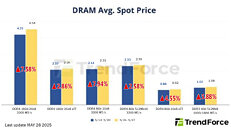

DDR5 Price Uptrend Weakens, Overall DRAM Prices to Cool Down in Q3 2025

The memory market starts to show a slowdown after months of steady price hikes according to TrendForce's latest memory spot price trend report. DDR5 memory prices, which had been going up consistently, are now stabilizing as they've hit fairly high levels that sometimes go beyond contract prices. While DDR5 still sees small price increases compared to DDR4, buyers and traders are growing more wary and leaning towards DDR4 products. The common DDR4 chips (i.e., DDR4 1Gx8 3200 MT/s) saw a big 12.8% rise this week going from $2.18 to $2.46, but industry experts think these big price jumps will ease off in the third quarter.

NAND flash memory prices are cooling off after big jumps since late February. NAND flash chip costs have shot up, but customers are losing interest as more products flood the market. This change in supply and demand is showing up in the numbers - 512 GB TLC chips dipped by 0.18% this week to $2.73, as buyers take a "wait and see" approach. The big picture hints that the memory market might be settling down after months of steep price hikes. Nevertheless, major North American cloud providers' AI investments drive enterprise SSD demand surge, creating a supply shortage and supporting up to 10% quarterly price increases in Q3 2025.

NAND flash memory prices are cooling off after big jumps since late February. NAND flash chip costs have shot up, but customers are losing interest as more products flood the market. This change in supply and demand is showing up in the numbers - 512 GB TLC chips dipped by 0.18% this week to $2.73, as buyers take a "wait and see" approach. The big picture hints that the memory market might be settling down after months of steep price hikes. Nevertheless, major North American cloud providers' AI investments drive enterprise SSD demand surge, creating a supply shortage and supporting up to 10% quarterly price increases in Q3 2025.