Friday, October 15th 2010

AMD Reports Third Quarter Results

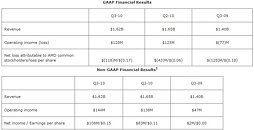

AMD today announced revenue for the third quarter of 2010 of $1.62 billion, a net loss of $118 million, or $0.17 per share, and operating income of $128 million. The company reported non-GAAP net income of $108 million, or $0.15 per share, and non-GAAP operating income of $144 million.

"AMD's third quarter performance was highlighted by solid gross margin and a continued focus on profitability, despite weaker than expected consumer demand," said Dirk Meyer, AMD president and CEO. "Our strategy to deliver platforms with superior visual experiences continues to resonate. We look forward to building on this momentum when we begin shipping our first AMD Fusion Accelerated Processor Units later this quarter."Quarterly Summary

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be approximately flat sequentially for the fourth quarter of 2010.

"AMD's third quarter performance was highlighted by solid gross margin and a continued focus on profitability, despite weaker than expected consumer demand," said Dirk Meyer, AMD president and CEO. "Our strategy to deliver platforms with superior visual experiences continues to resonate. We look forward to building on this momentum when we begin shipping our first AMD Fusion Accelerated Processor Units later this quarter."Quarterly Summary

- Gross margin was 46 percent.

- Cash, cash equivalents and marketable securities balance at the end of the quarter was $1.73 billion. The decrease from the second quarter was primarily due to the repurchase of $800 million aggregate principal amount of 6.00% Convertible Senior Notes due 2015 offset by proceeds from our issuance of $500 million of 7.75% Senior Notes due 2020.

o Approximately $780 million of the 6.00% Convertible Senior Notes remained outstanding as of September 25, 2010. - Computing Solutions segment revenue was flat sequentially and up 13 percent year-over-year. The year-over-year increase was primarily driven by record notebook microprocessor unit shipments.

o Operating income was $164 million, compared with $128 million in Q2-10 and $82 million in Q3-09.

o Microprocessor average selling price (ASP) decreased slightly sequentially and increased year-over-year.

o AMD updated its desktop processor family with six new offerings, including the six-core AMD Phenom II X6 1075 processor with high-end features like Turbo CORE acceleration technology, and the unlocked, quad-core AMD Phenom II X2 560 Black Edition processor which enables performance-tuning capabilities.

o IBM joined the ranks of global customers offering AMD Opteron 6000 series platform-based systems. In total, more than 40 unique AMD Opteron 6000 series-based platforms are now available from leading server manufacturers, including the HP ProLiant DL385 G7, the Dell PowerEdge R815, and many others.

o AMD released significant technical details of two new x86 cores during the quarter. "Bulldozer" targets high-performance PC and server markets, while "Bobcat" is intended for low-power notebook and desktop markets. Both cores were designed from the ground up to address specific customer requirements and compute workloads.

o AMD demonstrated "Brazos", the upcoming platform combining low-power x86 processor cores and discrete-level graphics capabilities in a single AMD Fusion Accelerated Processing Unit (APU). "Brazos" platforms will feature the "Ontario" and "Zacate" APUs and are expected to bring many of the vivid digital computing experiences once reserved for high-end PCs to value and mainstream notebooks and desktops early next year. - Graphics segment revenue decreased 11 percent sequentially but increased 33 percent year-over-year. The sequential decrease was driven by decreased mobile graphics processor unit (GPU) unit shipments and decreased ASP. The year-over-year increase was driven by an increase in GPU unit shipments and ASP.

o Operating income was $1 million, compared with $33 million in Q2-10 and $2 million in Q3-09.

o AMD has shipped more than 25 million DirectX11-capable GPUs since introduction in September 2009.

o AMD launched the ATI FirePro V9800, the company's flagship professional graphics card and the industry's only single-card solution for driving up to six monitors at a time.

o Apple refreshed its iMac and Mac Pro desktop computers, making ATI Radeon cards the only graphics solution for all configurations of these products.

AMD's outlook statements are based on current expectations. The following statements are forward looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to be approximately flat sequentially for the fourth quarter of 2010.

8 Comments on AMD Reports Third Quarter Results

Or am i missing something and they are making money, as such...?

www.nasdaq.com/aspx/nasdaqlastsale.aspx?symbol=AMD&selected=AMD

Way to go :)

AMD managed revenue of $1.62 billion, two percent down on the previous quarter, but 16 percent up year-over-year. This translated to an operating income of $128 million, but after interest payments of a whopping $56 million, among other expenses, the net operating income was $68 million.

Then came AMD's equity in the net income of GF, which amounted to a loss of $186 million, and resulted in a net loss for the quarter of $118 million.

The strange consequence of all this is that the non-GAAP EPS (earnings per share) number of $0.15 actually far exceeded analyst expectations of $0.06. AMD's shares were up 4.5 percent in pre-market trading."

source

Basicly GF dragged them into the red but i would hope that means by the time GF is making 28nm gpu cores that AMD and GF would both be out of the red as far as quarterly profits go.

If it gets there I'm quitting my job :)

Edit

I'm quitting even if it gets to 20$. I'm not too greedy...