U.S. Supreme Court to Hear NVIDIA and Facebook Appeals on Securities Fraud Claims

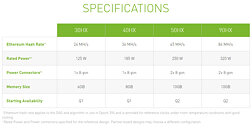

The United States Supreme Court is about to decide on two cases brought by NVIDIA and Meta (Facebook) to avoid legal action against them for fraud on securities. The U.S. Supreme Court will hear NVIDIA's arguments on November 13 regarding the dismissal attempt of the securities class action lawsuit. Swedish investment firm E. Ohman J:or Fonder AB claims NVIDIA misled investors in 2017-2018 by understating its revenue dependency on cryptocurrency mining. NVIDIA's stand lies in the plaintiff's failure to meet the criteria established by the 1995 Private Securities Litigation Reform Act. Earlier this year, NVIDIA settled with the U.S. regulatory authority to pay $5.5 million to settle charges about the poor reporting of crypto mining's impact on its gaming segment.

The Supreme Court is also set to adjudicate the case brought by Facebook to dismiss the securities lawsuit where investors led by Amalgamated Bank accused the company of deceiving them by not revealing a 2015 data breach that involved Cambridge Analytica and which, in turn, affected more than 30 million users. The case came to the fore after Facebook's stock tanked in the light of reports about Cambridge Analytica's misuse of user data during the 2016 Trump campaign. Facebook maintains it wasn't obliged to disclose past breaches in risk statements, as these are supposedly forward-looking. The company had previously paid $100 million in penalty to the SEC and $5 billion to the FTC over the same issue. Recently, three Supreme Court decisions in June had eroded federal regulators, namely the SEC which is the principal regulator of securities fraud, and appear to bring more limitations to the power of private plaintiffs to be able to enforce federal rules set out for corporate misconduct.

The Supreme Court is also set to adjudicate the case brought by Facebook to dismiss the securities lawsuit where investors led by Amalgamated Bank accused the company of deceiving them by not revealing a 2015 data breach that involved Cambridge Analytica and which, in turn, affected more than 30 million users. The case came to the fore after Facebook's stock tanked in the light of reports about Cambridge Analytica's misuse of user data during the 2016 Trump campaign. Facebook maintains it wasn't obliged to disclose past breaches in risk statements, as these are supposedly forward-looking. The company had previously paid $100 million in penalty to the SEC and $5 billion to the FTC over the same issue. Recently, three Supreme Court decisions in June had eroded federal regulators, namely the SEC which is the principal regulator of securities fraud, and appear to bring more limitations to the power of private plaintiffs to be able to enforce federal rules set out for corporate misconduct.