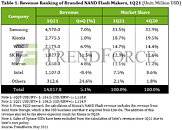

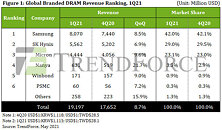

DRAM Revenue Undergoes 26% Increase QoQ for 2Q21 Owing to Rising Quotes and Higher-Than-Expected Shipment, Says TrendForce

After DRAM prices made a rebound into an upward trajectory in 1Q21, buyers expanded their DRAM procurement activities in 2Q21 as they anticipated a further price hike and insufficient supply going forward, according to TrendForce's latest investigations. Not only was demand robust from clients in the notebook segment, which benefitted from ongoing WFH and distance learning applications, but CSPs also sought to gradually replenish their DRAM inventories. Furthermore, demand for products that are relatively niche, including graphics DRAM and consumer DRAM, remained strong. Hence, DRAM suppliers experienced better-than-expected QoQ increases in their DRAM shipment for 2Q21. At the same time, DRAM quotes grew by a greater magnitude compared to the first quarter as well. With both shipment and quotes undergoing growths in tandem, DRAM suppliers registered remarkable growths in their revenues in 2Q21. Total DRAM revenue for 2Q21 reached US$24.1 billion, a 26% QoQ increase.