Wednesday, October 9th 2013

PC Shipments Down 7.6% in Q3, According to IDC

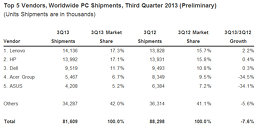

Worldwide PC shipments totaled 81.6 million units in the third quarter of 2013 (3Q13). In year-on-year terms, the market contracted -7.6%, ahead of a projected decline of -9.5% for the quarter, according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. While shipments remained weak during the early part of the quarter, the market was somewhat buoyed by business purchases, as well as channel intake of Windows 8.1-based systems during September.

A slight uptick in business volume contributed to shipments. The top three vendors (Lenovo, HP, and Dell), which all have an important presence in the enterprise and public sectors, each saw modest positive year-on-year growth during the quarter. Conversely, consumer sentiment remained lukewarm at best, as evidenced by the continued struggles of Acer and ASUS.Despite some encouraging developments in the business space, emerging markets continued to exhibit troubling signs, with Asia/Pacific (excluding Japan)(APeJ) in particular still facing stock of Ivy Bridge-based systems and continued encroachment from lower-priced tablets and smartphones.

"The third quarter was pretty close to forecast, which unfortunately doesn't reflect much improvement in the PC market, or potential for near-term growth," said Loren Loverde, Vice President Worldwide PC Trackers. "Whether constrained by a weak economy or being selective in their tech investments, buyers continue to evaluate options and delay PC replacements. Despite being a little ahead of forecast, and the work that's being done on new designs and integration of features like touch, the third quarter results suggest that there's still a high probability that we will see another decline in worldwide shipments in 2014."

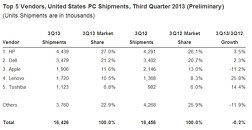

"The United States outperformed many other regions as growth stabilized just under 0%. Continuing upgrades from Windows XP boosted shipments, particularly in the commercial desktop segment, while retail acceptance of new and emerging product categories, such as Chromebooks and Ultraslims, helped the portables segment," said Rajani Singh, Senior Research Analyst, Personal Computers. "Nevertheless, the broad picture of the U.S. market has not changed much, with hopes for a small increase in the fourth quarter followed by a challenging 2014."

Regional Highlights

United States - The U.S. market continued to show signs of recovery although shipments were down slightly (-0.2%) year over year in the quarter. Better alignment with channel partners and internal restructuring helped most of the top vendors to grow faster than the market. Additionally, emerging product categories and a greater assortment of Windows 8-based models supported the volume uptick. Migration from Windows XP to Windows 7 added a few basis points as well. HP maintained its leadership position, gaining a few points of share in the U.S. Among the other top-tier leaders, Lenovo recorded impressive growth of 25.8% year on year and managed to maintain strong positive momentum by growing its channel reach and relationship sales.

EMEA - The PC market in Europe, Middle East, and Africa (EMEA) contracted in the third quarter in line with IDC forecasts. PC shipments remained constrained particularly in the home segment, which continued to suffer from weak consumer demand amid an ongoing budget shift to tablets. From a supply perspective, the quarter was also affected by an unfavorable year-on-year comparison with 3Q12, when shipments were supported by preparation to Windows 8 launch. Lean inventory remained a priority for channel partners across EMEA during 3Q13, inhibiting further sell-in. Portable PC shipments suffered a particularly strong decline, while desktops were less constrained. As forecast, the commercial market was less negative than the consumer market due to pockets of investments remaining available despite constrained spending. Shipments were also supported by seasonal back-to-school projects.

Japan - The PC market in Japan performed better than expected. Improved economic sentiments, favorable exchange rates, and the approaching expiration of Windows XP support helped to lift the market although consumer buying remained suppressed. Most of the top 5 vendors saw growth compared to the year before.

Asia/Pacific (excluding Japan) - APeJ was generally close to forecasts with a decline of -8.8% year on year. Many countries, particularly in developing markets, struggled with exchange rate pressures, but commercial buying in China was better than expected.

Vendor Highlights

Lenovo maintained the top PC vendor title, and continued to expand its channel reach as well as experiment with new form factors. Troubles in Asia/Pacific continued to pose a significant problem, where much of the lower-tier channels struggled with inventory clearance, constraining overall growth. However, the vendor posted a strong gain in the U.S. market, growing more than 2% compared to a year ago.

HP finished the quarter in the number 2 position, with growth improving from recent quarters. The company continued to receive a boost from shipments to India as part of a large education project. Shipment trends also improved in the U.S. and EMEA, but HP continued to face struggles in Latin America.

Dell saw its first positive year-on-year growth since the fourth quarter of 2011, thanks largely to maintaining growth in the Americas market. The company also managed to edge past 9.5 million units shipped in a quarter for the first time in over a year.

Acer Group continued to be affected by declines in shipments across all regions due to continued weakness in consumer PC spending. The firm nevertheless has remained aggressive in trying new form factors and hybrid devices.

ASUS shared a similar predicament with Acer where despite a focus on new designs, its lack of corporate customer base has also limited its growth.

A slight uptick in business volume contributed to shipments. The top three vendors (Lenovo, HP, and Dell), which all have an important presence in the enterprise and public sectors, each saw modest positive year-on-year growth during the quarter. Conversely, consumer sentiment remained lukewarm at best, as evidenced by the continued struggles of Acer and ASUS.Despite some encouraging developments in the business space, emerging markets continued to exhibit troubling signs, with Asia/Pacific (excluding Japan)(APeJ) in particular still facing stock of Ivy Bridge-based systems and continued encroachment from lower-priced tablets and smartphones.

"The third quarter was pretty close to forecast, which unfortunately doesn't reflect much improvement in the PC market, or potential for near-term growth," said Loren Loverde, Vice President Worldwide PC Trackers. "Whether constrained by a weak economy or being selective in their tech investments, buyers continue to evaluate options and delay PC replacements. Despite being a little ahead of forecast, and the work that's being done on new designs and integration of features like touch, the third quarter results suggest that there's still a high probability that we will see another decline in worldwide shipments in 2014."

"The United States outperformed many other regions as growth stabilized just under 0%. Continuing upgrades from Windows XP boosted shipments, particularly in the commercial desktop segment, while retail acceptance of new and emerging product categories, such as Chromebooks and Ultraslims, helped the portables segment," said Rajani Singh, Senior Research Analyst, Personal Computers. "Nevertheless, the broad picture of the U.S. market has not changed much, with hopes for a small increase in the fourth quarter followed by a challenging 2014."

Regional Highlights

United States - The U.S. market continued to show signs of recovery although shipments were down slightly (-0.2%) year over year in the quarter. Better alignment with channel partners and internal restructuring helped most of the top vendors to grow faster than the market. Additionally, emerging product categories and a greater assortment of Windows 8-based models supported the volume uptick. Migration from Windows XP to Windows 7 added a few basis points as well. HP maintained its leadership position, gaining a few points of share in the U.S. Among the other top-tier leaders, Lenovo recorded impressive growth of 25.8% year on year and managed to maintain strong positive momentum by growing its channel reach and relationship sales.

EMEA - The PC market in Europe, Middle East, and Africa (EMEA) contracted in the third quarter in line with IDC forecasts. PC shipments remained constrained particularly in the home segment, which continued to suffer from weak consumer demand amid an ongoing budget shift to tablets. From a supply perspective, the quarter was also affected by an unfavorable year-on-year comparison with 3Q12, when shipments were supported by preparation to Windows 8 launch. Lean inventory remained a priority for channel partners across EMEA during 3Q13, inhibiting further sell-in. Portable PC shipments suffered a particularly strong decline, while desktops were less constrained. As forecast, the commercial market was less negative than the consumer market due to pockets of investments remaining available despite constrained spending. Shipments were also supported by seasonal back-to-school projects.

Japan - The PC market in Japan performed better than expected. Improved economic sentiments, favorable exchange rates, and the approaching expiration of Windows XP support helped to lift the market although consumer buying remained suppressed. Most of the top 5 vendors saw growth compared to the year before.

Asia/Pacific (excluding Japan) - APeJ was generally close to forecasts with a decline of -8.8% year on year. Many countries, particularly in developing markets, struggled with exchange rate pressures, but commercial buying in China was better than expected.

Vendor Highlights

Lenovo maintained the top PC vendor title, and continued to expand its channel reach as well as experiment with new form factors. Troubles in Asia/Pacific continued to pose a significant problem, where much of the lower-tier channels struggled with inventory clearance, constraining overall growth. However, the vendor posted a strong gain in the U.S. market, growing more than 2% compared to a year ago.

HP finished the quarter in the number 2 position, with growth improving from recent quarters. The company continued to receive a boost from shipments to India as part of a large education project. Shipment trends also improved in the U.S. and EMEA, but HP continued to face struggles in Latin America.

Dell saw its first positive year-on-year growth since the fourth quarter of 2011, thanks largely to maintaining growth in the Americas market. The company also managed to edge past 9.5 million units shipped in a quarter for the first time in over a year.

Acer Group continued to be affected by declines in shipments across all regions due to continued weakness in consumer PC spending. The firm nevertheless has remained aggressive in trying new form factors and hybrid devices.

ASUS shared a similar predicament with Acer where despite a focus on new designs, its lack of corporate customer base has also limited its growth.

14 Comments on PC Shipments Down 7.6% in Q3, According to IDC

Kudos to the PC vendors on making lasting hardware I say.

PC is no where near being dead. This year alone, it has gone up more than last year.

More people are starting too see than these pre-built garbage paper weights, are just a burden to the industry.

Where you can head over to NCIX and have a custom PC built, with the parts you pick out yourself. which will vastly be superior.

I bet when the market is 90% APUs, they will say "CPU" shipments down. They are processors. They are not CPUs.

Also, computers are becoming so powerful, upgrades are becoming less influential on performance gain.

I think a better measure would be shipments of must have PC parts say CPU's or motherboards would be a better indicator.

Home buying of PC's is slowing. Aside from gaming and MS Office, tablets and smartphones are definitely killing PC sales. No longer do people have to spend $2000 to play solitare and surf for porn and cornbread recipes :)

thats simple explanation

The point of a pre built is simplicity, time, and support, and in some cases even money. At the low low end a pre built is as cheap as anything you can build on your own (when including a Windows license, which still is ubiquitous in the PC space). And if you don't know how to build one, don't want to know how to build one and don't have the time to build one or to learn how to build one, why should you? And if something goes wrong you call support, unless you have a kid in your family/circle of friends that knows stuff, and chances are that kid, as it turns out, knows nothing and what he really is good at is trolling Facebook.

So they absolutely have a place in this world, a bigger place than custom PC's actually, and it will stay that way. This space is being chipped away by tablets and smartphones, that is clear. As Sasqui say, things will get interesting when XP fases out (god I can't wait for that glorious day to come, I really REALLY wish I'll work at MS tech support that day) though.