Wednesday, August 26th 2020

Jon Peddie Research Reports PC GPU Shipments Increased 2.5% Quarter over Quarter, Sequentially

As part of its ongoing research on the PC graphics market, Jon Peddie Research (JPR) has released its Market Watch report for the second quarter of 2020. Before 2020, the PC market was showing signs of improvement and settling into a new normal. JPR's Market Watch report confirms that trend for the second quarter of 2020, but with some surprises results for this very unusual year. Overall GPU shipments increased 2.5% from last quarter, AMD shipments increased by 8.4%, Intel's shipments, decreased by -2.7%, and NVIDIA's shipments increased by 17.8%.Quick highlights

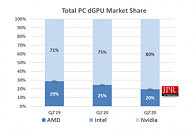

The above charts express the supplier's market share, in the current quarter, as well as quarter-to-quarter results, and year-to-year quarter results.

Jon Peddie, President of JPR, notes "the pandemic has been disruptive and had varying effects on the market. Some sales that might have occurred in Q3 (such as notebooks for the back-to-school season) have been pulled in to Q2 while desktop sales declined. Intel's manufacturing challenges have also negatively affected desktop sales.

"We believe the stay at home orders have continued to increase demand in spite of the record-setting unemployment levels. As economies open up, consumer confidence will be an important metric to watch."

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before suppliers' ships the PC, most of the semiconductor vendors are guiding up for next quarter, by an average of 12%. Some of that guidance is based on normal seasonality, but there is also a factor for the Coronavirus impact.

JPR also publishes a series of reports on the graphics Add-in-Board Market and PC Gaming Hardware Market, which covers the total market including system and accessories, and looks at 31 countries.

Pricing and Availability

JPR's Market Watch is available now in both electronic and hard copy editions and sells for $2,750. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $5,500 and includes four quarterly issues. Full subscribers to JPR services receive Tech Watch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription.

- AMD's overall unit shipments increased by 8.4% quarter-to-quarter, Intel's total shipments decreased by -2.7% from last quarter, and NVIDIA's increased by 17.8%.

- The overall attach rate of GPUs (includes integrated and discrete GPUs, desktop, notebook, and workstations) to PCs for the quarter was 126% which was up by 2.3% from last quarter.

- The overall PC market increased by 0.68% quarter-to-quarter and increased by 12.54% year-to-year.

- Desktop graphics add-in boards (AIBs that use discrete GPUs) increased by 6.55% from last quarter.

- Q2'20 saw no change in tablet shipments from last quarter.

The above charts express the supplier's market share, in the current quarter, as well as quarter-to-quarter results, and year-to-year quarter results.

Jon Peddie, President of JPR, notes "the pandemic has been disruptive and had varying effects on the market. Some sales that might have occurred in Q3 (such as notebooks for the back-to-school season) have been pulled in to Q2 while desktop sales declined. Intel's manufacturing challenges have also negatively affected desktop sales.

"We believe the stay at home orders have continued to increase demand in spite of the record-setting unemployment levels. As economies open up, consumer confidence will be an important metric to watch."

GPUs are traditionally a leading indicator of the market since a GPU goes into every system before suppliers' ships the PC, most of the semiconductor vendors are guiding up for next quarter, by an average of 12%. Some of that guidance is based on normal seasonality, but there is also a factor for the Coronavirus impact.

JPR also publishes a series of reports on the graphics Add-in-Board Market and PC Gaming Hardware Market, which covers the total market including system and accessories, and looks at 31 countries.

Pricing and Availability

JPR's Market Watch is available now in both electronic and hard copy editions and sells for $2,750. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR's Market Watch is $5,500 and includes four quarterly issues. Full subscribers to JPR services receive Tech Watch (the company's bi-weekly report) and a copy of Market Watch as part of their subscription.

13 Comments on Jon Peddie Research Reports PC GPU Shipments Increased 2.5% Quarter over Quarter, Sequentially

AMD dont have the performance crown but that is likely 10% of the GPU market, they outperform and come in cheaper in most segments below the 2080

Edited out name-calling, please stick to the topic and let's constructively debate and disagree. Thanks! - TPU Moderation

38% ir.amd.com/news-releases/news-release-details/amd-reports-fourth-quarter-and-annual-2018-financial-results

44% (like I said probably thanks to their CPUs getting much better) ir.amd.com/news-releases/news-release-details/amd-reports-second-quarter-2020-financial-results

Nvidia:

64.9% nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-fourth-quarter-and-fiscal-2020

based on your info the 5700 xt would be selling at 2070s prices ( which would be fine as they are about the same performance) if they were making the same margins as nvidia, please tell me how this makes a 5700 xt close to 2080 ti price? at the same margins, a $1200 GPU compared to a 5700 xt at $400 or $500 based on your flawed logic? :eek: :slap:

In the last quarter before Ryzen was launched in Feb 2017, AMD's margin was 32%: www.amd.com/en/press-releases/press-release-2017jan31

At the end of 2016, Nvidia had 70% discrete GPU market share, AMD 30%. Fast forward to today, AMDs graphics share goes down and their CPU market share goes significantly up. Their margin goes from 32% to 44%. And you are trying to suggest, that the margin increase is NOT coming from their CPUs? Of course we don't have exact numbers because AMD does not release data by company departments, but I'm willing to bet AMD GPUs are maybe even below 30% margin at the moment.

Some considerations:

- AMD is investing heavily into CPU, so margins might go straight to ramping up for the next generations. They know they have to keep a tight leash on that, Intel didn't concede or anything and they have market share to conquer. They also need to prove themselves as reliable long term partner for enterprise/datacenter.

- AMD's GPUs are obviously the cheapest, most cost effective route to a product. Lacking technology, refinement, and even the die size is super tiny for RDNA while they clocked it high. This is a cheap GPU to build and selling it at 400 will definitely command a good margin. The question is, how many they sell?

- AMD is specifically saying EPYC sales drive up Revenue. The revenue growth is higher than the profit growth; 3% profit growth and 26% YoY revenue growth.

I do agree it seems logical most of AMD's growth and margin growth does probably come from CPU. But I wouldn't underestimate their current GPU margin either, it might well be higher than 44%.

I don't want Nvidia's share at 80% but it is what it is because of AMD's lack of competitiveness, not because Nvidia is sneaky or underhanded.