Tuesday, November 20th 2012

HP Reports Fourth Quarter and Full Year 2012 Results

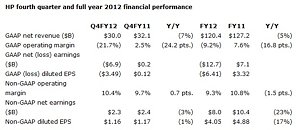

HP today announced financial results for its fourth fiscal quarter and full fiscal year ended Oct. 31, 2012. For the full year fiscal 2012, net revenue of $120.4 billion was down 5% from the prior-year period and down 4% when adjusted for the effects of currency.

Full-year GAAP loss per share was $6.41, down from diluted earnings per share (EPS) of $3.32 in the prior-year period. Full-year non-GAAP diluted EPS was $4.05, down 17% from the prior-year period. Full year non-GAAP earnings information excludes after tax costs of $20.7 billion, or $10.46 per diluted share, related to the impairment of goodwill and purchased intangible assets, restructuring charges, amortization of purchased intangible assets, charges relating to the wind down of non-strategic businesses and acquisition-related charges.For the fourth quarter, net revenue of $30.0 billion was down 7% year over year and down 4% when adjusted for the effects of currency.

Fourth quarter GAAP loss per share was $3.49, down from diluted EPS of $0.12 in the prior-year period. Fourth quarter non-GAAP diluted EPS was $1.16, down 1% from the prior-year period. Fourth quarter non-GAAP earnings information excludes after-tax costs of $9.1 billion, or $4.65 per diluted share, related to the impairment of goodwill and purchased intangible assets, restructuring charges, amortization of purchased intangible assets and acquisition-related charges.

"As we discussed during our Securities Analyst Meeting last month, fiscal 2012 was the first year in a multiyear journey to turn HP around," said Meg Whitman, HP president and chief executive officer. "We're starting to see progress in key areas, such as new product releases and customer wins. We're particularly pleased that in Q4, we were able to improve our balance sheet, generating $4.1 billion in operating cash flow, and we returned $384 million to shareholders in the form of share repurchases and dividends."

Fourth Fiscal Quarter 2012 Business Group Results

● Personal Systems revenue was down 14% year over year with a 3.5% operating margin. Commercial revenue decreased 13%, and Consumer revenue declined 16%. Total units were down 12% with both Desktops and Notebooks units down 12%.

● Printing revenue declined 5% year over year with a 17.5% operating margin. Total hardware units were down 20% year over year. Commercial hardware units were down 15% year over year, and Consumer hardware units were down 22% year over year.

● Services revenue declined 6% year over year with a 14.2% operating margin. Technology Services revenue was down 4% year over year, Application and Business Services revenue was down 7% year over year, and IT Outsourcing revenue declined 6% year over year.

● Enterprise Servers, Storage and Networking (ESSN) revenue declined 9% year over year with an 8.3% operating margin. Networking revenue was up 7%, Industry Standard Servers revenue was down 7%, Business Critical Systems revenue was down 25%, and Storage revenue was down 13% year over year.

● Software revenue grew 14% year over year with a 27.2% operating margin, including the results of Autonomy. Software revenue was driven by 9% license growth, 9% support growth, and 48% growth in services.

● HP Financial Services revenue grew 1% year over year as a 3% increase in net portfolio assets was offset by an 11% decrease in financing volume. The business delivered a 10.8% operating margin.

Asset Management

HP generated $4.1 billion in cash flow from operations in the fourth quarter. Inventory ended the quarter at $6.3 billion, with days of inventory down 2 days year over year to 25 days. Accounts receivable of $16.4 billion was down 2 days year over year to 49 days. Accounts payable ended the quarter at $13.4 billion, up 1 day from the prior-year period to 53 days. HP's dividend payment of $0.132 per share in the fourth quarter resulted in cash usage of $260 million. HP also utilized $124 million of cash during the quarter to repurchase approximately 7.6 million shares of common stock in the open market. HP exited the quarter with $11.8 billion in gross cash.

HP recorded a non-cash charge for the impairment of goodwill and intangible assets within its Software segment of approximately $8.8 billion in the fourth quarter of its 2012 fiscal year. The majority of this impairment charge is linked to serious accounting improprieties, disclosure failures and outright misrepresentations at Autonomy Corporation plc that occurred prior to HP's acquisition of Autonomy and the associated impact of those improprieties, failures and misrepresentations on the expected future financial performance of the Autonomy business over the long-term. The balance of the impairment charge is linked to the recent trading value of HP stock. There will be no cash impact associated with the impairment charge.

Outlook

For the first quarter of fiscal 2013, HP estimates non-GAAP diluted EPS to be in the range of $0.68 to $0.71 and GAAP diluted EPS to be in the range of $0.34 to $0.37.

First quarter fiscal 2013 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $0.34 per share, related primarily to the amortization of purchased intangible assets, restructuring charges and acquisition-related charges.

For the full year fiscal 2013, HP estimates a non-GAAP diluted EPS to be in the range of $3.40 to $3.60 and GAAP diluted EPS to be in the range of $2.10 to $2.30, in line with HP's previously communicated outlook.

Full year fiscal 2013 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $1.30 per share, related primarily to the amortization of purchased intangible assets, restructuring charges and acquisition-related charges.

More information on HP's earnings, including additional financial analysis and an earnings overview presentation, is available on HP's Investor Relations website at www.hp.com/investor/home.

HP's Q4 FY12 earnings conference call is accessible via an audio webcast at www.hp.com/investor/2012Q4webcast.

Full-year GAAP loss per share was $6.41, down from diluted earnings per share (EPS) of $3.32 in the prior-year period. Full-year non-GAAP diluted EPS was $4.05, down 17% from the prior-year period. Full year non-GAAP earnings information excludes after tax costs of $20.7 billion, or $10.46 per diluted share, related to the impairment of goodwill and purchased intangible assets, restructuring charges, amortization of purchased intangible assets, charges relating to the wind down of non-strategic businesses and acquisition-related charges.For the fourth quarter, net revenue of $30.0 billion was down 7% year over year and down 4% when adjusted for the effects of currency.

Fourth quarter GAAP loss per share was $3.49, down from diluted EPS of $0.12 in the prior-year period. Fourth quarter non-GAAP diluted EPS was $1.16, down 1% from the prior-year period. Fourth quarter non-GAAP earnings information excludes after-tax costs of $9.1 billion, or $4.65 per diluted share, related to the impairment of goodwill and purchased intangible assets, restructuring charges, amortization of purchased intangible assets and acquisition-related charges.

"As we discussed during our Securities Analyst Meeting last month, fiscal 2012 was the first year in a multiyear journey to turn HP around," said Meg Whitman, HP president and chief executive officer. "We're starting to see progress in key areas, such as new product releases and customer wins. We're particularly pleased that in Q4, we were able to improve our balance sheet, generating $4.1 billion in operating cash flow, and we returned $384 million to shareholders in the form of share repurchases and dividends."

Fourth Fiscal Quarter 2012 Business Group Results

● Personal Systems revenue was down 14% year over year with a 3.5% operating margin. Commercial revenue decreased 13%, and Consumer revenue declined 16%. Total units were down 12% with both Desktops and Notebooks units down 12%.

● Printing revenue declined 5% year over year with a 17.5% operating margin. Total hardware units were down 20% year over year. Commercial hardware units were down 15% year over year, and Consumer hardware units were down 22% year over year.

● Services revenue declined 6% year over year with a 14.2% operating margin. Technology Services revenue was down 4% year over year, Application and Business Services revenue was down 7% year over year, and IT Outsourcing revenue declined 6% year over year.

● Enterprise Servers, Storage and Networking (ESSN) revenue declined 9% year over year with an 8.3% operating margin. Networking revenue was up 7%, Industry Standard Servers revenue was down 7%, Business Critical Systems revenue was down 25%, and Storage revenue was down 13% year over year.

● Software revenue grew 14% year over year with a 27.2% operating margin, including the results of Autonomy. Software revenue was driven by 9% license growth, 9% support growth, and 48% growth in services.

● HP Financial Services revenue grew 1% year over year as a 3% increase in net portfolio assets was offset by an 11% decrease in financing volume. The business delivered a 10.8% operating margin.

Asset Management

HP generated $4.1 billion in cash flow from operations in the fourth quarter. Inventory ended the quarter at $6.3 billion, with days of inventory down 2 days year over year to 25 days. Accounts receivable of $16.4 billion was down 2 days year over year to 49 days. Accounts payable ended the quarter at $13.4 billion, up 1 day from the prior-year period to 53 days. HP's dividend payment of $0.132 per share in the fourth quarter resulted in cash usage of $260 million. HP also utilized $124 million of cash during the quarter to repurchase approximately 7.6 million shares of common stock in the open market. HP exited the quarter with $11.8 billion in gross cash.

HP recorded a non-cash charge for the impairment of goodwill and intangible assets within its Software segment of approximately $8.8 billion in the fourth quarter of its 2012 fiscal year. The majority of this impairment charge is linked to serious accounting improprieties, disclosure failures and outright misrepresentations at Autonomy Corporation plc that occurred prior to HP's acquisition of Autonomy and the associated impact of those improprieties, failures and misrepresentations on the expected future financial performance of the Autonomy business over the long-term. The balance of the impairment charge is linked to the recent trading value of HP stock. There will be no cash impact associated with the impairment charge.

Outlook

For the first quarter of fiscal 2013, HP estimates non-GAAP diluted EPS to be in the range of $0.68 to $0.71 and GAAP diluted EPS to be in the range of $0.34 to $0.37.

First quarter fiscal 2013 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $0.34 per share, related primarily to the amortization of purchased intangible assets, restructuring charges and acquisition-related charges.

For the full year fiscal 2013, HP estimates a non-GAAP diluted EPS to be in the range of $3.40 to $3.60 and GAAP diluted EPS to be in the range of $2.10 to $2.30, in line with HP's previously communicated outlook.

Full year fiscal 2013 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $1.30 per share, related primarily to the amortization of purchased intangible assets, restructuring charges and acquisition-related charges.

More information on HP's earnings, including additional financial analysis and an earnings overview presentation, is available on HP's Investor Relations website at www.hp.com/investor/home.

HP's Q4 FY12 earnings conference call is accessible via an audio webcast at www.hp.com/investor/2012Q4webcast.

Comments on HP Reports Fourth Quarter and Full Year 2012 Results

There are no comments yet.