Thursday, April 18th 2013

AMD Reports 2013 First Quarter Results

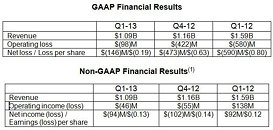

AMD (NYSE:AMD) today announced revenue for the first quarter of 2013 of $1.09 billion, an operating loss of $98 million and a net loss of $146 million, or $0.19 per share. The company reported a non-GAAP operating loss of $46 million and a non-GAAP net loss of $94 million, or $0.13 per share.

"Our first quarter results reflect our disciplined operational execution in a difficult market environment," said Rory Read, AMD president and CEO. "We have largely completed our restructuring and are now focused on delivering a powerful set of new products that will accelerate our business in 2013. We will continue to diversify our portfolio and attack high-growth markets like dense server, ultra low-power client, embedded and semi-custom solutions to create the foundation for sustainable financial returns."Quarterly Financial Summary

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2013, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

"Our first quarter results reflect our disciplined operational execution in a difficult market environment," said Rory Read, AMD president and CEO. "We have largely completed our restructuring and are now focused on delivering a powerful set of new products that will accelerate our business in 2013. We will continue to diversify our portfolio and attack high-growth markets like dense server, ultra low-power client, embedded and semi-custom solutions to create the foundation for sustainable financial returns."Quarterly Financial Summary

- Gross margin was 41 percent.

o Gross margin increased sequentially due to a $20 million benefit from sales of inventory that had been previously reserved which positively impacted gross margin by 2 percentage points. - Cash, cash equivalents and marketable securities balance, including long-term marketable securities, was $1.2 billion at the end of the quarter.

o First quarter cash was bolstered by the closing of a sale and leaseback transaction of the "Lone Star Campus" in Austin, Texas generating cash proceeds of approximately $164 million, net of certain fees. - Computing Solutions segment revenue decreased 9 percent sequentially and 38 percent year-over-year. The sequential decrease was primarily due to lower desktop, notebook and chipset unit shipments. The year-over-year decline was driven primarily by lower unit shipments.

o Operating loss was $39 million, compared with an operating loss of $323 million in Q4 2012 and operating income of $124 million in Q1 2012. The Q4 2012 operating loss included the impact of a GLOBALFOUNDRIES-related "lower of cost or market" (LCM) charge of $273 million.

o Microprocessor Average Selling Price (ASP) increased sequentially and decreased year-over-year. - Graphics segment revenue increased 3 percent sequentially and decreased 12 percent year-over-year. Graphics processor unit (GPU) revenue was flat sequentially and down year-over-year.

o Operating income was $16 million, compared with $22 million in Q4 2012 and $34 million in Q1 2012.

o GPU ASP increased sequentially and year-over-year.

- Sony announced a semi-custom AMD APU would power its upcoming PS4 gaming console. The APU combines AMD's "Jaguar" processor cores and next-generation AMD Radeon graphics, integrating a combination of x86 processor cores and advanced graphics IP unique to AMD.

- Highlighting AMD's commitment to optimizing the world's top PC titles for AMD Radeon graphics cards, the company launched the "Never Settle: Reloaded" promotion. The current program bundles up to five of the year's most anticipated PC games ─ "BioShock Infinite" by 2K Games and Irrational Games, "Crysis 3" by Electronic Arts and Crytek, "DmC Devil May Cry" by Capcom, "Tomb Raider" by Square Enix and Crystal Dynamics and most recently, "Far Cry 3 Blood Dragon" by Ubisoft ─ with the purchase of select AMD Radeon HD 7900 Series, HD 7800 Series as well as HD 7790 and HD 7770 graphics cards.2

- AMD ushered in the new frontier of gaming realism with the introduction of TressFX Hair - a collaboration with Crystal Dynamics to deliver the world's first real-time hair rendering technology that can react to forces like gravity, wind and head movement in a playable game. The technology uses the DirectCompute programming language to unlock the capabilities of the AMD Graphics Core Next architecture and is featured heavily in the newly launched PC version of Tomb Raider.

- AMD expanded its server graphics solutions with the introduction of the AMD FirePro R5000 remote graphics card supporting remote 3D-graphics workflows and full computing experiences over IP networks.

- AMD moved into cloud gaming with AMD Radeon Sky Graphics, based on AMD Graphics Core Next architecture. Working with CiiNow, G-Cluster, Otoy and Ubitus, AMD developed a flexible cloud gaming technology that enables developers and service providers to deliver excellent gaming experiences through PCs, tablets, smart TVs and mobile devices.

- AMD announced AMD Turbo Dock Technology which automatically adjusts performance of the AMD accelerated processing unit (APU) higher while a hybrid PC is docked and being used for more complex tasks like content creation.

- AMD began shipping the next generation of AMD Elite A-Series APUs, codenamed "Richland," which combine improved performance and battery life4,5 with advanced user experiences like AMD Face Login and AMD Gesture Control.

- AMD extended its commitment to drive the development of accelerated applications that tap into the full compute performance of the APU through collaboration with Aviary to bring an optimized version of its popular photo editing tool to Windows 8 PCs and tablets powered by AMD APUs.

- AMD announced that the SeaMicro SM15000 server is now certified for CDH4, Cloudera's Distribution, creating a "Hadoop-in-a-Box" solution. Red 5, Livestream and Wayfair also announced they have deployed SeaMicro-powered microservers across their businesses.

- AMD launched the AMD Open 3.0 server platform, a radical rethinking of the server motherboard designed to the standards developed by the Open Compute Project. The AMD Open 3.0 server enables substantial gains in computing flexibility, efficiency and operating cost by simplifying motherboard design.

- Aligned with the company's strategy to reduce investments and capital in non-core parts of the business, AMD announced that it sold and leased-back its "Lone Star Campus" in Austin, Texas, generating approximately $164 million in cash, net of certain fees.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2013, AMD expects revenue to increase 2 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMD's results and outlook please see the CFO commentary posted at quarterlyearnings.amd.com.

41 Comments on AMD Reports 2013 First Quarter Results

Either way, cheers to AMD, the least evil corporation in the PC industry...

That's why the numbers are better than last quarter

I just they nail something soon, heterogeneous computing I would think but this requires the support of the software industry but things are looking positive here wither WinZip, Handbrake and Adobe all getting into the OpenCL game.

NVidia make more because they put a higher profit margin on all their stuff, and dont give away 3 free games with their cards, just 1. They also make the Tegra chips for mobile graphics. Which AMD has only started doing recently.

AMD tried the high price wagon and they got slayed by their fans. I paid £520 for a Powercolor Liquid cooled 7970 way back in Feb 12 (it had RRP of £600 :twitch:). Likewise, their other cards were >£400. Now they're £100 cheaper. They tried to do what Nvidia do and got their asses chewed off by the very people who claim to be loyal.

Then when Nvidia release the 680 with sweet drivers it knocks the spots of the 7970. Instead of having aggressive driver developments, AMD cut prices as if to say - sorry, we're shitter than we thought, letting Nvidia rake in all the plaudits from reviews and the cash.

Now we have a 7970 that's generally: more OC friendly, faster and without doubt superior in compute (gpgpu) and is cheaper than the competition. Are we surprised they make less money?

Even their AAA title promo is not the right thing to do. AMD need to build up brand quality image. They need to do that by nailing the few software issues that still haunt them. Good hardware plus ace software makes the cash once people are told how good it is.

Take Malta. Unless it is released to positive reviews (especially about you know what) it's another excellent piece of hardware with substandard software. Reviewers will not be forgiving - they really wont and that knocks the confidence out of the product line as a whole.

Nvidia got screwed by Fermi. They spent a lot of time on improving it and refining the systems to a point today where folks like me are playing with bios's left right and centre to get more power into the bloody thing. They learned from Fermi. Read W1zz's review about the 680 - he loves it's power efficiency. That's a direct consequence of Nvidia making something wrong, right.

If AMD release Malta with substandard drivers/latency etc, they've learned shit. I'm hoping they have learned though. I really do. Nvidia need a kick in the ass on the pricing front.

In short, AMD may be better spending the profits on themselves than giving it to the government - if they want to grow faster.

When was the last Radeon product that launched with anything approaching solid and mature driver support? It seems that every product cycle comes with the unspoken understanding that AMD will launch a "miracle" or "performance" driver some months after the product hits the shelves...and the dust has already settled from review PR bonanza.

* AMDs board of directors still retains the core of those who signed off on all three of those deals.

www.techpowerup.com/178129/AMD-to-Fix-GCN-Latency-Issues-with-Driver-Updates.html?cp=2

www.anandtech.com/show/6857/amd-stuttering-issues-driver-roadmap-fraps

(in which AMD software guys sat down with Anandtech guys to discuss the issues)

then that has an impact on brand reliability, which will eventually have an impact on market value.

Look what happened to Apple after it ditched Google Maps. Bad PR reduced share price. AMD's driver reliability in certain set ups is an issue. If you looked back you might see Fermi's toaster jokes and power draw problems hit Nvidia's market value. Ultimately profits are driven by many things but solid performance will always help and little hiccups here and there do not.

1. It's remarkably consistent, and

2. It seems to be resulting in a company visibly contracting in market share, size, breadth of product line, human resources, and assets.Well, firstly, I'd say that what I was speaking about was AMD needing half a year or so to realize the full potential of the product. i.e.

...but running with your (deliberate?) misinterpretation of what I wrote, I'd say lets present;

Exhibit 1 : How long between AMD touting VCE on December 22nd 2011

... and AMD having VCE fully functional ?Sorry about that. I was under the impression that better optimized drivers equates to better relative performance in reviews...which equates to better PR/Marketing, which in turn equates to better sales and brand awareness. I Didn't realize all that had no impact on the companies bottom line.Not to mention a long OT spiel about Tegra :shadedshu

Get a job other them nvidias pr hore you gimps, drivers have feck all to do with financial reporting

May i point how tech press closed eyes to nvidia 8800GTS 320 MB problems or intel socket problem www.anandtech.com/show/2859 AMD would get tortured and executed for something like that or how most went silent with intel errata problem at beginning of core2duo era.

Do you know intel i820 chipset problem ; it was designed for rambus originally but intel used with sdram and users had memory corruption problems , motherboards called back in lucky countries .But you can see AMD problems all over net

It's only in follow up reviews, they might have more optimised driver, by which stage the buzz of the product has gone or has simmered.

Enthusiasts make a very small miniority. Generally speaking, AMD's high end cards are performing well. When they read reviews all they are going to see is an AMD's card cheaper than Nvidia card doing as well or better and won't be interested in optimisations as it's already doing well today on the day of purchase.

Also, the majority of ATI/AMD video cards sold are lowend and integrated, the lowend market don't read reviews and are not technical enough to understand what a driver is - This is AMD's biggest and lucrative market.

When the first person starts throwing 'fanboi' or 'zealot' around you have lost the discussion.

They still have a lot of work to do to get back to regular quarterly profits as they have done in the past. As long as they keep delivering excellent products and consumer value they will be around for another 40 years. Their lead in APUs has proven that the purchase of ATI was a very good strategic decision and wise investment, which is now starting to show exponential returns.

The AMD customers/fans will switch to nvidia with a drop off a hat if Nvidia is better, whereas Nvidia customers/fans will not even if nvidia is worse (Performance/price doesn't matter to them).

AMD`s biggest enemy is AMD itself = Marketing and people in charge of GPU Reviews