Thursday, April 19th 2012

AMD Reports First Quarter Results

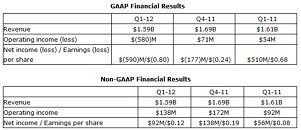

AMD today announced revenue for the first quarter of 2012 of $1.59 billion, net loss of $590 million, or $0.80 per share, and operating loss of $580 million. The company reported non-GAAP net income of $92 million, or $0.12 per share, and non-GAAP operating income of $138 million. First quarter non-GAAP net income excludes: the previously disclosed charge of $703 million for a limited waiver of exclusivity of certain 28 nanometer (nm) APU products from GLOBALFOUNDRIES Inc. (GF) related to the 2012 Amendment to the Wafer Supply Agreement; amortization of acquired intangible assets of $1 million; a restructuring charge of $8 million; SeaMicro, Inc. (SeaMicro) acquisition costs of $6 million, and a tax benefit related to the SeaMicro acquisition of $36 million.

"AMD delivered solid results in the first quarter as we remain focused on improving our execution, delivering innovative products, and building a company around a strategy to deliver strong cash flow and earnings growth," said Rory Read, AMD president and CEO. "A complete top-to-bottom introduction of new APU offerings, combined with ample product supply resulting from continued progress with our manufacturing partners, positions us to win and grow."Quarterly Summary

- Gross margin was 2 percent due to the previously disclosed charge of $703 million for a limited waiver of exclusivity for certain 28nm APU products from GF.

- Non-GAAP gross margin was 46 percent, flat sequentially.

- Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.71 billion at the end of the quarter.

● Cash payments in the quarter included $281 million related to the SeaMicro acquisition and $150 million related to the limited waiver of exclusivity of certain 28 nm APU products from GF.

- AMD's first quarter of 2011 had 14 weeks of business compared to 13 weeks for the first quarter of 2012.

- Computing Solutions segment revenue decreased eight percent sequentially and was flat year-over-year. The sequential decrease was driven by seasonally lower sales in the Client business.

● Operating income was $124 million, compared with $165 million in Q411 and $100 million in Q111.

● Microprocessor ASP decreased sequentially and was flat year-over-year.

● AMD announced and began shipping the follow-on to its essential notebook platform "Brazos," its bestselling platform ever. The new essential notebook platform, codenamed "Brazos 2.0," delivers improved performance, extended battery life and many new features. Systems based on "Brazos 2.0" are expected to be available in the second quarter.

● AMD ramped volume production of its second generation A-Series APU, codenamed "Trinity," in anticipation of global notebook availability from leading OEMs in the second quarter. "Trinity" delivers twice the performance-per-watt compared with AMD's current generation A-Series APU. Systems powered by "Trinity" will enable outstanding entertainment and gaming performance with superior battery life.

● Dell, Tyan, MSI and Fujitsu are among the partners that introduced systems based on AMD Opteron 3200 processors targeting hosting customers who require enterprise-class reliability at desktop-class price points. The new server platform delivers price-performance and power-per-core advantages compared to competitive offerings.

● Telus, a leading Canadian Telecommunications provider, selected the AMD Opteron 6200 Series processors to power its latest offering, the TELUS AgilIT Virtual Private Cloud.

● AMD announced two new heterogeneous computing milestones, both with the objective of enhancing the user experience and nurturing future software development. AMD announced an investment through AMD Ventures in Nuvixa, Inc., a developer of gesture-based video communication and presentation solutions, and the first AMD Fusion Center of Innovation was established at the University of Illinois at Urbana-Champaign.

- Graphics segment revenue was flat sequentially and decreased 7 percent year-over-year. GPU revenue was up in a seasonally down quarter, due to higher improved desktop GPU ASP in the channel, offset by seasonally lower game console royalty revenue. The year-over-year decrease was primarily driven by lower demand for desktop and mobile graphics.

● Operating income was $34 million, compared with $27 million in Q411 and $19 million in Q111.

● GPU ASP was flat sequentially and increased year-over-year.

● AMD reached a major milestone with worldwide availability of its full line of next generation 28 nm AMD Radeon HD 7000 Series desktop GPUs in less than three months. In addition to the AMD Radeon HD 7950 Series GPU, AMD introduced the first graphics card to break the 1 GHz barrier, the AMD Radeon HD 7770 GPU. AMD also launched the AMD Radeon HD 7800 Series GPU featuring 2 GB of GDDR5 memory for serious gamers.

- Corporate

● AMD announced an amended Wafer Supply Agreement with GF that established a negotiated wafer pricing based on a take or pay arrangement in 2012 and established a framework for wafer pricing in 2013. AMD transferred its remaining ownership interest in GF to GF and GF waived the exclusivity arrangement for AMD to manufacture certain 28 nm APU products at GF for a specified period.

● AMD acquired SeaMicro, Inc., a pioneer in energy-efficient, high-bandwidth microservers. The acquisition accelerates the company's strategy to deliver disruptive server technology and positions AMD to expand its current server offerings to provide customers and partners with low-power, low-cost, high-bandwidth server solutions.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to increase 3 percent, plus or minus 3 percent, sequentially for the second quarter of 2012.

For additional detail regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"AMD delivered solid results in the first quarter as we remain focused on improving our execution, delivering innovative products, and building a company around a strategy to deliver strong cash flow and earnings growth," said Rory Read, AMD president and CEO. "A complete top-to-bottom introduction of new APU offerings, combined with ample product supply resulting from continued progress with our manufacturing partners, positions us to win and grow."Quarterly Summary

- Gross margin was 2 percent due to the previously disclosed charge of $703 million for a limited waiver of exclusivity for certain 28nm APU products from GF.

- Non-GAAP gross margin was 46 percent, flat sequentially.

- Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.71 billion at the end of the quarter.

● Cash payments in the quarter included $281 million related to the SeaMicro acquisition and $150 million related to the limited waiver of exclusivity of certain 28 nm APU products from GF.

- AMD's first quarter of 2011 had 14 weeks of business compared to 13 weeks for the first quarter of 2012.

- Computing Solutions segment revenue decreased eight percent sequentially and was flat year-over-year. The sequential decrease was driven by seasonally lower sales in the Client business.

● Operating income was $124 million, compared with $165 million in Q411 and $100 million in Q111.

● Microprocessor ASP decreased sequentially and was flat year-over-year.

● AMD announced and began shipping the follow-on to its essential notebook platform "Brazos," its bestselling platform ever. The new essential notebook platform, codenamed "Brazos 2.0," delivers improved performance, extended battery life and many new features. Systems based on "Brazos 2.0" are expected to be available in the second quarter.

● AMD ramped volume production of its second generation A-Series APU, codenamed "Trinity," in anticipation of global notebook availability from leading OEMs in the second quarter. "Trinity" delivers twice the performance-per-watt compared with AMD's current generation A-Series APU. Systems powered by "Trinity" will enable outstanding entertainment and gaming performance with superior battery life.

● Dell, Tyan, MSI and Fujitsu are among the partners that introduced systems based on AMD Opteron 3200 processors targeting hosting customers who require enterprise-class reliability at desktop-class price points. The new server platform delivers price-performance and power-per-core advantages compared to competitive offerings.

● Telus, a leading Canadian Telecommunications provider, selected the AMD Opteron 6200 Series processors to power its latest offering, the TELUS AgilIT Virtual Private Cloud.

● AMD announced two new heterogeneous computing milestones, both with the objective of enhancing the user experience and nurturing future software development. AMD announced an investment through AMD Ventures in Nuvixa, Inc., a developer of gesture-based video communication and presentation solutions, and the first AMD Fusion Center of Innovation was established at the University of Illinois at Urbana-Champaign.

- Graphics segment revenue was flat sequentially and decreased 7 percent year-over-year. GPU revenue was up in a seasonally down quarter, due to higher improved desktop GPU ASP in the channel, offset by seasonally lower game console royalty revenue. The year-over-year decrease was primarily driven by lower demand for desktop and mobile graphics.

● Operating income was $34 million, compared with $27 million in Q411 and $19 million in Q111.

● GPU ASP was flat sequentially and increased year-over-year.

● AMD reached a major milestone with worldwide availability of its full line of next generation 28 nm AMD Radeon HD 7000 Series desktop GPUs in less than three months. In addition to the AMD Radeon HD 7950 Series GPU, AMD introduced the first graphics card to break the 1 GHz barrier, the AMD Radeon HD 7770 GPU. AMD also launched the AMD Radeon HD 7800 Series GPU featuring 2 GB of GDDR5 memory for serious gamers.

- Corporate

● AMD announced an amended Wafer Supply Agreement with GF that established a negotiated wafer pricing based on a take or pay arrangement in 2012 and established a framework for wafer pricing in 2013. AMD transferred its remaining ownership interest in GF to GF and GF waived the exclusivity arrangement for AMD to manufacture certain 28 nm APU products at GF for a specified period.

● AMD acquired SeaMicro, Inc., a pioneer in energy-efficient, high-bandwidth microservers. The acquisition accelerates the company's strategy to deliver disruptive server technology and positions AMD to expand its current server offerings to provide customers and partners with low-power, low-cost, high-bandwidth server solutions.

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

AMD expects revenue to increase 3 percent, plus or minus 3 percent, sequentially for the second quarter of 2012.

For additional detail regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

29 Comments on AMD Reports First Quarter Results

And I said ATI for a reason there, because I will never let ATI be killed by those morons.

Looking from the outside, their net income is fantastic which shows their products sell, but it's negated by the loss i.e. overspending.

The bad news- they still aren't making anywhere near what Nvidia or Intel makes.

Yes, they've got new CEOs but only recently, it could take years to realign a failing multinational corporation to the ideologies of new management.james888, thats the other reason. CEOs need time to implement change. If they keep changing all the good internal policies and structures set up will get undone by the replacement CEO. Also the staff start to lose respect for the company and moral runs low, thus they stop working as hard to make the company a success.

Sometimes a business plan needs to account for the long term rather than maxing profits for short-sighted investors. A good ceo would be disposed of in 6 months... Despite having a solid, practical plan for the company.

They just need to excecute them properly with no delays. :D

I just spent the entire thread explaining that AMD's issue is not their product but their mis-management and overspending. A new CPU range alone will not help.

Even though they are spending a shit ton of money producing a CPU range that isn't even selling all that well? A new range of CPUs that sell will help.

There marketing department should be fired.

Calling the new CPU's FX devalues the FX branding.

Years ago the Athlon 64 came out it was an intel killer.

Amd needs another CPU that can preform better or the same as an intel CPU at a less price.

I wonder if AMD's CPU deparment will go the way of Via only making small neich CPU's?

Then towards the bottom; "GF waived the exclusivity arrangement for AMD to manufacture certain 28 nm APU products at GF for a specified period."

AMD is probably doing fine, but they could definitely use more revenue while simultaneously cutting costs. Acquiring tons of companies is a risky move, because all it takes is one really weak quarter and they are a stones throw from bankruptcy.

Everyone that is blaming their product or performance doesnt understand basic business.

Back when Intel didn't have "semi decent" CPUs - Intel still made profit. Why because they had good management and marketing.

Only those who dare to fail greatly can ever achieve greatly. ~Robert F. Kennedy

:)