Apr 10th, 2025 06:05 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Looking for input on fan placement for my Define R5 (4)

- How is the Gainward Phoenix Model in terms of quality? (2)

- Will you buy a RTX 5090? (478)

- Downgrading bios on asrock A320 board (1)

- Star Citizen (2515)

- ## [Golden Sample] RTX 5080 – 3300 MHz @ 1.020 V (Stock Curve) – Ultra-Stable & Efficient (45)

- RX 9000 series GPU Owners Club (276)

- random system shutdown with fans running at full speed (17)

- Shadow of the Tomb Raider benchmark (555)

- Do you use Linux? (573)

Popular Reviews

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- ASRock Z890 Taichi OCF Review

- MCHOSE L7 Pro Review

- Sapphire Radeon RX 9070 XT Pulse Review

- PowerColor Radeon RX 9070 Hellhound Review

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Acer Predator GM9000 2 TB Review

- ASUS GeForce RTX 5080 Astral OC Review

- UPERFECT UStation Delta Max Review - Two Screens In One

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (174)

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (100)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

News Posts matching #Profit

Return to Keyword Browsing

Alleged Apple Mixed Reality Headset Material Cost Leaks Out

Self-described mixed reality nerd, Brad Lynch, has tweeted out several interesting details about Apple's yet-to-be announced VR/AR headset. He has managed to compile information from several sources - mostly reports produced by hardware analysts based in China. His summation of the leaked info states: "The Apple HMD's Bill of Materials (BoM) cost to be about $1500-1600 (USD). This is about double the reported BoM for the (Meta) Quest Pro (which was 800 dollars including the controllers and charging pad)."

Minsheng Electronics's article suggests that 400,000 - 500,000 headset units are set for production in the second half of this year. An operating system with the codename "rOS" is reportedly clashing with Apple's traditional iOS mobile platform, but the author does not provide further information about these compatibility issues. The headset's operating system is supposedly capable of supporting a wide range of games, productivity applications and methods of video communication.

Minsheng Electronics's article suggests that 400,000 - 500,000 headset units are set for production in the second half of this year. An operating system with the codename "rOS" is reportedly clashing with Apple's traditional iOS mobile platform, but the author does not provide further information about these compatibility issues. The headset's operating system is supposedly capable of supporting a wide range of games, productivity applications and methods of video communication.

Microsoft to Shrink Surface Accessories Lineup Due to Poor Profits

According to the Nikkei, Microsoft is cutting production for a wide range of its Surface accessories, i.e. keyboards, mice, docking solutions, headsets etc. This is despite the fact that the company has invested heavily into its Surface brand of computers and accessories over the past decade. This is said to be in response to the poor performance of the business unit in Microsoft's last financial report. The Nikkei mentioned that Microsoft is suspending all standalone keyboards in the Surface series and it seems like Microsoft is also looking at calling it quits when it comes to its own branded accessories, or there won't at least be any new models from the company in the foreseeable future.

Microsoft used to be a significant competitor in the keyboard, mouse and webcam market, but with increasing competition from more brands, it seems like the company has been having a hard time making a niche for itself in what can only be said to be a crowded market. Consumer expectations have also changed and most people don't want membrane keyboards any more and are instead buying more expensive mechanical keyboards. Microsoft has also been late to market with many of its Surface computers and have delivered overpriced and underwhelming products, which in turn has led to fewer sales of both the computers and the matching accessories. We'll have to wait and see if Microsoft makes an official announcement as to what will happen to its Surface brand of products, but right now it doesn't look like there's a very bright future for the Surface line of products as a whole.

Microsoft used to be a significant competitor in the keyboard, mouse and webcam market, but with increasing competition from more brands, it seems like the company has been having a hard time making a niche for itself in what can only be said to be a crowded market. Consumer expectations have also changed and most people don't want membrane keyboards any more and are instead buying more expensive mechanical keyboards. Microsoft has also been late to market with many of its Surface computers and have delivered overpriced and underwhelming products, which in turn has led to fewer sales of both the computers and the matching accessories. We'll have to wait and see if Microsoft makes an official announcement as to what will happen to its Surface brand of products, but right now it doesn't look like there's a very bright future for the Surface line of products as a whole.

Meta AI-Assisted Advertising Sales Prove Profitable

Facebook's parent company, Meta, has announced that revenues generated by advertisement sales have improved fortunes, following on from three quarters of consistent slumps. It has reported an operating profit of $5.7 billion for the first quarter of 2023, this announcement arrives as a surprise to business analysts - their calculations predicted yet another decline in advertising sales for Q1 '23. Mark Zuckerberg - co-founder, executive chairman and CEO of Meta Platforms - has informed his investors that artificial intelligence-assisted systems have directed more user traffic to its social media platforms. Reels and Instagram have experienced the most user population growth, thanks to Meta's AI-driven recommendation system boosting engagement by 24% for the latter platform. The company's leader stated that AI-related operations are set to expand into generative tasking, visual creation tools (for Instagram) and business chatbots.

Meta is continuing to streamline its operations in 2023 - Zuckerberg has previously outlined plans for a year of "efficiency" with extensive plans already underway to reduce company-wide headcounts. 10,000 positions are set to be cut this year, and press coverage from last week revealed that Meta's gaming divisions being hit hard in terms of layoffs. Reports suggest that a third of the team at Ready at Dawn, an Oculus Rift-oriented development studio, were let go throughout that period. The social media and technology let go of 13,000 employees last year due to reduced profits margins. A return to better fortunes has not resulted in an immediate slowdown of headcount reduction - Meta is expected to carry on implementing its 2023 efficiency initiative.

Meta is continuing to streamline its operations in 2023 - Zuckerberg has previously outlined plans for a year of "efficiency" with extensive plans already underway to reduce company-wide headcounts. 10,000 positions are set to be cut this year, and press coverage from last week revealed that Meta's gaming divisions being hit hard in terms of layoffs. Reports suggest that a third of the team at Ready at Dawn, an Oculus Rift-oriented development studio, were let go throughout that period. The social media and technology let go of 13,000 employees last year due to reduced profits margins. A return to better fortunes has not resulted in an immediate slowdown of headcount reduction - Meta is expected to carry on implementing its 2023 efficiency initiative.

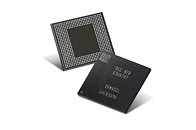

Samsung Profits Down 96%, Cutting Back on Memory Chip Production

Samsung Electronics will be cutting back on memory chip production, following a worrying drop in its operational profits. Estimates for the first quarter point to a 96% year-on-year decline - the silicon mega-corporation's lowest profit result in 14 years (since the first quarter of 2009). Samsung's operating profits fell to 600 billion won ($456 million) in January to March 2023, from 14 trillion won the previous year. The company has confirmed that a slump in sales is the main cause behind the smaller margins - with a slow global economy and a drop in demand after the chip shortages of 2020 - 2022. Manufacturers of computer and server equipment have reduced expenditure on procurements of RAM and storage solutions.

In a statement released last week, the company confirmed that it was adjusting its manufacturing output in reaction to the drop in demand: "We are lowering the production of memory chips by a meaningful level, especially that of products with supply secured." Industry analysts in South Korean are foreseeing that Samsung's chip business will post heavy losses (into the billions of dollars) during the first three months of 2023. Samsung is expected to publish detailed financial results later this month. The analysts have spotted similar patterns at other South Korea-based memory chip markers - SK Hynix and Micron have recorded heavy financial losses across recent quarters.

In a statement released last week, the company confirmed that it was adjusting its manufacturing output in reaction to the drop in demand: "We are lowering the production of memory chips by a meaningful level, especially that of products with supply secured." Industry analysts in South Korean are foreseeing that Samsung's chip business will post heavy losses (into the billions of dollars) during the first three months of 2023. Samsung is expected to publish detailed financial results later this month. The analysts have spotted similar patterns at other South Korea-based memory chip markers - SK Hynix and Micron have recorded heavy financial losses across recent quarters.

Cyberpunk 2077 Experiences Sales Boost, CD Projekt Rakes in Almost $222 Million in Revenue

CD Projekt has revealed that 2022 was its second-best year in terms of financial results - it cites an uptick in sales of action role-playing shooter Cyberpunk 2077 as the main reason behind the nice boost to its earnings - around $222 million in revenue, leading to about $80 million in net profit. The Cyberpunk intellectual property has expanded beyond the scope of the video games format and onto the small screen - evidently a combination of the Netflix anime series adaptation and continued efforts into polishing and expanding the game has spread a positive word of mouth. The company states: "In 2022 CD PROJEKT RED carried out intensive work on Cyberpunk 2077, which resulted in successive updates and the next-gen console edition of the game. An important event was the well-received Netflix premiere of Cyberpunk: Edgerunners. It attracted many new players to the game, and convinced many others to revisit Night City."

Adam Kiciński, CEO of CD PROJEKT was buoyed by these results and set expectations for continuations in both fields in the future: "The popularity of the series and the positive reception of the update, released a week before the premiere, had a notable effect on Cyberpunk sales and general sentiment around the game, as evidenced by gamers' reviews. This is a clear sign that deeper involvement in our franchises and expanding their reach is the right way to go. Another important event supporting the Cyberpunk franchise will be the release of Phantom Liberty - a large expansion scheduled for this year."

Adam Kiciński, CEO of CD PROJEKT was buoyed by these results and set expectations for continuations in both fields in the future: "The popularity of the series and the positive reception of the update, released a week before the premiere, had a notable effect on Cyberpunk sales and general sentiment around the game, as evidenced by gamers' reviews. This is a clear sign that deeper involvement in our franchises and expanding their reach is the right way to go. Another important event supporting the Cyberpunk franchise will be the release of Phantom Liberty - a large expansion scheduled for this year."

Samsung Electronics Announces Fourth Quarter and FY 2022 Results, Profits at an 8-year Low

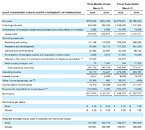

Samsung Electronics today reported financial results for the fourth quarter and the fiscal year 2022. The Company posted KRW 70.46 trillion in consolidated revenue and KRW 4.31 trillion in operating profit in the quarter ended December 31, 2022. For the full year, it reported 302.23 trillion in annual revenue, a record high and KRW 43.38 trillion in operating profit.

The business environment deteriorated significantly in the fourth quarter due to weak demand amid a global economic slowdown. Earnings at the Memory Business decreased sharply as prices fell and customers continued to adjust inventory. The System LSI Business also saw a decline in earnings as sales of key products were weighed down by inventory adjustments in the industry. The Foundry Business posted a new record for quarterly revenue while profit increased year-on-year on the back of advanced node capacity expansion as well as customer base and application area diversification.

The business environment deteriorated significantly in the fourth quarter due to weak demand amid a global economic slowdown. Earnings at the Memory Business decreased sharply as prices fell and customers continued to adjust inventory. The System LSI Business also saw a decline in earnings as sales of key products were weighed down by inventory adjustments in the industry. The Foundry Business posted a new record for quarterly revenue while profit increased year-on-year on the back of advanced node capacity expansion as well as customer base and application area diversification.

Samsung Profits Down by 69 Percent in Q4 2022

Consumer electronics giant Samsung had what can only be described as a terrible fourth quarter in 2022, with profits falling by around 4.3 trillion Korean Won, or US$3.4 billion, a drop of 69 percent compared to the previous year. This will be Samsung's lowest profit since Q3 2014 and Samsung has grown a lot as a company in those eight years. The revenue was also down nine percent from the third quarter of 2022, suggesting that Samsung is in for a rough start to the new year.

There seems to be a combination of reasons for the drop in profit, from lower demand for Samsung's range of smartphones and other consumer electronics, but also due to lower demand for memory chips, both DRAM and NAND, both of which Samsung is a big producer of. Samsung stated that "for the memory business, the decline in fourth-quarter demand was greater than expected as customers adjusted inventories in their effort to further tighten finances," which places Samsung in the same situation as its major competitors, who have also reported huge demand slumps.

There seems to be a combination of reasons for the drop in profit, from lower demand for Samsung's range of smartphones and other consumer electronics, but also due to lower demand for memory chips, both DRAM and NAND, both of which Samsung is a big producer of. Samsung stated that "for the memory business, the decline in fourth-quarter demand was greater than expected as customers adjusted inventories in their effort to further tighten finances," which places Samsung in the same situation as its major competitors, who have also reported huge demand slumps.

Intel Looking to Lay Off Meaningful Numbers of Staff, Can Some Products, After Profit Slump

Intel's third quarter financials that the company released yesterday, weren't exactly what you'd call stellar. This has put Intel CEO Pat Gelsinger in a bind, as he's been forced to announce cost cuts of US$3 billion annually, starting 2023, but that it'll grow to somewhere between US$8 to 10 billion by 2025. Although Gelsinger didn't reveal the specifics of what these cost cuts will entail, he did mention quite a few potentials, according to The Register. Gelisinger stated that Intel "need to balance increased investment in areas like leadership in [technology development], product, and capacity [at new plants under construction] in Ohio and Germany, with the efficiency measures elsewhere as we drive to have best in class structures."

Intel's CFO David Zinsner, told Barron's that the company will be cutting a "meaningful number" of employees from Intel's payroll. Zisner went on to say that Intel will also perform "portfolio cuts, right-sizing our support organizations, more stringent cost controls in all aspects of our spending, and improved sales and marketing efficiency". It sounds like almost no-one is safe at Intel, especially as portofolio cuts mean that some product lines will either be sold off, or simply just canned in favour of more profitable products. Intel is also betting hard on its IDM 2.0 strategy, where the company is decoupling its hardware and software design teams from its foundry business. Time will tell if this helps restart Intel as a business, but Gelsinger seems to believe that the changes he's implementing at Intel will help turn things around.

Intel's CFO David Zinsner, told Barron's that the company will be cutting a "meaningful number" of employees from Intel's payroll. Zisner went on to say that Intel will also perform "portfolio cuts, right-sizing our support organizations, more stringent cost controls in all aspects of our spending, and improved sales and marketing efficiency". It sounds like almost no-one is safe at Intel, especially as portofolio cuts mean that some product lines will either be sold off, or simply just canned in favour of more profitable products. Intel is also betting hard on its IDM 2.0 strategy, where the company is decoupling its hardware and software design teams from its foundry business. Time will tell if this helps restart Intel as a business, but Gelsinger seems to believe that the changes he's implementing at Intel will help turn things around.

TSMC Cuts Back CAPEX Budget Despite Record Profits

Another quarter, another record breaking earnings report by TSMC, but it seems like the company has released that things are set to slow down sooner than initially expected and the company is hitting the brakes on some of its expansion projects. The company saw a 79.7 percent increase in profits compared to last year, with a profit of US$8.8 billion and a revenue of somewhere between US$19.9 to US$ 20.7 billion for the third quarter, which is a 47.9 percent bump compared to last year. TSMC's 5 nm nodes were the source for 28 percent of the revenues, followed by 26 percent for 7 nm nodes, 12 percent for 16 nm and 10 percent for 28 nm, with remaining nodes at 40 nm and larger making up for the remainder of the revenue. By platform, smartphone chips made up 41 percent, followed by High Performance Computing at 39 percent, IoT at 10 percent and automotive at five percent.

TSMC said it will cut back its CAPEX budget by around US$4 billion, to US$36 billion, compared to the earlier stated US$40 billion budget the company had set aside for expanding its fabs. Part of the reason for this is that TSMC is already seeing weaker demand for products manufactured using its N7 and N6 nodes, as the N7 node was meant to be a key part of the new fab in Kaohsiung in southern Taiwan. TSMC is expecting to start production on its first N3 node later this quarter and is expecting the capacity to be fully utilised for all of 2023. Supply is said to be exceeding demand, which TSMC said is partially to blame on tooling delivery issues. TSMC is expecting next year's revenue for its N3 node to be higher than its N5 node in 2020, although the revenue is said to be in the single digit percentage range. The N3E node is said to start production sometime in the second half of next year, or about a quarter earlier than expected. The N2 node isn't due to start production until 2025, but TSMC is already having very high customer engagement, so it doesn't look like TSMC is likely to suffer from a lack of business in the foreseeable future, as long as the company keeps delivering new nodes as planned.

TSMC said it will cut back its CAPEX budget by around US$4 billion, to US$36 billion, compared to the earlier stated US$40 billion budget the company had set aside for expanding its fabs. Part of the reason for this is that TSMC is already seeing weaker demand for products manufactured using its N7 and N6 nodes, as the N7 node was meant to be a key part of the new fab in Kaohsiung in southern Taiwan. TSMC is expecting to start production on its first N3 node later this quarter and is expecting the capacity to be fully utilised for all of 2023. Supply is said to be exceeding demand, which TSMC said is partially to blame on tooling delivery issues. TSMC is expecting next year's revenue for its N3 node to be higher than its N5 node in 2020, although the revenue is said to be in the single digit percentage range. The N3E node is said to start production sometime in the second half of next year, or about a quarter earlier than expected. The N2 node isn't due to start production until 2025, but TSMC is already having very high customer engagement, so it doesn't look like TSMC is likely to suffer from a lack of business in the foreseeable future, as long as the company keeps delivering new nodes as planned.

Acer Reports FY2021 Financial Results with Profitability Returning to Over NT$10 Billion

Acer Inc. (2353.TW) announced its financial results for the fourth quarter of 2021 and fiscal 2021 ended December 31. For the fourth quarter, Acer reported consolidated revenues of NT$86.53 billion; gross profits of NT$9.92 billion with 11.5% margin; operating income of NT$3.91 billion, with 4.5% margin; net income of NT$2.24 billion, and earnings per share (EPS) of NT$0.75.

For the full year of 2021, Acer reported consolidated revenues of NT$319.01 billion, gross profits of NT$37.19 billion with 11.7% margin, operating income of NT$14.16 billion with 58.5% in year-on-year (YoY) growth and a record high 4.4% margin. The net income of NT$10.90 billion and EPS of NT$3.63 were both the highest in 11 years.

For the full year of 2021, Acer reported consolidated revenues of NT$319.01 billion, gross profits of NT$37.19 billion with 11.7% margin, operating income of NT$14.16 billion with 58.5% in year-on-year (YoY) growth and a record high 4.4% margin. The net income of NT$10.90 billion and EPS of NT$3.63 were both the highest in 11 years.

Samsung Electronics Announces Second Quarter 2021 Results

Samsung Electronics today reported financial results for the second quarter ended June 30, 2021. Total consolidated revenue was KRW 63.67 trillion, a 20% increase from the previous year and a record for the second quarter. Operating profit increased 34% from the previous quarter to KRW 12.57 trillion as market conditions improved in the memory market, operations normalized at the Austin foundry fab, and as effective global supply chain management (SCM) helped maintain solid profitability for the finished product businesses.

The Semiconductor business saw a significant improvement in earnings as memory shipments exceeded previous guidance and price increases were higher than expected, while the Company strengthened its cost competitiveness. For the Display Panel Business, a one-off gain and an increase in overall prices boosted profits.

The Semiconductor business saw a significant improvement in earnings as memory shipments exceeded previous guidance and price increases were higher than expected, while the Company strengthened its cost competitiveness. For the Display Panel Business, a one-off gain and an increase in overall prices boosted profits.

CD Projekt RED Profits Go Downhill Amid Cyberpunk 2077 Delisting from PlayStation Store

CD Projekt RED (CDPR), the maker of popular games like Witcher 3 and Cyberpunk 2077, has just published company's quarterly earnings report. The video game maker is responsible for the development of the most anticipated game in the year 2020—Cyberpunk 2077. Featuring Hollywood star Keanu Reeves, the game was teased multiple times with an amazing delay that happened three times. A bug-ridden debut happened and the overall gaming experience was very unpleasant, leading to an unprecedented move from PlayStation maker Sony. The Japanese company has delisted Cyberpunk 2077 from its PlayStation store, which caused a big impact to CDPR's sales figures.

Today, we got the exact details. The Q1 numbers are down, with net profits down by 67% to 32.5 million zlotys (Polish national currency), revenue down 2% to 197.6 million zlotys, and selling costs that soared 79.6% to 62.1 million zlotys. The company shares have tumbled down by around 10% since the Q1 report, closely following the outlook of the quarter. What remains for CDPR is to re-engage the Cyberpunk 2077 community and repair the game so it can reach its full potential, and give players a chance to finally enjoy the whole experience the game has to offer. This will hopefully get the company's financials back on track.

Today, we got the exact details. The Q1 numbers are down, with net profits down by 67% to 32.5 million zlotys (Polish national currency), revenue down 2% to 197.6 million zlotys, and selling costs that soared 79.6% to 62.1 million zlotys. The company shares have tumbled down by around 10% since the Q1 report, closely following the outlook of the quarter. What remains for CDPR is to re-engage the Cyberpunk 2077 community and repair the game so it can reach its full potential, and give players a chance to finally enjoy the whole experience the game has to offer. This will hopefully get the company's financials back on track.

Logitech Exceeds Full-Year Sales and Profit Outlook

Logitech International today announced financial results for the fourth quarter and full year of Fiscal Year 2020, ended March 31, 2020. "We have delivered five consecutive years at or near double-digit growth, and Logitech's products have never been more relevant," said Bracken Darrell, Logitech president and chief executive officer. "Video conferencing, working remotely, creating and streaming content, and gaming are long-term secular trends driving our business. The pandemic hasn't changed these trends: it has accelerated them."

"We finished a solid year with a very strong fourth quarter," said Nate Olmstead, Logitech chief financial officer. "The COVID-19 pandemic introduces operational challenges, yet our ability to execute and strong long-term growth drivers give us the confidence to maintain our financial outlook for Fiscal Year 2021."

"We finished a solid year with a very strong fourth quarter," said Nate Olmstead, Logitech chief financial officer. "The COVID-19 pandemic introduces operational challenges, yet our ability to execute and strong long-term growth drivers give us the confidence to maintain our financial outlook for Fiscal Year 2021."

Samsung Profits Tank as DRAM, NAND Flash, and SoC Prices Slump

Samsung Electronics Q1-2019 preliminary reads like a horror story to investors, as the company posted its worst drop in operating-profit in over four years. Operating income fell 60 percent in the quarter ending March 2019, to about USD $5.5 billion, beating Bloomberg analysts who had predicted a 56 percent drop. Sluggish sales to IoT major Amazon, smartphone major Apple, and other handset makers, compounded by swelling inventory in the supply chain, has triggered sharp drops in DRAM prices that were offsetting critically low NAND flash prices. Demand for Samsung SoCs (application processors) is also on the decline.

Samsung is betting heavily on the success of its Galaxy S10 family of smartphones to recover from losses faced in the three component markets. Prices of DRAM prices fell 22 percent YoY, and NAND flash continues to slide by roughly that much, at 23 percent. NAND flash prices have been on a continuous decline over the past 3 years. DRAM prices, on the other hand, rallied in that period, and it's only now that it posted its first price-drop since 2016. NAND flash prices are expected to slide further down, as oversupply and failure of newer technologies like QLC taking off, hurt NAND flash manufacturers.

Samsung is betting heavily on the success of its Galaxy S10 family of smartphones to recover from losses faced in the three component markets. Prices of DRAM prices fell 22 percent YoY, and NAND flash continues to slide by roughly that much, at 23 percent. NAND flash prices have been on a continuous decline over the past 3 years. DRAM prices, on the other hand, rallied in that period, and it's only now that it posted its first price-drop since 2016. NAND flash prices are expected to slide further down, as oversupply and failure of newer technologies like QLC taking off, hurt NAND flash manufacturers.

Following Crypto Bust, GIGABYTE May Hit the Red Line in Earnings

GIGABYTE, like most manufacturers of graphics cards, bet hard in the crypto craze to fuel demand for their graphics card solutions - an easy deal, considering the company is an AIB to both AMD and NVIDIA, which means they would cater to all of the cryptocurrency mining market. According to DigiTimes, market watchers are aware of the inventory buildup on GIGABYTE's watch, and cite the recent production issues with NVIDIA's latest RTX 2080 Ti graphics cards as reasons for the company to leave the black and cross the profit threshold towards a loss on the Q4.

GIGABYTE's Q3 was already reported as being a close cut in the earnings department, where the company didn't post losses simply because of non-operating incomes - meaning that inventory sold wasn't enough to offset all costs associated with bringing their products to market.

GIGABYTE's Q3 was already reported as being a close cut in the earnings department, where the company didn't post losses simply because of non-operating incomes - meaning that inventory sold wasn't enough to offset all costs associated with bringing their products to market.

Apr 10th, 2025 06:05 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Looking for input on fan placement for my Define R5 (4)

- How is the Gainward Phoenix Model in terms of quality? (2)

- Will you buy a RTX 5090? (478)

- Downgrading bios on asrock A320 board (1)

- Star Citizen (2515)

- ## [Golden Sample] RTX 5080 – 3300 MHz @ 1.020 V (Stock Curve) – Ultra-Stable & Efficient (45)

- RX 9000 series GPU Owners Club (276)

- random system shutdown with fans running at full speed (17)

- Shadow of the Tomb Raider benchmark (555)

- Do you use Linux? (573)

Popular Reviews

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- ASRock Z890 Taichi OCF Review

- MCHOSE L7 Pro Review

- Sapphire Radeon RX 9070 XT Pulse Review

- PowerColor Radeon RX 9070 Hellhound Review

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Acer Predator GM9000 2 TB Review

- ASUS GeForce RTX 5080 Astral OC Review

- UPERFECT UStation Delta Max Review - Two Screens In One

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (174)

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (100)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)