DRAM Revenue for 4Q20 Undergoes Modest 1.1% Increase QoQ in Light of Continued Rising Shipment and Falling Prices, Says TrendForce

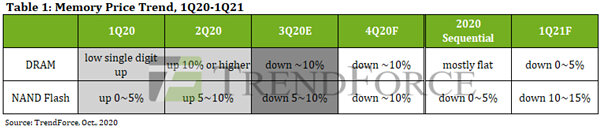

Global DRAM revenue reached US$17.65 billion, a 1.1% increase YoY, in 4Q20, according to TrendForce's latest investigations. For the most part, this growth took place because Chinese smartphone brands, including Oppo, Vivo, and Xiaomi, expanded their procurement activities for components in order to seize the market shares made available after Huawei was added to the Entity List by the U.S. Department of Commerce. These procurement activities in turn provided upward momentum for DRAM suppliers' bit shipment. However, clients in the server segment were still in the middle of inventory adjustments during this period, thereby placing downward pressure on DRAM prices. As a result, revenues of most DRAM suppliers, except for Micron, remained somewhat unchanged in 4Q20 compared to 3Q20. Micron underwent a noticeable QoQ decline in 4Q20 (which Micron counts as its fiscal 1Q21), since Micron had fewer work weeks during this period compared to the previous quarter.