Friday, November 14th 2014

Big Swing in Market Share From AMD to NVIDIA: JPR

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, today announced estimated graphics chip shipments and suppliers' market share for 2014 2Q in its Market Watch quarterly PC graphics report, an industry reference since 1988.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

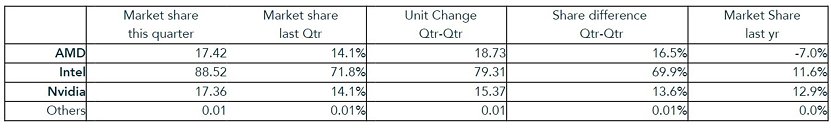

- AMD's overall unit shipments decreased 7% quarter-to-quarter, Intel's total shipments increased 11.6% from last quarter, and Nvidia's jumped 12.9%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs, for the quarter was 155% (up 2%) and 32% of PCs had discrete GPUs, (flat from last quarter), which means 68% of PCs today are using the embedded graphics in the CPU.

- The overall PC market increased 6.9% quarter-to-quarter, and decreased 2.6% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 7.8% from last quarter.

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

- AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs increased 10.5% from the previous quarter, and decreased 16% in notebooks. AMD's discrete desktop shipments decreased 19% and notebook discrete shipments increased 10%. The company's overall PC graphics shipments decreased 7%.

- Intel's desktop processor embedded graphics (EPGs) shipments decreased from last quarter by 0.3%, and notebooks increased by 18.6%. The company's overall PC graphics shipments increased 11.6%.

- Nvidia's desktop discrete shipments increased 24.3% from last quarter; and the company's notebook discrete shipments increased 3.5%. The company's overall PC graphics shipments increased 12.9%.

- Year-to-year this quarter AMD's overall PC shipments decreased 24%, Intel increased 19%, Nvidia decreased 4%, and the others essentially are too small to measure.

- Total discrete GPU (desktop and notebook) shipments from the last quarter increased 6.6%, and decreased 7.7% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the trend for discrete GPUs has increased with a CAGR from 2014 to 2017 now of 3%.

- Ninety nine percent of Intel's non-server processors have graphics, and over 66% of AMD's non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

58 Comments on Big Swing in Market Share From AMD to NVIDIA: JPR

We know people want strong GPUs; be it integrated in a mobile device with increasingly higher rez screen, apu for a sff/laptop, or discrete desktop part for gaming, especially as even low-power arm cpus are reaching the general purpose tipping point that x86 hit around the time of Conroe or so. It's unfortunate when you see companies like Qualcomm (ironically with adreno) and nvidia with K1 release products that are well-regarded, especially given amd's mission statement since 2006. Even Intel had 4k decoding before AMD...it's just sad, given they used to be the pioneers in so many areas over the years that attracted customers for one reason or another. Such a long way from avivo and the AIWs (not to mention core gpu features).

While ofc AMD is still in a (forced) holding/restructuring pattern until 14nm/2016ish, and I'm sure I'm not alone in hoping they can shock the world with products at that point...the last couple years of generally stale products have devastated them; it really is starting to bite them when their competition (intel in apus, nvidia in gpus) have or will have lower-end parts competing with the strengths of their flagships...conceivably even before some launch. Say what you will about their finances, but that never should have been allowed to happen when there are so many ripe markets to plunder with their specific strengths and IP. Dirk has been gone for FOUR YEARS, and it is beyond the blame of anyone of that time period. It's one thing to readjust focus to where they can be profitable, it's another to allow your competition to seriously start to nullify your purpose of existence in the meantime. Everyone has got to have an angle; at least then a niche will bite (more cpu or gpu performance discrete or apu, best price/perf per market, perf/watt, arm, x86, unique or first to a feature-set). AMD has the potential for any of them and is close to having none, while the areas that have held them back from further innovation (bandwidth and process tech) are being solved by the companies that used to so far behind them in such matters it didn't even use to be a concern*. When you're a company that has largely played second fiddle in your market(s), the last thing you want people to do is forget your name or what you do uniquely/best...because it takes a lot to make them come back.

I'm not saying this because I bought one (which coming from a big supporter of amd I do think is something), but when you see a product like the 970 versus the 290x, that's really quite shameful...and I've already expressed my reservations about Fiji (ram size for efficient bw with HBM, power/size/cooling requirements, inability to likely compete with anything above GM204 while probably being less efficient). When you see intel, the laughing stock of hardware graphics, surpass your video capabilities (and soon integrated graphics capabilities as the edram Iris pros float into more markets with broadwell and skylake), it's inexcusable.

*Intel/nvidia largely solved bandwidth issues with on/off die cache and unit optimization, while amd has been flops-heavy for years (and should have been in the forefront about solving the issue). AMD used to be first to a new process (compared to nvidia) by a large margin, but are having difficulty innovating without it (one could argue contrary to Maxwell).

TLDR:

I'm not saying anything anyone doesn't already know, and surely amd will live to see another day (with better products or a dead-shot aim on specific markets), but damn...this is the start of what's going to be a truly rough year...and I think it was avoidable on multiple counts. I'm not saying we may have been talking about a better cpu than intel, nor a more efficient gpu than maxwell...maybe it could have been a competitor to Tegra, or a faster time-to-market for off-die buffer than HBM, or something else completely that was better/unique. But instead, it's nothing...just hopes (and further anticipation of having) to catch up...with the sales numbers starting to show it...and that bums me right out.

AMD would need to make a massive perf leap over the 290X to compete. This is all of course, rumour. The stacked memory technology is a positive step but it's not yet known how much that will help with the new architecture in terms of overall performance improvement.

All that said, I think a GM200 >500mm2 won't sip power but it'll be a perf/watt increase, instead of an absolute reduction.

I would dearly like to see the AMD 'rabbit out of a hat trick' - we need it moving forward with 4k adoption. They need it for their finances.

Haven't AMD been behind Nvidea for the last several years? They've spent the last decade being one step behind Nvidea, but generally offering a much better value proposition. I'm loathe to pay the Nvidea tax, and the mild loss of performance in going with AMD is generally not an issue for the games I play. The 970/980 are eating into AMD's sales because they aren't really an Nvidea move. They're priced reasonably, relatively silent, and more importantly they've got a substantial performance lead over the AMD offerings. Even with lower pricing on the high-end AMD cards, I'd be very hard pressed to recommend a 290x over a 970.

AMD has been on the down-swing since introducing their new architecture. It was a bold experiment, that unfortunately did not pan out. AMD went whole-hog on the Bulldozer, and has wound-up paying the price in the GPU department. None of this is easy to say, but it's the truth. Hopefully the new AMD GPUs are released soon, and showcase substantial performance gains. As of right now, AMD can't really bring anything to the table except price cuts. Such a poor showing is depressing, given AMD has demonstrated so much more potential.

In all seriousness though, I see there being very little wrong with the GPU architecture in general. I think GCN is pretty solid. The problem is that they're not making incremental improvements regularly like nVidia and Intel have been. They ride out a card for a long time then overhaul it. I think the risk that AMD runs when they do this is that when you have a company like nVidia that releases new cards more often, it adds incentive to people to get the latest technology and right now if you look at AMD, the 200-series Radeons are, relatively speaking, old. The 900-series GTX cards are brand new, hot off the press.

With that said, I think that AMD's CPU shortcomings influenced the rate at which new GPUs have been released which is a shame because that hurts sales.

With that said, I still don't see myself buying a new GPU to replace my 6870s until we start seeing some 20nm GPUs.

AMD loses in the high end and that affects it's brand strength against Nvidia's in the whole market. People will buy Nvidia hardware or Intel hardware even if AMD's offering is better, because Nvidia and Intel are stronger brands. When you don't know what to buy, you just buy the one with the stronger brand on it.

Also the GTX 9XX is not the reason for this shift in my opinion because its just a repeat of what happens over the years. Its the expansion of extra products like the Tegra line and a lot of new changes in the OEM world bringing this on.

That's how the hi end affects the low end sells.

They have consistently failed to shrink the die size for performance increases in the last two cards, so engineering dollars went to make a better mud pie, silicon costs are the same.

They have failed to materialize a CPU that could compete in per clock performance, so have been forced to add more cores, and thus more silicon to get closer, higher cost.

Manufacturing hasn't improved at the rate they have needed and planned on, and this may be holding up production of plans for smaller chips, and without the R&D budget to allow for side by side development it halts their production improvement.

The strange part of JP's. numbers are all they're about Q2 (April-June) sales, and has nothing to do with 9X0 Maxwell products, but is perhaps a strong indicator of the 750Ti that had released in Feb. Remember in this quarter; April (first month) was when the "mining craze went bust", and AMD had perhaps not much volume in the channel. While AMD started to see pricing normalize they couldn't necessarily cut prices as they probably hadn't product to offer. I think a lot of this "doom-n-gloom" is just... Monday morning quarterback’n. What I think it indicates is AMD caught off guard by mining, never had the volume (wafer starts) to meet the demand, and AMD had some sales jump to Nvidia, as some folk seeing still high prices that hung around well too long after things went bust!

What happen in to past... is history, sure it has a bad feel but look at it in "context" and we see perhaps meaning. Oddly there's more "the sky is fall’n" going in here than was made of TSCM 16nm FF, just now passing risk production, which is perhaps put a bind in Nvidia's bottom line moving forward.

As to R&D, AMD has had less and most of the work we see now was spent three years ago (or longer) when AMD was really bad off probably spending money they didn't have and working from executive decision’s that where poorly put in place long before that.

I think we may see something change later on in this world but right now its going to be a very slow process of rebuilding and honestly the best course of action is to develop the APU and work towards their single core performance and getting into the OEM's machines over than trying to release hard core CPU's.

As for the GPU's, its all going to depend on the node it comes out on and the overall performance. The waiting game they played instead of just sticking to the basics like Nvidia did could pay off heavily if the 390X is power efficient enough and out performs the 980 using a 20nm die and the 3D stacked memory (HBM) then they will have stuck a hard foot in the ground on the GPU segment of once again. However if they stick to the 28nm and even with the stacked memory only perform on par or around the 980 even if the power consumption for all intensive purposes is about the same then they have made a huge error in waiting this long.