Friday, January 18th 2008

AMD Reports Fourth Quarter and Annual Results

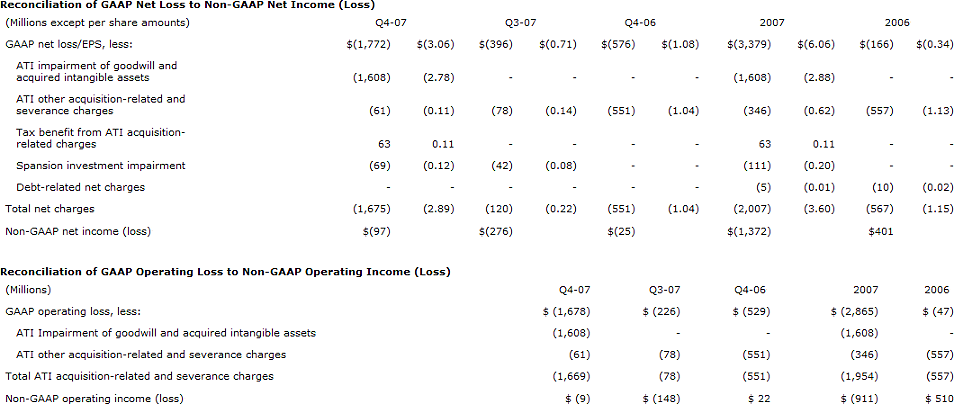

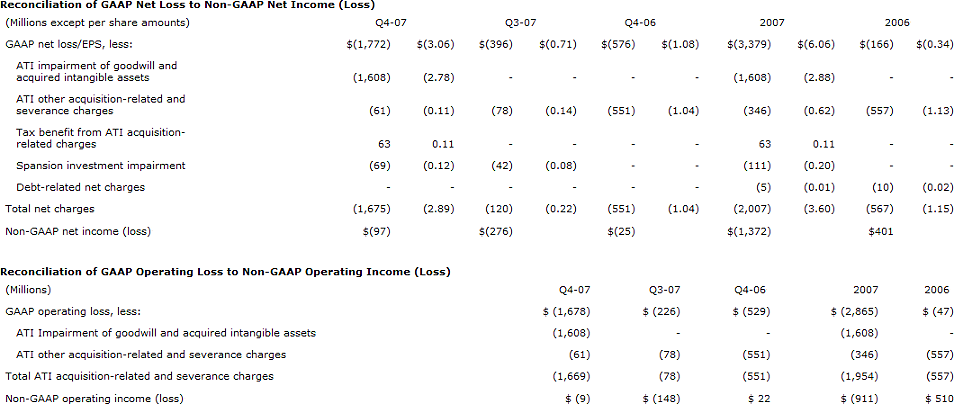

AMD today reported fourth quarter 2007 revenue of $1.770 billion, an 8 percent increase compared to the third quarter of 2007 and flat compared to the fourth quarter of 2006. In the fourth quarter of 2007, AMD reported a net loss of $1.772 billion, or $3.06 per share, and an operating loss of $1.678 billion. Fourth quarter net loss included charges of $1.675 billion, or $2.89 per share, of which $1.669 billion were operating charges. The non-cash portion of the fourth quarter charges was $1.606 billion. In the third quarter of 2007, AMD reported revenue of $1.632 billion, a net loss of $396 million, and an operating loss of $226 million. In the fourth quarter of 2006, AMD reported revenue of $1.773 billion, a net loss $576 million, and an operating loss of $529 million.

For the year ended December 29, 2007, AMD achieved revenue of $6.013 billion, a 6 percent increase from 2006. The fiscal 2007 net loss was $3.379 billion. Included in the 2007 net loss were non-cash charges of $2.007 billion. AMD reported revenue of $5.649 billion and a net loss of $166 million for fiscal 2006. Details of the various charges are described in the tables below.

"We were close to break-even operationally for the quarter, reducing our fourth quarter non-GAAP operating loss to $9 million1. We improved gross margin by three points sequentially, driven by increased shipments of new products, higher average selling prices and cost containment actions," said Robert J. Rivet, AMD's Chief Financial Officer. "We shipped a record number of microprocessor units in the quarter, including nearly four hundred thousand quad-core processors."

Fourth quarter 2007 gross margin was 44 percent, compared to 41 percent in the third quarter of 2007 and 36 percent in the fourth quarter of 2006.

Computing Solutions

Fourth quarter Computing Solutions segment revenue was $1.402 billion, a 9 percent sequential increase. Server, mobile and desktop processor revenue each increased quarter-over-quarter, driving an 11 percent sequential increase in microprocessor revenue. Record desktop and mobile processor unit shipments drove a 7 percent sequential increase in overall microprocessor unit shipments, resulting in record microprocessor unit shipments. Server processor unit shipments increased 22 percent sequentially, driven by a significant increase in quad-core AMD Opteron processor shipments.

Graphics

Graphics segment revenue was $259 million, a three percent sequential increase. The growth was due to demand for AMD's new ATI Radeon HD 3800 series and continued adoption of the ATI Radeon HD 2000 series of graphics processors.

Consumer Electronics

Fourth quarter Consumer Electronics segment revenue was $109 million, a 12 percent increase compared with $97 million in the third quarter of 2007. The increase was driven largely by increased game console royalties and sales of products for the handheld market.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

In the seasonally down first quarter, AMD expects revenue to decrease in line with seasonality.

Source:

AMD

For the year ended December 29, 2007, AMD achieved revenue of $6.013 billion, a 6 percent increase from 2006. The fiscal 2007 net loss was $3.379 billion. Included in the 2007 net loss were non-cash charges of $2.007 billion. AMD reported revenue of $5.649 billion and a net loss of $166 million for fiscal 2006. Details of the various charges are described in the tables below.

"We were close to break-even operationally for the quarter, reducing our fourth quarter non-GAAP operating loss to $9 million1. We improved gross margin by three points sequentially, driven by increased shipments of new products, higher average selling prices and cost containment actions," said Robert J. Rivet, AMD's Chief Financial Officer. "We shipped a record number of microprocessor units in the quarter, including nearly four hundred thousand quad-core processors."

Fourth quarter 2007 gross margin was 44 percent, compared to 41 percent in the third quarter of 2007 and 36 percent in the fourth quarter of 2006.

Computing Solutions

Fourth quarter Computing Solutions segment revenue was $1.402 billion, a 9 percent sequential increase. Server, mobile and desktop processor revenue each increased quarter-over-quarter, driving an 11 percent sequential increase in microprocessor revenue. Record desktop and mobile processor unit shipments drove a 7 percent sequential increase in overall microprocessor unit shipments, resulting in record microprocessor unit shipments. Server processor unit shipments increased 22 percent sequentially, driven by a significant increase in quad-core AMD Opteron processor shipments.

Graphics

Graphics segment revenue was $259 million, a three percent sequential increase. The growth was due to demand for AMD's new ATI Radeon HD 3800 series and continued adoption of the ATI Radeon HD 2000 series of graphics processors.

Consumer Electronics

Fourth quarter Consumer Electronics segment revenue was $109 million, a 12 percent increase compared with $97 million in the third quarter of 2007. The increase was driven largely by increased game console royalties and sales of products for the handheld market.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

In the seasonally down first quarter, AMD expects revenue to decrease in line with seasonality.

8 Comments on AMD Reports Fourth Quarter and Annual Results

"AMD (NYSE: AMD) today reported fourth quarter 2007 revenue of $1.770 billion.... In the fourth quarter of 2007, AMD reported a net loss of $1.772 billion, "

so they suddenly realized today that their figures were WAY off the mark?wtf is going on over at amd?

But I think He can stand Up from It!

I think ATI(AMD) Doing well with the HD3xxx Series!

Good product with affordable price point!

When the B3 stepping of CPUs is out they start to make money I'm Sure!

If they have the "mojo"(Austin Powers:) they make a 2x4core Phenom CPU at last Q4 2008 and they back on track!

If only had AMD an answer on intel HT tech... Because when intel starts to roll out 4 Core or 8 Core CPUs with HT (8 or 16 Cores to System side)...

AMD wouldn't be a match for intel anymore!

And, if this is any indicator as to how they're doing:although still below what everyone wants them to be at, it appears that AMD still intends to expand some more; meaning they're getting themselves straightened out.

The Opterons are doing well - 22% increase - but ATI isn't, pulling in only 3% extra revenue.

Let's hope Q1 of 2008 isn't as bad as they think it will be.

en.wikipedia.org/wiki/Nehalem_(CPU_architecture)

Nehalem architecture 45nm/32nm Sandybridge (q4 2009?)32nm/22nm