arguing that the new AI applications have usability level beyond that of crypto. Interestingly, trading applications are also familiar to NVIDIA, as they had clients (banks) using their hardware for faster trading execution. Mr. Kegan noted: "We were heavily involved in also trading: people on Wall Street were buying our stuff to save a few nanoseconds on the wire, the banks were doing crazy things like pulling the fibers under the Hudson taut to make them a little bit shorter, to save a few nanoseconds between their datacentre and the stock exchange."

Wi-Fi 7 Cryptomining Router - A Fresh Scam (Ab)using a Friendly Name

An entity calling themselves "TP-Link ASIC" recently announced a Wi-Fi 7 capable ASIC cryptocurrency miner with claims of hashing rates above even the mighty RTX 4090... In one specific ASIC friendly algorithm. If the concept of a router that mines crypto sounds strange, deranged, or downright questionable to you, you're not alone. The consumer market for crypto mining has waned heavily in the last handful of months due in no small part to Ethereum switching to Proof of Stake last September, which led to GPUs being ineffectual for mining the previously profitable coin. However, ASIC mining does remain prevalent across the sea of various algorithms and alt-coins that exist. One such alt-coin is Kadena, a smaller Proof of Work cryptocurrency that appears to flutter around the $1USD range. This is where "TP-Link ASIC" has placed their engineering efforts with the, "TP-Link NX31 31.2 THS Router Miner," which, as the name implies, offers 31.2 TH/s of Kadena hashing power at a cool $1,990 USD (previously $1,440).

If you've been around long enough to remember the Butterfly Labs fiasco and fallout, you're probably already groaning and holding your head in your hands. Buying ASICs from new and unproven vendors promising the moon is never a good idea. But TP-Link isn't an unproven company, they have a successful business and sell legitimate products. Surely this would be handled properly since this is a well established brand, right? Well, here's the twist; "TP-Link ASIC" is NOT TP-Link. When questioned about this new launch by Tom's Hardware a TP-Link representative responded that "TP-Link ASIC" has no affiliation with TP-Link, nor does their NX31 mining router.

If you've been around long enough to remember the Butterfly Labs fiasco and fallout, you're probably already groaning and holding your head in your hands. Buying ASICs from new and unproven vendors promising the moon is never a good idea. But TP-Link isn't an unproven company, they have a successful business and sell legitimate products. Surely this would be handled properly since this is a well established brand, right? Well, here's the twist; "TP-Link ASIC" is NOT TP-Link. When questioned about this new launch by Tom's Hardware a TP-Link representative responded that "TP-Link ASIC" has no affiliation with TP-Link, nor does their NX31 mining router.

Crypto Miners Paint GDDR Memory Chips to Hide Wear and Tear

With the once-lucrative business of cryptocurrency mining now slowly falling out of favor for discrete graphics, crypto miners are turning their heads to creative solutions to "refurbish" and sell their remaining inventory to third-party users. When GPU components, such as the die or GDDR memory, overheat, they can produce visual signs of damage, such as discoloration or melting. Some miners have started painting the memory on their GPU's boards with special thermal paint to hide the wear and tear from the naked eye and make the GDDR chips appear new in hopes that no one would notice. According to Iskandar Souza and TecLab, their cases are now getting debunked.

As these reports note, miners are removing the stock cooling systems from GPUs to install a third-party solution or recently tried to resolder failed GPU dies back in place and paint the yellowish GDDR memory chips. According to the testing done by Iskandar Souza, you can see below the difference between a worn-out yellowish GDDR chip and its painted deception standing next to one another. Below you can also see the process of resoldering failed GPUs back in place. Crypto miners have been very careful to make them look almost as brand new, so GPU buyers from third-party sources need to be extra cautious before making a purchase.

As these reports note, miners are removing the stock cooling systems from GPUs to install a third-party solution or recently tried to resolder failed GPU dies back in place and paint the yellowish GDDR memory chips. According to the testing done by Iskandar Souza, you can see below the difference between a worn-out yellowish GDDR chip and its painted deception standing next to one another. Below you can also see the process of resoldering failed GPUs back in place. Crypto miners have been very careful to make them look almost as brand new, so GPU buyers from third-party sources need to be extra cautious before making a purchase.

South Korea Issues Arrest Warrant for Terra/LUNA Crypto Founder Do Kwon

The latest episode in the whole Terra/LUNA debacle - which saw $40 billion in crypto evaporating in a few hours - showcases that the crypto world doesn't operate within its own locked ecosystem. A court order for the arrest of Terra founder Do Kwon and five others was issued this Wednesday morning, on charges of violating the Capital Markets Act. LUNA fell 36% in the past 24 hours while LUNC (Luna Classic, representing the circulating LUNA tokens before the UST stablecoin's catastrophic depeg from the dollar value) dropped 25%, with much of the price movement coming after news of the warrant was made public on Wednesday morning.

The Terra/LUNA debacle brought about billions in losses across the cryptocurrency ecosystem, with multiple companies in the crypto finance area (from DeFi [Decentralized Finance] through CeFi [Centralized Finance] players such as Celsius Network, Voyager Digital and Three Arrows Capital claiming bankruptcy as their Terra/LUNA investments and reserves trended towards zero value. Accusations have been spread left and right that Terra/LUNA operated like a Ponzi Scheme - it remains to be seen whether that's the interpretation of the South Korea justice system.

The Terra/LUNA debacle brought about billions in losses across the cryptocurrency ecosystem, with multiple companies in the crypto finance area (from DeFi [Decentralized Finance] through CeFi [Centralized Finance] players such as Celsius Network, Voyager Digital and Three Arrows Capital claiming bankruptcy as their Terra/LUNA investments and reserves trended towards zero value. Accusations have been spread left and right that Terra/LUNA operated like a Ponzi Scheme - it remains to be seen whether that's the interpretation of the South Korea justice system.

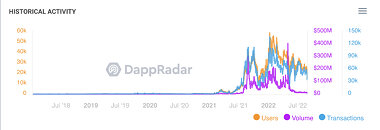

NFT Craze Hits the Brakes as OpenSea Records 99% Volume Decline in 90 days

OpenSea, one of the most widely recognized NFT markets in the cryptocurrency world, has slammed into a wall of absence. Namely, the absence of volume: the decentralized marketplace has seen a 99% drop on NFT trading volume in merely 90 days. From its high of $405.75 million on May 1, transactions on Non- Fungible Tokens have petered out to just $5 million throughout the entire month of August.

Reduced volume connects to reduced demand, which has in turn led to reducing floor prices (the lowest available price for a given NFT) for even the most recognized collections: the cheapest Bored Ape Yacht Club NFT can now be had for 72.5 ETH ($104,634 at time of writing). That's a 53% reduction in its ETH price (153.7 ETH) from May 1st. But the drop is even more massive when one takes into account the devaluation of Ethereum itself: On May 1st, the 153.7 ETH asking price for the NFT equaled $434,048 (price has thus tumbled by 76% on a dollar basis). CryptoPunks, another popular Ethereum-based NFT collection, has seen its floor price decline by a less drastic 20%.

Reduced volume connects to reduced demand, which has in turn led to reducing floor prices (the lowest available price for a given NFT) for even the most recognized collections: the cheapest Bored Ape Yacht Club NFT can now be had for 72.5 ETH ($104,634 at time of writing). That's a 53% reduction in its ETH price (153.7 ETH) from May 1st. But the drop is even more massive when one takes into account the devaluation of Ethereum itself: On May 1st, the 153.7 ETH asking price for the NFT equaled $434,048 (price has thus tumbled by 76% on a dollar basis). CryptoPunks, another popular Ethereum-based NFT collection, has seen its floor price decline by a less drastic 20%.

KINGMAX Makes Crypto Hardware Wallet Debut With SecSycript Card X1

KINGMAX, a world-renowned professional supplier of memory products, is launching into the cryptocurrency and NFT market with SecSycript Card X1, a highly secure cryptocurrency hardware, or cold, wallet. After microSD memory cards for smartphones and fingerprint USB flash drives, KINGMAX's R&D team has come up with a new high-specification offering to cater to the rapidly growing blockchain market that imposes even more stringent requirements over security.

Coming with Bluetooth 5.0 transmission technology and an industry-leading CC EAL 6+ certified chip embedded, SecSycript Card X1 provides cryptocurrency owners with a highly secure hardware private key for asset protection. Moreover, this cold wallet's capacity for offline storage means a wide range of corporate or individual applications in different settings, such as electronic signing of smart contracts, that promise to ensure the security of both assets and data in blockchain applications.

Coming with Bluetooth 5.0 transmission technology and an industry-leading CC EAL 6+ certified chip embedded, SecSycript Card X1 provides cryptocurrency owners with a highly secure hardware private key for asset protection. Moreover, this cold wallet's capacity for offline storage means a wide range of corporate or individual applications in different settings, such as electronic signing of smart contracts, that promise to ensure the security of both assets and data in blockchain applications.

NVIDIA Pays $5.5 Million Fine After Failing To Disclose 2018 Crypto Revenue

The Securities and Exchange Commission today announced settled charges against technology company NVIDIA Corporation for inadequate disclosures concerning the impact of cryptomining on the company's gaming business. The SEC's order finds that, during consecutive quarters in NVIDIA's fiscal year 2018, the company failed to disclose that cryptomining was a significant element of its material revenue growth from the sale of its graphics processing units (GPUs) designed and marketed for gaming. Cryptomining is the process of obtaining crypto rewards in exchange for verifying crypto transactions on distributed ledgers. As demand for and interest in crypto rose in 2017, NVIDIA customers increasingly used its gaming GPUs for cryptomining.

In two of its Forms 10-Q for its fiscal year 2018, NVIDIA reported material growth in revenue within its gaming business. NVIDIA had information, however, that this increase in gaming sales was driven in significant part by cryptomining. Despite this, NVIDIA did not disclose in its Forms 10-Q, as it was required to do, these significant earnings and cash flow fluctuations related to a volatile business for investors to ascertain the likelihood that past performance was indicative of future performance. The SEC's order also finds that NVIDIA's omissions of material information about the growth of its gaming business were misleading given that NVIDIA did make statements about how other parts of the company's business were driven by demand for crypto, creating the impression that the company's gaming business was not significantly affected by cryptomining.

In two of its Forms 10-Q for its fiscal year 2018, NVIDIA reported material growth in revenue within its gaming business. NVIDIA had information, however, that this increase in gaming sales was driven in significant part by cryptomining. Despite this, NVIDIA did not disclose in its Forms 10-Q, as it was required to do, these significant earnings and cash flow fluctuations related to a volatile business for investors to ascertain the likelihood that past performance was indicative of future performance. The SEC's order also finds that NVIDIA's omissions of material information about the growth of its gaming business were misleading given that NVIDIA did make statements about how other parts of the company's business were driven by demand for crypto, creating the impression that the company's gaming business was not significantly affected by cryptomining.

Announcing IBM z16: Real-time AI for Transaction Processing at Scale and Industry's First Quantum-Safe System

IBM today unveiled IBM z16, IBM's next-generation system with an integrated on-chip AI accelerator—delivering latency-optimized inferencing. This innovation is designed to enable clients to analyze real-time transactions, at scale -- for mission-critical workloads such as credit card, healthcare and financial transactions. Building on IBM's history of security leadership, IBM z16 also is specifically designed to help protect against near-future threats that might be used to crack today's encryption technologies.

IBM innovations, including the IBM z16, have formed the technology backbone of the global economy for decades. Today's modern IBM mainframe is central to hybrid cloud environments, valued by two thirds of the Fortune 100, 45 of the world's top 50 banks, 8 of the top 10 insurers, 7 of the top 10 global retailers and 8 out of the top 10 telcos as a highly secured platform for running their most mission critical workloads. For example, according to a recent IBM commissioned study by Celent "Operationalizing Fraud Prevention on IBM Z," IBM zSystems run 70% of global transactions, on a value basis. "IBM is the gold standard for highly secured transaction processing. Now with IBM z16 innovations, our clients can increase decision velocity with inferencing right where their mission critical data lives," said Ric Lewis, SVP, IBM Systems. "This opens up tremendous opportunities to change the game in their respective industries so they will be positioned to deliver better customer experiences and more powerful business outcomes.

IBM innovations, including the IBM z16, have formed the technology backbone of the global economy for decades. Today's modern IBM mainframe is central to hybrid cloud environments, valued by two thirds of the Fortune 100, 45 of the world's top 50 banks, 8 of the top 10 insurers, 7 of the top 10 global retailers and 8 out of the top 10 telcos as a highly secured platform for running their most mission critical workloads. For example, according to a recent IBM commissioned study by Celent "Operationalizing Fraud Prevention on IBM Z," IBM zSystems run 70% of global transactions, on a value basis. "IBM is the gold standard for highly secured transaction processing. Now with IBM z16 innovations, our clients can increase decision velocity with inferencing right where their mission critical data lives," said Ric Lewis, SVP, IBM Systems. "This opens up tremendous opportunities to change the game in their respective industries so they will be positioned to deliver better customer experiences and more powerful business outcomes.

Intel "Bonanza Mine" Bitcoin ASIC Secures First Big Customer, a $3.3 Billion Crypto-Mining Startup

Just a few days ago, we reported that Intel is preparing to unveil the company's first application-specific integrated circuit (ASIC) dedicated to mining cryptocurrency. To be more specific, Intel plans to show off its "Bonanza Mine" ASIC at the 2022 ISSCC Conference, describing the chip as "ultra low-voltage energy-efficient Bitcoin mining ASIC." We have yet to see how this competes with other industry-made ASICs like the ones from Bitmain. However, it seems like the startup company GRIID, valued at around $3.3 billion, thinks that the Bonanza Mine ASIC is the right choice and has entered a definitive supply agreement with Intel.

According to the S-4 filing, GRIID has "entered into a definitive supply contract with Intel to provide ASICs that we expect to fuel our growth. The initial order will supply units to be delivered in 2022 and GRIID will have access to a significant share of Intel's future production volumes." There are a few other mentions of Intel in the document, and you can see another exciting tidbit below.

According to the S-4 filing, GRIID has "entered into a definitive supply contract with Intel to provide ASICs that we expect to fuel our growth. The initial order will supply units to be delivered in 2022 and GRIID will have access to a significant share of Intel's future production volumes." There are a few other mentions of Intel in the document, and you can see another exciting tidbit below.

BadgerDAO Sees $120 Million Crypto Heist via Cloudflare Hack

BadgerDAO, "one of the most security-minded DAOs in operation", has been hit with a cryptocurrency heist enabled via a JavaScript hack on their website. BadgerDAO enables Bitcoin holders to "bridge" their cryptocurrency over to the smart-contract and DeFi-enabled Ethereum platform via its token, thus allowing access to the world of decentralized finance. After preliminary investigations aided by blockchain security and data analytics Peckshield, it seems that the bad actors inserted a malicious script in the BadgerDAO website - in turn intercepting Web 3.0 transactions and inserting a request to transfer the victim's tokens to the attacker's chosen address. It's currently estimated that around $120 million were siphoned off via this attack. A single transfer saw 896 Bitcoin being diverted this way - a cool $50 million.

As soon as BadgerDAO became aware of suspect wallet activity, the company immediately froze all smart contracts running in its platform - a way to stem the bleeding until the security audit could be conducted. Thursday night, BadgerDAO announced it had "retained data forensics experts Chainalysis to explore the full scale of the incident & authorities in both the US & Canada have been informed & Badger is cooperating fully with external investigations as well as proceeding with its own."

As soon as BadgerDAO became aware of suspect wallet activity, the company immediately froze all smart contracts running in its platform - a way to stem the bleeding until the security audit could be conducted. Thursday night, BadgerDAO announced it had "retained data forensics experts Chainalysis to explore the full scale of the incident & authorities in both the US & Canada have been informed & Badger is cooperating fully with external investigations as well as proceeding with its own."

NVIDIA CMP 170HX Mining Card Tested, Based on GA100 GPU SKU

NVIDIA's Crypto Mining (CMP) series of graphics cards are made to work only for one purpose: mining cryptocurrency coins. Hence, their functionality is somewhat limited, and they can not be used for gaming as regular GPUs can. Today, Linus Tech Tips got ahold of NVIDIA's CMP 170HX mining card, which is not listed on the company website. According to the source, the card runs on NVIDIA's GA100-105F GPU, a version based on the regular GA100 SXM design used in data-center applications. Unlike its bigger brother, the GA100-105F SKU is a cut-down design with 4480 CUDA cores and 8 GB of HBM2E memory. The complete design has 6912 cores and 40/80 GB HBM2E memory configurations.

As far as the reason for choosing 8 GB HBM2E memory goes, we know that the Ethereum DAG file is under 5 GB, so the 8 GB memory buffer is sufficient for mining any coin out there. It is powered by an 8-pin CPU power connector and draws about 250 Watts of power. It can be adjusted to 200 Watts while retaining the 165 MH/s hash rate for Ethereum. This reference design is manufactured by NVIDIA and has no active cooling, as it is meant to be cooled in high-density server racks. Only a colossal heatsink is attached, meaning that the cooling needs to come from a third party. As far as pricing is concerned, Linus managed to get this card for $5000, making it a costly mining option.More images follow...

As far as the reason for choosing 8 GB HBM2E memory goes, we know that the Ethereum DAG file is under 5 GB, so the 8 GB memory buffer is sufficient for mining any coin out there. It is powered by an 8-pin CPU power connector and draws about 250 Watts of power. It can be adjusted to 200 Watts while retaining the 165 MH/s hash rate for Ethereum. This reference design is manufactured by NVIDIA and has no active cooling, as it is meant to be cooled in high-density server racks. Only a colossal heatsink is attached, meaning that the cooling needs to come from a third party. As far as pricing is concerned, Linus managed to get this card for $5000, making it a costly mining option.More images follow...

NVIDIA Crypto Mining Processor 170HX Card Spotted with 164 MH/s Hash Rate

NVIDIA announced the first four Crypto Mining Processor (CMP) cards earlier this year with performance ranging from 26 MH/s to 86 MH/s. These cards were all based on existing Turing/Ampere silicon and featured board partner-designed cooling systems. NVIDIA appears to have introduced a new flagship model with the passively-cooled 170HX that is based on the NVIDIA A100 accelerator which features a GA100 GPU.

This new model is the first mining card to be designed by NVIDIA and features 4480 CUDA cores paired with 8 GB of HBM2E memory which are both considerably less than what is found in other GA100 based products. NVIDIA has also purposively limited the PCIe interface to Gen 1 x4 to ensure the card cannot be used for tasks outside of cryptocurrency mining. The 170HX has a TDP of 250 W and runs at a base clock of 1140 MHz with a locked-down BIOS that does not allow memory overclocking resulting in a hash rate of 164 MH/s when using the Etash algorithm.

This new model is the first mining card to be designed by NVIDIA and features 4480 CUDA cores paired with 8 GB of HBM2E memory which are both considerably less than what is found in other GA100 based products. NVIDIA has also purposively limited the PCIe interface to Gen 1 x4 to ensure the card cannot be used for tasks outside of cryptocurrency mining. The 170HX has a TDP of 250 W and runs at a base clock of 1140 MHz with a locked-down BIOS that does not allow memory overclocking resulting in a hash rate of 164 MH/s when using the Etash algorithm.

Sudden Drop in Cryptocurrency Prices Hurts Graphics DRAM Market in 3Q21, Says TrendForce

The stay-at-home economy remains robust due to the ongoing COVID-19 pandemic, so the sales of gaming products such as game consoles and the demand for related components are being kept at a decent level, according to TrendForce's latest investigations. However, the values of cryptocurrencies have plummeted in the past two months because of active interventions from many governments, with the graphics DRAM market entering into a bearish turn in 3Q21 as a result. While graphics DRAM prices in the spot market will likely show the most severe fluctuations, contract prices of graphics DRAM are expected to increase by 10-15% QoQ in 3Q21 since DRAM suppliers still prioritize the production of server DRAM over other product categories, and the vast majority of graphics DRAM supply is still cornered by major purchasers.

It should be pointed out that, given the highly volatile nature of the graphics DRAM market, it is relatively normal for graphics DRAM prices to reverse course or undergo a more drastic fluctuation compared with other mainstream DRAM products. As such, should the cryptocurrency market remain bearish, and manufacturers of smartphones or PCs reduce their upcoming production volumes in light of the ongoing pandemic and component supply issues, graphics DRAM prices are unlikely to experience further increase in 4Q21. Instead, TrendForce expects prices in 4Q21 to largely hold flat compared to the third quarter.

It should be pointed out that, given the highly volatile nature of the graphics DRAM market, it is relatively normal for graphics DRAM prices to reverse course or undergo a more drastic fluctuation compared with other mainstream DRAM products. As such, should the cryptocurrency market remain bearish, and manufacturers of smartphones or PCs reduce their upcoming production volumes in light of the ongoing pandemic and component supply issues, graphics DRAM prices are unlikely to experience further increase in 4Q21. Instead, TrendForce expects prices in 4Q21 to largely hold flat compared to the third quarter.

Crypto Goes Nuclear: Pennsylvania and Ohio to be Home to Nuclear-Powered Cryptomining

Crypto is going nuclear in the not so distant future, as US company Talen Energy revealed plans to construct a cryptomining data center in the immediate vicinity of the Susquehanna Steam Electric Station in Pennsylvania. Initial power consumption of the installation is expected to settle around 164 MW, with that figure climbing up to 300 MW once the infrastructure is complete - powered by dual 1+GW nuclear units and two independent substations. Talen Energy estimates maximum on-site power in the order of 1 GW.

The idea is to begin a narrative reversal around the environmental cost of cryptocurrency mining - if power is provided by cleaner technology, cryptocurrency mining's carbon footprint is bound to be reduced, in turn increasing attractiveness for environmentally-conscious businesses. Elon Musk, for one, made waves in both news outlets and cryptocurrency markets (and value) when he announced the decision for Tesla to cancel acceptance of Bitcoin as payment for its vehicles, citing environmental concerns regarding power sources keeping Bitcoin's blockchain secure. Another company, Energy Harbor Corp, announced a five-year collaboration with Standard Power to power its Bitcoin blockchain mining center in Coshocton, Ohio, starting December this year.

The idea is to begin a narrative reversal around the environmental cost of cryptocurrency mining - if power is provided by cleaner technology, cryptocurrency mining's carbon footprint is bound to be reduced, in turn increasing attractiveness for environmentally-conscious businesses. Elon Musk, for one, made waves in both news outlets and cryptocurrency markets (and value) when he announced the decision for Tesla to cancel acceptance of Bitcoin as payment for its vehicles, citing environmental concerns regarding power sources keeping Bitcoin's blockchain secure. Another company, Energy Harbor Corp, announced a five-year collaboration with Standard Power to power its Bitcoin blockchain mining center in Coshocton, Ohio, starting December this year.

Cryptocurrency Miners Selling RTX 3060 Cards For 270 USD in China

The Chinese government imposed harsh restrictions on cryptocurrency transactions last month which forced many mining farms to relocate or shut down and sell their equipment. This mass exodus has helped drive graphics card pricing downwards and according to recent reports, the price for RTX 3060 cards has hit a low of 270 USD (1760 yuan). These prices appear to be limited and only available for large purchases in China however as more farms are forced to sell we may see some cards listed for individual or international sale. Gaming laptops with RTX 3060 graphics cards that were purchased for mining farms are also entering the market for ~1000 USD. While the RTX 3060 cards currently represent the best value mining operations are selling a wide variety of NVIDIA and AMD graphics cards. These prices have been falling steadily over the last week so we wouldn't be surprised if they continue to drop.

Biggest Crypto Scam Ever Recorded Sees Appropriation of $3.6 billion in Bitcoin - AfriCrypt

The biggest crypto scam ever recorded (so far, of course) has made investors lose some $3.6 billion. The scam was enacted by a pair of South African brothers, Ameer Cajee and his brother Raees Cajee, who funded crypto investment firm AfriCrypt in 2019. Another element of warning for all crypto investors, in that rug pulls can obviously be done years after the start of a project - so longevity and temporal maintenance of a given project shouldn't be the "be all, end all" of your due diligence when choosing where to invest your money into.

The story goes as follows: circle back to April 2021, when Bitcoin was at its peak value of around $62,000. That was when AfriCrypt's COO and current heist suspect Ameer Cajee informed users of the platform of a hack - and asked investor not to contact authorities or seek legal proceedings, saying that those actions might impede progress in dealing with its effects and recovery of the funds.

The story goes as follows: circle back to April 2021, when Bitcoin was at its peak value of around $62,000. That was when AfriCrypt's COO and current heist suspect Ameer Cajee informed users of the platform of a hack - and asked investor not to contact authorities or seek legal proceedings, saying that those actions might impede progress in dealing with its effects and recovery of the funds.

Sabrent Rides the Chia Cryptocurrency Wave, Announces "Plotripper" SSDs with up to 54,000 TBW Endurance

Sabrent, which has become one of the go-tos in the world of Chia plotting and farming due to the price/performance/endurance ratio of its Rocket NVMe SSDs, has announced a new series of products specifically developed and marketed towards the Chia plotting crowds. Their new Plotripper SSDs (which drink from a quite obvious reference to AMD's Threadripper) have been designed to endure the harsh writing cycles for Chia plotting. Plotting is the process wherein you calculate the cryptographically-generated plots, and which can incur SSDs on a 1.6 TB write workload per 101 GB plot. The finished plot is then usually offloaded to a slow, capacious storage device (such as an external HDD) where it lays, awaiting for network challenges ad-infinitum. At time of writing, the total storage committed to Chia farming is estimated at 14 Exabytes.

The new Plotripper products are available in a mainstream and a "pro" variant. The mainstream Sabrent Plotripper offers a 10,000 TBW for its 2 TB capacity, which is already one of the highest available in consumer drives (until now). The Pro versions, however, promise 27,000 TBW of endurance for its 1 Tb capacity, and a staggering 54,000 TBW endurance rating for the 2 TB one. No word on pricing as of now, but these are sure to become some of the most sought-after SSDs for anyone planning to enter the Chia "farming" scene - and will definitely be priced accordingly.

The new Plotripper products are available in a mainstream and a "pro" variant. The mainstream Sabrent Plotripper offers a 10,000 TBW for its 2 TB capacity, which is already one of the highest available in consumer drives (until now). The Pro versions, however, promise 27,000 TBW of endurance for its 1 Tb capacity, and a staggering 54,000 TBW endurance rating for the 2 TB one. No word on pricing as of now, but these are sure to become some of the most sought-after SSDs for anyone planning to enter the Chia "farming" scene - and will definitely be priced accordingly.

NVIDIA RTX 3080 Ti, 3060 LHR Tested in Cryptomining Workloads

Expreview have tested one of the latest RTX 3060 graphics cards of the LHR (Lite Hash Rate) nature, so as to discern exactly how cryptomining limited these LHR cards are in practice - and whether or not there are performance differences for non-mining related workloads such as gaming. The results are satisfying: the new RTX 3060 Lite Hash Rate puts out around 21 MH/s at 119 W - and it does so from the beginning of the workload, which didn't happen prior, when NVIDIA's solution was a poorly implemented driver check instead of a new device ID (it started at 40 MH/s and then decreased until it hit the LHR ceiling). The RTX 3060 also didn't show any performance difference compared to previous, non-LHR cards in gaming benchmarks, which might put some prospective buyers at ease.

Also leaked was the said RTX 3080 Ti mining score. Since this card is only coming out now, a way to differentiate it from existing stock is unneeded. But even if the RTX 3080 Ti doesn't carry the LHR suffix as does the RTX 3060 and eventually the 3070 and 3080 upon their re-release to the wild, it does pack in the same mining performance limiter. And the card was tested to deliver some 58 MH/s at a 199 W board power. One should be cautious about expecting swift prices back on the market, as miners shift their focus towards the RTX cards already in the second-hand market or the new CMP cards; one can only be hopeful that the actual gaming market is already well-furnished with cards enough that scalpers aren't able to contend with the (ideal?) overflow of stock on LHR cards.

Also leaked was the said RTX 3080 Ti mining score. Since this card is only coming out now, a way to differentiate it from existing stock is unneeded. But even if the RTX 3080 Ti doesn't carry the LHR suffix as does the RTX 3060 and eventually the 3070 and 3080 upon their re-release to the wild, it does pack in the same mining performance limiter. And the card was tested to deliver some 58 MH/s at a 199 W board power. One should be cautious about expecting swift prices back on the market, as miners shift their focus towards the RTX cards already in the second-hand market or the new CMP cards; one can only be hopeful that the actual gaming market is already well-furnished with cards enough that scalpers aren't able to contend with the (ideal?) overflow of stock on LHR cards.

Cryptocurrency Market Bleeds Trillions in Less Than 24 Hours; Did the Bubble Pop?

The cryptocurrency market is experiencing another major shakedown in pricing, with the overall crypto market valuation dropping by more than a trillion dollars in less than 24 hours. As of time of writing, leading cryptocurrency by market cap Bitcoin has lost more than 30% in value, dropping to $31,000. Ethereum is down by 40% to $2,424, and memecoin Dogecoin has fallen by 45% - one would think a memecoin would have had its value dropped to zero from the instant of its conception, but that's not the world we live in.

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.

Binance, World's Largest Crypto Exchange, Reportedly Under Investigation by DoJ, IRS

Binance, the world's largest crypto exchange in trade volume, is reportedly being investigated by both the US Department of Justice and the IRS. Ever since its founding in 2017, Binance has been the de-facto castle door towards the world of crypto - that the eyes of justice and fiscal-enforcement are set upon it shouldn't come as a surprise. Incorporated in the Cayman Islands - a well-known offshore paradise for avoidance of taxation - the firm has an operating office in Singapore, and has thus been able to skirt massive amounts of tax (though not unlike many other, more traditional businesses do). The investigation also shouldn't come as a surprise considering how cryptocurrency - for all its technological and economic impact - is now one of the more common currencies in usage for the enablement and support of illegal activities.

According to Chainalysis.inc, a company specializing in scrutinizing the crypto market and its players, Binance was the principal crypto exchange through where funds derived from illegal activities went. According to the company, the amount of money attributed to illegal activities isn't low either; Chainalysis estimated Binance was the gateway of choice for moving upwards of $756 million dollars in illegal activities, a tidy percentage of its 2.8 billion dollar flux in that same year. No formal investigation has been announced yet, but this could be the prelude to a deeper dive onto the company's finances and possible enablement of criminal activity.

According to Chainalysis.inc, a company specializing in scrutinizing the crypto market and its players, Binance was the principal crypto exchange through where funds derived from illegal activities went. According to the company, the amount of money attributed to illegal activities isn't low either; Chainalysis estimated Binance was the gateway of choice for moving upwards of $756 million dollars in illegal activities, a tidy percentage of its 2.8 billion dollar flux in that same year. No formal investigation has been announced yet, but this could be the prelude to a deeper dive onto the company's finances and possible enablement of criminal activity.

Apr 6th, 2025 15:30 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- How I made an Ultimate Cooling Guide (18)

- The easiest way to connect the BOOTSEL test metal terminal and the GND terminal.... (0)

- What local LLM-s you use? (147)

- All Intel DG1 needs special bios? (30)

- Regarding Arctic's new Lineup of MAX fans! (1)

- TPU's F@H Team (20421)

- RX 9000 series GPU Owners Club (192)

- Clicks & Pops in Mic Audio due to buffer underruns. Please send help. (0)

- What are you playing? (23348)

- 9070XT or 7900XT (25)

Popular Reviews

- ASUS Prime X870-P Wi-Fi Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- PowerColor Radeon RX 9070 Hellhound Review

- Corsair RM750x Shift 750 W Review

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (124)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (92)