Monday, February 27th 2012

Jon Peddie Research: Graphics Add-in Board Shipments Down 6.5% in Q4

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics Add-in Board (AIB) shipments and sales' market share for Q4'11. The JPR AIB Report tracks computer graphics boards, which carry discrete graphics chips. They are used in desktop PCs, workstations, servers, and some other devices such as scientific instruments. They may be sold as after-market products directly to customers or they may be factory installed. In all cases, they represent the higher-end of the graphics industry as discrete chips rather than integrated processors.

Overall shipments of graphics AIBs for the quarter came in above the last quarter at 16.1 million units compared to 17.2 million for Q3'11.

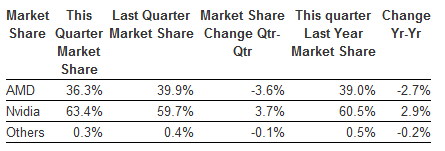

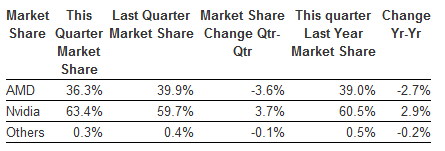

The evolution of the graphics market has resulted in two camps - suppliers of graphics AIBs: those which carry NVIDIA graphics chips and those which carry AMD chips. NVIDIA GPU-based boards increased by 3.7% from Q3 while AMD-based boards decreased 3.6% for the same period. Sales of AIB products have been directly impacted by the rise in economic growth in the BRIC countries, and in particular in China where there is a strong preference for discrete graphics AIBs.

Shipments during the fourth quarter of 2011 behaved according to past years with regard to seasonality but were lower on a year-to-year comparison for the quarter. Q4'11 was down from the previous quarter by 6.5%, and the ten year average for the quarter is -4.78%.

Our forecast for the coming years has been modified since the last report, and has been less aggressive on add-in boards (AIBs) due to the prolonged worldwide recession.

The quarter in general

In terms of market share, market leader NVIDIA gained market share by 3.7% from Q3, 2011, while AMD's market share shrank 3.6% for the same period. On a year-to-year basis AMD lost market share by 2.7% while NVIDIA gained 2.9% of market share. Obviously, these are not huge moves in the market and NVIDIA still leads in unit shipments.

Over 16 million AIBs shipped in Q4 2011. NVIDIA was the leader in unit shipments for the quarter, elevated by double attach and GPU-compute/CUDA sales.

The AIB market is fueled at the high-end by the enthusiast gamer, small in volume (~3m a year) but high in dollars (average spend for an AIB ~$300). The AIB shipment volume comes from the Performance and Mainstream segments. GPU-compute is adding to sales on the high end. The Workstation Market is smaller in unit sales than the enthusiast segment but characterized by even higher average selling prices (ASPs).

For the year, the AIB market reached $14.9 billion, down 0.4% from 2010 due to a pull back by consumers and a gradual decline in ASP.

The JPR AIB report covers seven regions and reports on the value of AIB sales and units in those regions.

The death of AIBs has been reported and predicted for over 10 years, and this quarter's decline will no doubt give reassurances to the nay sayers that their prognostications are correct. However, they should note that overall graphics chips are down 10.4% for the quarter whereas AIBs are only down 6.5% in a down quarter.

Overall shipments of graphics AIBs for the quarter came in above the last quarter at 16.1 million units compared to 17.2 million for Q3'11.

The evolution of the graphics market has resulted in two camps - suppliers of graphics AIBs: those which carry NVIDIA graphics chips and those which carry AMD chips. NVIDIA GPU-based boards increased by 3.7% from Q3 while AMD-based boards decreased 3.6% for the same period. Sales of AIB products have been directly impacted by the rise in economic growth in the BRIC countries, and in particular in China where there is a strong preference for discrete graphics AIBs.

Shipments during the fourth quarter of 2011 behaved according to past years with regard to seasonality but were lower on a year-to-year comparison for the quarter. Q4'11 was down from the previous quarter by 6.5%, and the ten year average for the quarter is -4.78%.

Our forecast for the coming years has been modified since the last report, and has been less aggressive on add-in boards (AIBs) due to the prolonged worldwide recession.

The quarter in general

In terms of market share, market leader NVIDIA gained market share by 3.7% from Q3, 2011, while AMD's market share shrank 3.6% for the same period. On a year-to-year basis AMD lost market share by 2.7% while NVIDIA gained 2.9% of market share. Obviously, these are not huge moves in the market and NVIDIA still leads in unit shipments.

Over 16 million AIBs shipped in Q4 2011. NVIDIA was the leader in unit shipments for the quarter, elevated by double attach and GPU-compute/CUDA sales.

The AIB market is fueled at the high-end by the enthusiast gamer, small in volume (~3m a year) but high in dollars (average spend for an AIB ~$300). The AIB shipment volume comes from the Performance and Mainstream segments. GPU-compute is adding to sales on the high end. The Workstation Market is smaller in unit sales than the enthusiast segment but characterized by even higher average selling prices (ASPs).

For the year, the AIB market reached $14.9 billion, down 0.4% from 2010 due to a pull back by consumers and a gradual decline in ASP.

The JPR AIB report covers seven regions and reports on the value of AIB sales and units in those regions.

The death of AIBs has been reported and predicted for over 10 years, and this quarter's decline will no doubt give reassurances to the nay sayers that their prognostications are correct. However, they should note that overall graphics chips are down 10.4% for the quarter whereas AIBs are only down 6.5% in a down quarter.

12 Comments on Jon Peddie Research: Graphics Add-in Board Shipments Down 6.5% in Q4

TBH I never put to much into these thing's as they always seem to fluctuate with who has the best single card out ATM. I am a bit surprised how ever that there are so many more nVidia user's overall. I really thought that ATi's price/performance would hold them closer but i guess they just can't keep up to that damn marketing dept over at NV

Maybe the red team should focus a lil' more on agressive marketing this year?

AMD definitely should market more aggressively. However, the price of the AIB is determined by the marketers (ASUS, MSI, etc), not the GPU maker, so a campaign based on price/performance can't really be done by AMD. I think. But right now they definitely could plaster "THE MOST POWERFUL GPU ON THE PLANET" everywhere...

with the Exception of Crysis 1, BF3 and BC2 somewhat what other PC game can be said to make your PC/GPU cry that has been released within the last 2-3years other then the games ive stated?

There is no need to keep upgrading GPUs when the most 'hardware intensive' game is CoD.

If you are the soul survivor of a zombie apocalypse - are you still going to don a suit and go into work and carry on buying and selling shares or stand on the street corner selling chillidawgs when its all over despite your country and possibly the whole world completely being void of human life???

Obviously not.

PC games are the proverbial 'carrot on a stick'

EDIT: I just forgot to add the.. But you're right... to the end of it on the previous post.. :p