Amid Weakening Consumer Demand and Falling Prices, Total NAND Flash Revenue Declined 3.0% in 1Q22, Says TrendForce

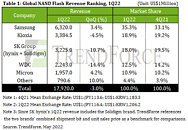

According to TrendForce research, as manufacturers actively shifted production capacity to 128 layer products, the market turned to oversupply, resulting in a drop in contract prices in 1Q22, among which the decline in consumer-grade products was more pronounced. Although enterprise SSD purchase order volume has grown, demand for smart phone bits has weakened due to the Russian-Ukrainian war, the traditional off-season, and rising inflation. Client inventories have increased significantly, so it remains challenging for overall bit shipment volume to offset potential decline. In 1Q22, NAND Flash bit shipments and average selling prices fell by 0.5% and 2.3%, respectively, resulting in a 3.0% quarterly decrease in overall industry revenue to US$17.92 billion.

Although China's smartphone stocking momentum was marginally weak considering the off-season, due to sluggish supply on the part of Kioxia and WDC, Samsung's 1Q22 client SSD shipment bit growth was driven up by an influx of rush orders and North American enterprise SSD client orders also recovered significantly in March. Overall bit shipments increased by 9% QoQ and ASP decreased by 2% QoQ. In 1Q22, the NAND Flash portion of Samsung's electronics business posted revenue of US$6.32 billion, up 3.4% QoQ.

Although China's smartphone stocking momentum was marginally weak considering the off-season, due to sluggish supply on the part of Kioxia and WDC, Samsung's 1Q22 client SSD shipment bit growth was driven up by an influx of rush orders and North American enterprise SSD client orders also recovered significantly in March. Overall bit shipments increased by 9% QoQ and ASP decreased by 2% QoQ. In 1Q22, the NAND Flash portion of Samsung's electronics business posted revenue of US$6.32 billion, up 3.4% QoQ.