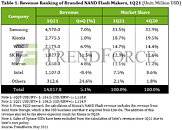

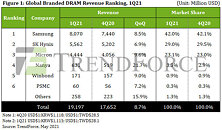

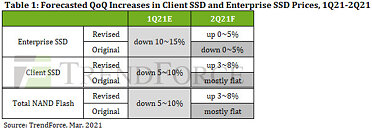

NAND Flash Contract Prices Likely to Increase by 5-10% QoQ in 3Q21 as Quotes Continue to Rise, Says TrendForce

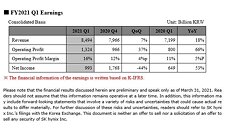

The recent wave of COVID-19 outbreaks in India has weakened sales of retail storage products such as memory cards and USB drives, according to TrendForce's latest investigations. However, demand remains fairly strong in the main application segments due to the arrival of the traditional peak season and the growth in the procurement related to data centers. Hence, the sufficiency ratio of the entire market has declined further. NAND Flash suppliers have kept their inventories at a healthy level thanks to clients' stock-up activities during the past several quarters. Moreover, the ongoing shortage of NAND Flash controller ICs continues to affect the production of finished storage products. Taking account of these demand-side and supply-side factors, TrendForce forecasts that contract prices of NAND Flash products will rise marginally for 3Q21, with QoQ increases in the range of 5-10%.