UMC Reports Second Quarter 2022 Results

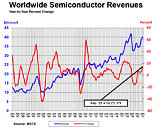

United Microelectronics Corporation ("UMC" or "The Company"), a leading global semiconductor foundry, today announced its consolidated operating results for the second quarter of 2022. Second quarter consolidated revenue was NT$72.06 billion, increasing 13.6% QoQ from NT$63.42 billion in 1Q22. Compared to a year ago, 2Q22 revenue grew 41.5% YoY from NT$50.91 billion in 2Q21. Consolidated gross margin for 2Q22 reached 46.5%. Net income attributable to the shareholders of the parent was NT$21.33 billion, with earnings per ordinary share of NT$1.74.

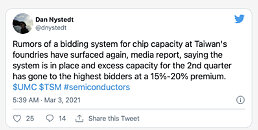

Jason Wang, UMC co-president, said, "In the second quarter, we delivered results in line with guidance, thanks to continuous strong demand for UMC's differentiated processes across our end markets. Overall wafer shipments rose 4.3% from the previous quarter, while higher average selling price and a favorable foreign exchange rate lifted second-quarter gross margin to 46.5%. Revenue from our 22/28 nm portfolio increased 29% sequentially, driven by the additional capacity at Fab 12A P5 that came online during the second quarter. We are confident in the long-term growth prospects of our 22/28 nm business, which now represents 22% of UMC's overall wafer revenue, and has demonstrated solid traction for OLED display drivers, image processors, WiFi, and automotive applications. As structural trends drive semiconductor content increase in end devices from smartphones to automobiles, it is our conviction that 28 nm is a long-lasting node that will be important for many existing and emerging applications for years to come."

Jason Wang, UMC co-president, said, "In the second quarter, we delivered results in line with guidance, thanks to continuous strong demand for UMC's differentiated processes across our end markets. Overall wafer shipments rose 4.3% from the previous quarter, while higher average selling price and a favorable foreign exchange rate lifted second-quarter gross margin to 46.5%. Revenue from our 22/28 nm portfolio increased 29% sequentially, driven by the additional capacity at Fab 12A P5 that came online during the second quarter. We are confident in the long-term growth prospects of our 22/28 nm business, which now represents 22% of UMC's overall wafer revenue, and has demonstrated solid traction for OLED display drivers, image processors, WiFi, and automotive applications. As structural trends drive semiconductor content increase in end devices from smartphones to automobiles, it is our conviction that 28 nm is a long-lasting node that will be important for many existing and emerging applications for years to come."