NVIDIA Grabs Market Share, AMD Loses Ground, and Intel Disappears in Latest dGPU Update

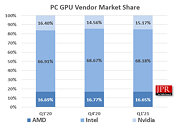

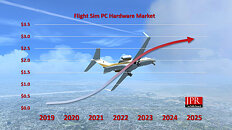

Within the discrete graphics card sector, NVIDIA achieved a remarkable 92% share of the add-in board (AIB) GPU market in the first quarter of 2025, according to data released by Jon Peddie Research (JPR). This represents an 8.5% increase compared to NVIDIA's previous position. By contrast, AMD's share contracted to just 8%, down 7.3 points, while Intel's presence effectively disappeared, falling to 0% after losing 1.2 points. JPR reported that AIB shipments reached 9.2 million units during Q1 2025 despite desktop CPU shipments declining to 17.8 million units. The firm projects that the AIB market will face a compound annual decline of 10.3% from 2024 to 2028, although the installed base of discrete GPUs is expected to grow to 130 million units by the end of the forecast period. By 2028, an estimated 86% of desktop PCs are expected to feature a dedicated graphics card.

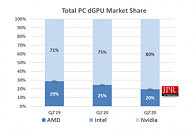

NVIDIA's success this quarter can be attributed to its launch of the RTX 50 series GPUs. In contrast, AMD's RDNA 4 GPUs were released significantly later in Q1. Additionally, Intel's Battlemage Arc GPUs, which were launched in Q4 2024, have struggled to gain traction, likely due to limited availability and low demand in the mainstream market. The broader PC GPU market, which includes integrated solutions, contracted by 12% from the previous quarter, with a total of 68.8 million units shipped. Desktop graphics unit sales declined by 16%, while notebook GPUs decreased by 10%. Overall, NVIDIA's total GPU share rose by 3.6 points, AMD's dipped by 1.6 points, and Intel's declined by 2.1 points. Meanwhile, data center GPUs bucked the overall downward trend, rising by 9.6% as enterprises continue to invest in artificial intelligence applications. On the CPU side, notebook processors accounted for 71% of shipments, with desktop CPUs comprising the remaining 29%.

NVIDIA's success this quarter can be attributed to its launch of the RTX 50 series GPUs. In contrast, AMD's RDNA 4 GPUs were released significantly later in Q1. Additionally, Intel's Battlemage Arc GPUs, which were launched in Q4 2024, have struggled to gain traction, likely due to limited availability and low demand in the mainstream market. The broader PC GPU market, which includes integrated solutions, contracted by 12% from the previous quarter, with a total of 68.8 million units shipped. Desktop graphics unit sales declined by 16%, while notebook GPUs decreased by 10%. Overall, NVIDIA's total GPU share rose by 3.6 points, AMD's dipped by 1.6 points, and Intel's declined by 2.1 points. Meanwhile, data center GPUs bucked the overall downward trend, rising by 9.6% as enterprises continue to invest in artificial intelligence applications. On the CPU side, notebook processors accounted for 71% of shipments, with desktop CPUs comprising the remaining 29%.