Thursday, October 18th 2012

AMD Reports Third Quarter Results and Announces Restructuring

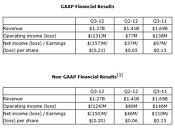

AMD today announced revenue for the third quarter of 2012 of $1.27 billion, a net loss of $157 million, or $0.21 per share, and an operating loss of $131 million. The company reported a non-GAAP net loss of $150 million, or $0.20 per share, and a non-GAAP operating loss of $124 million. AMD is also announcing a restructuring plan designed to reduce operating expenses and better position the company competitively.

"The PC industry is going through a period of very significant change that is impacting both the ecosystem and AMD," said Rory Read, AMD president and CEO. "It is clear that the trends we knew would re-shape the industry are happening at a much faster pace than we anticipated. As a result, we must accelerate our strategic initiatives to position AMD to take advantage of these shifts and put in place a lower cost business model. Our restructuring efforts are designed to simplify our product development cycles, reduce our breakeven point and enable us to fund differentiated product roadmaps and strategic breakaway opportunities."Quarterly Summary

● Gross margin was 31 percent.

- Gross margin decreased sequentially due to an inventory write-down of approximately $100 million primarily consisting of first generation A-Series Accelerated Processor Units (APUs) ("Llano"), weaker-than-expected demand, which contributed to lower average selling prices (ASPs) for the company's microprocessor products and lower utilization of the company's back-end manufacturing facilities.

● Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.48 billion at the end of the quarter. The sequential cash decline was primarily from cash used in operations.

● Computing Solutions segment revenue decreased 11 percent sequentially and 28 percent year-over-year. The sequential decrease was driven primarily by a weaker consumer buying environment impacting sales to Original Equipment Manufacturers (OEMs) as well as lower ASPs across all geographies.

- Operating loss was $114 million, compared with operating income of $82 million in Q2-12 and $149 million in Q3-11.

- Microprocessor ASP decreased sequentially and year-over-year.

- AMD launched the second generation A-series APU for the desktop channel market, offering PC enthusiasts affordable performance, discrete-level graphics, multiple cores and fast processing for outstanding responsiveness.

- AMD Introduced the AMD Z-60 APU tablet processor for upcoming Windows 8 tablets. Supporting full HD 1080p of resolution, the AMD Z-60 APU delivers up to 10 hours of idle battery life, nearly eight hours of Web browsing and six hours of video playback.

- AMD launched the AMD AppZone, a new online showcase where consumers can download and run thousands of popular Android apps on AMD-based tablets, notebooks and all-in-one PCs.

- Qualcomm and Samsung became Founder members of the HSA Foundation, adding their support to AMD's vision of delivering a common hardware standard for heterogeneous computing. Since its formation in June 2012, the HSA Foundation has more than doubled its membership.

- AMD announced new products that firmly cement the company as the leader in fabric computing and micro servers, including the SeaMicro SM15000, which extends the SeaMicro Freedom Fabric beyond the chassis to connect directly to massive disk arrays and which will also be offered with AMD Opteron processors.

● Graphics segment revenue decreased seven percent sequentially and 15 percent year-over-year. Graphics processor unit (GPU) revenue decreased 14 percent sequentially due to lower unit shipments to OEMs partially offset by higher channel sales.

- Operating income was $18 million, compared with $31 million in Q2-12 and $12 million in Q3-11.

- GPU ASP was up sequentially and year-over-year.

- AMD continued to expand its industry-leading graphics solutions:

- AMD launched the next generation of AMD FirePro products based on the company's Graphics Core Next Architecture. Setting new levels of performance-per-dollar, the AMD FirePro W5000, W7000, W8000 and W9000 GPUs are capable of delivering 1.5 times greater performance than other available solutions.

- AMD added to its powerful line-up of professional graphics solutions with the introduction of the AMD FirePro S7000 and S9000 cards for server data center environments. Excelling at compute and virtual desktop infrastructure (VDI), these solutions redefine data center graphics capability while consuming 95 percent less power at idle and dramatically cutting data center operating costs.

- AMD announced a collaboration with CiiNOW to deliver the first cloud gaming solution powered by AMD Radeon graphics to enable the best online gaming experience possible.

Operational Restructuring Designed to Enhance Financial Results, Set New Revenue Breakeven Target

AMD's restructuring plan, a significant portion of which will be implemented in the fourth quarter of 2012, will include a workforce reduction and site consolidations.

AMD expects that the restructuring actions taken in the fourth quarter of 2012 will result in operational savings, primarily in operating expenses, of approximately $20 million in the fourth quarter of 2012 and approximately $190 million in 2013. The savings will be largely driven through a reduction of AMD's global workforce by approximately 15 percent, which is expected to be largely completed in the fourth quarter of 2012. The company currently estimates it will record a restructuring expense in the fourth quarter of 2012 of approximately $80 million in connection with these actions.

AMD is also putting in place a business model to break even at an operating income level of $1.3 billion of quarterly revenue. The company is targeting to achieve this by the end of the third quarter of 2013.

"Our restructuring efforts are decisive actions that position AMD to compete more effectively and improve our financial results," said Mr. Read. "Reducing our workforce is a difficult, but necessary, step to take advantage of the eventual market recovery and capitalize on growth opportunities for our products outside of the traditional PC market."

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2012, AMD expects revenue to decrease 9 percent, plus or minus 4 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"The PC industry is going through a period of very significant change that is impacting both the ecosystem and AMD," said Rory Read, AMD president and CEO. "It is clear that the trends we knew would re-shape the industry are happening at a much faster pace than we anticipated. As a result, we must accelerate our strategic initiatives to position AMD to take advantage of these shifts and put in place a lower cost business model. Our restructuring efforts are designed to simplify our product development cycles, reduce our breakeven point and enable us to fund differentiated product roadmaps and strategic breakaway opportunities."Quarterly Summary

● Gross margin was 31 percent.

- Gross margin decreased sequentially due to an inventory write-down of approximately $100 million primarily consisting of first generation A-Series Accelerated Processor Units (APUs) ("Llano"), weaker-than-expected demand, which contributed to lower average selling prices (ASPs) for the company's microprocessor products and lower utilization of the company's back-end manufacturing facilities.

● Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.48 billion at the end of the quarter. The sequential cash decline was primarily from cash used in operations.

● Computing Solutions segment revenue decreased 11 percent sequentially and 28 percent year-over-year. The sequential decrease was driven primarily by a weaker consumer buying environment impacting sales to Original Equipment Manufacturers (OEMs) as well as lower ASPs across all geographies.

- Operating loss was $114 million, compared with operating income of $82 million in Q2-12 and $149 million in Q3-11.

- Microprocessor ASP decreased sequentially and year-over-year.

- AMD launched the second generation A-series APU for the desktop channel market, offering PC enthusiasts affordable performance, discrete-level graphics, multiple cores and fast processing for outstanding responsiveness.

- AMD Introduced the AMD Z-60 APU tablet processor for upcoming Windows 8 tablets. Supporting full HD 1080p of resolution, the AMD Z-60 APU delivers up to 10 hours of idle battery life, nearly eight hours of Web browsing and six hours of video playback.

- AMD launched the AMD AppZone, a new online showcase where consumers can download and run thousands of popular Android apps on AMD-based tablets, notebooks and all-in-one PCs.

- Qualcomm and Samsung became Founder members of the HSA Foundation, adding their support to AMD's vision of delivering a common hardware standard for heterogeneous computing. Since its formation in June 2012, the HSA Foundation has more than doubled its membership.

- AMD announced new products that firmly cement the company as the leader in fabric computing and micro servers, including the SeaMicro SM15000, which extends the SeaMicro Freedom Fabric beyond the chassis to connect directly to massive disk arrays and which will also be offered with AMD Opteron processors.

● Graphics segment revenue decreased seven percent sequentially and 15 percent year-over-year. Graphics processor unit (GPU) revenue decreased 14 percent sequentially due to lower unit shipments to OEMs partially offset by higher channel sales.

- Operating income was $18 million, compared with $31 million in Q2-12 and $12 million in Q3-11.

- GPU ASP was up sequentially and year-over-year.

- AMD continued to expand its industry-leading graphics solutions:

- AMD launched the next generation of AMD FirePro products based on the company's Graphics Core Next Architecture. Setting new levels of performance-per-dollar, the AMD FirePro W5000, W7000, W8000 and W9000 GPUs are capable of delivering 1.5 times greater performance than other available solutions.

- AMD added to its powerful line-up of professional graphics solutions with the introduction of the AMD FirePro S7000 and S9000 cards for server data center environments. Excelling at compute and virtual desktop infrastructure (VDI), these solutions redefine data center graphics capability while consuming 95 percent less power at idle and dramatically cutting data center operating costs.

- AMD announced a collaboration with CiiNOW to deliver the first cloud gaming solution powered by AMD Radeon graphics to enable the best online gaming experience possible.

Operational Restructuring Designed to Enhance Financial Results, Set New Revenue Breakeven Target

AMD's restructuring plan, a significant portion of which will be implemented in the fourth quarter of 2012, will include a workforce reduction and site consolidations.

AMD expects that the restructuring actions taken in the fourth quarter of 2012 will result in operational savings, primarily in operating expenses, of approximately $20 million in the fourth quarter of 2012 and approximately $190 million in 2013. The savings will be largely driven through a reduction of AMD's global workforce by approximately 15 percent, which is expected to be largely completed in the fourth quarter of 2012. The company currently estimates it will record a restructuring expense in the fourth quarter of 2012 of approximately $80 million in connection with these actions.

AMD is also putting in place a business model to break even at an operating income level of $1.3 billion of quarterly revenue. The company is targeting to achieve this by the end of the third quarter of 2013.

"Our restructuring efforts are decisive actions that position AMD to compete more effectively and improve our financial results," said Mr. Read. "Reducing our workforce is a difficult, but necessary, step to take advantage of the eventual market recovery and capitalize on growth opportunities for our products outside of the traditional PC market."

Current Outlook

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the fourth quarter of 2012, AMD expects revenue to decrease 9 percent, plus or minus 4 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

28 Comments on AMD Reports Third Quarter Results and Announces Restructuring

I bet they gonna even fire some people from the graphics section or other high qualified technical staff, the only people that could save AMD.

On a serious note, there is a point where a company will begin cannibalizing themselves between the important constituents and their families. This could go on for years even, where the pay of these important members usually increases, and bonuses are silently handed out. This prepares them for the eventual shutdown, if it may occur, at the expense of the companies resources, so that they may remain wealthy after the business is gone. Many members will then go on to create a new business with their new wealth.

Who's with me :D

I suspect they need more though, you better buy in bulk.

Question: Can AMD get bail out money like the GM Bas****s?

15% layoff is sad. Hopefully the company bounces back.

Hell, back in the Socket A days they were competing and even beating Intel in that market. At the very least they really really need to develop processors that highly compete with Intel.

GPU wise, I thought they were doing a good job competing with Nvidia. Am I wrong with that assumption?

AMDs numbers are miserable. I hope they make good decisions or AMD will mean Another Manufacturer Died.

unluckly you have to market your products better, even if they are bad or good.

Restructuring is what Amd has been doing for the past several years.....

I seriously hope the arse doesn't drop out of there act.

But be warry.

Nvidia

Q4 2011

$116 million in profit

Q1 2012

$60 million in profit

Q2 2012

$119 million in profit

Total: $295 million in profit

Why do this even matter ? Intel is paying $300 million annually to Nvidia for a total of $1.5 billion over 5yrs.

The bright side they can operate at a small loss for the next 5 years.

As far as AMD is concern there is a report that the Canadian GPU department is getting the axe. The bright side if there is one is restructuring will be done by Q4 2012 end so they shall start the year a new.