TrendForce: Demand for Consumer Electronics Sluggish, NAND Flash Wafer Pricing Leads Downturn in May

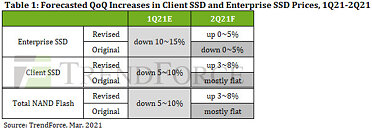

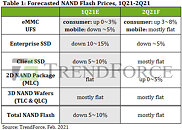

According to TrendForce research, looking at NAND Flash wafers, the pricing of which more sensitively reflects the market, suppliers are increasingly motivated to cut prices in exchange for sales due to weak retail demand since March and a more conservative outlook for shipments of other end products. The price of NAND Flash wafers is expected to begin falling in May and the supply of NAND Flash will gradually overtake demand in 2H22. The price decline of NAND Flash wafers in 3Q22 may reach 5~10%.

At the same time, TrendForce indicates that February's contamination incident at Kioxia was expected to tighten the market in 2Q22 and 3Q22. However, as a consequence of rising inflation and the war between Russia and Ukraine, market demand for consumer products in the traditional peak season of the second half of the year is trending conservative and the prices of client SSD, eMMC, and UFS in 3Q22 will be flat compared to 2Q22, breaking from the original expectation that prices may rise. In terms of enterprise SSDs, as demand for data centers remains strong, no significant correction in demand has yet been observed. However, as the overall NAND Flash market gradually moves into oversupply, prices will only grow slightly by approximately 0~5% in 3Q22.

At the same time, TrendForce indicates that February's contamination incident at Kioxia was expected to tighten the market in 2Q22 and 3Q22. However, as a consequence of rising inflation and the war between Russia and Ukraine, market demand for consumer products in the traditional peak season of the second half of the year is trending conservative and the prices of client SSD, eMMC, and UFS in 3Q22 will be flat compared to 2Q22, breaking from the original expectation that prices may rise. In terms of enterprise SSDs, as demand for data centers remains strong, no significant correction in demand has yet been observed. However, as the overall NAND Flash market gradually moves into oversupply, prices will only grow slightly by approximately 0~5% in 3Q22.