Thursday, April 16th 2015

AMD Reports 2015 First Quarter Results

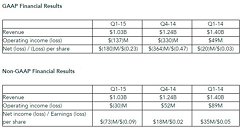

AMD today announced revenue for the first quarter of 2015 of $1.03 billion, operating loss of $137 million and net loss of $180 million, or $0.23 per share. Non-GAAP operating loss was $30 million and non-GAAP net loss was $73 million, or $0.09 per share.

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."Q1 2015 Results

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."Q1 2015 Results

- Revenue of $1.03 billion, down 17 percent sequentially and 26 percent year-over-year.

- Gross margin of 32 percent, up 3 percentage points sequentially, primarily due to a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP gross margin of 32 percent, decreased 2 percentage points sequentially due to product mix and lower game console royalties in the first quarter.

- Operating loss of $137 million, compared to an operating loss of $330 million for the prior quarter, which included a goodwill impairment and a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP operating loss of $30 million, compared to non-GAAP operating income of $52 million in Q4 2014, primarily due to lower revenue and gross margin.

- Net loss of $180 million, loss per share of $0.23, and non-GAAP net loss of $73 million, non-GAAP loss per share of $0.09, compared to a net loss of $364 million, loss per share of $0.47 and non-GAAP net income of $18 million, non-GAAP earnings per share of $0.02 in Q4 2014.

- Cash, cash equivalents and marketable securities were $906 million at the end of the quarter, down $134 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.27 billion, up $56 million from the prior quarter.

- As a part of the strategy to simplify and sharpen the company's investment focus, AMD is exiting the dense server systems business, formerly SeaMicro, effective immediately.

AMD recorded $75 million of special charges in Q1 2015 primarily related to impairment of previously acquired intangible assets. - AMD entered into a fifth amendment to our Wafer Supply Agreement with GLOBALFOUNDRIES. AMD expects to purchase approximately $1 billion in wafers in 2015, in line with the company's current market expectations.

- Computing and Graphics segment revenue decreased 20 percent sequentially and 38 percent from Q1 2014. The sequential decrease was primarily due to lower desktop and notebook processor sales and the annual decrease was driven by lower desktop processor sales and GPU channel sales.

Operating loss was $75 million, compared with an operating loss of $56 million in Q4 2014 and operating income of $3 million in Q1 2014. The sequential decrease was primarily driven by lower desktop and notebook processor sales, partially offset by lower operating expenses. The year-over-year decrease was primarily driven by lower desktop processor sales.

Client average selling price (ASP) decreased sequentially and increased year-over-year primarily driven by processor product sales mix.

GPU ASP increased sequentially primarily due to higher channel GPU and Professional Graphics ASPs and decreased year-over-year primarily due to a lower channel ASP. - Enterprise, Embedded and Semi-Custom segment revenue decreased 14 percent sequentially, primarily driven by seasonally lower sales of semi-custom SoCs. The year-over-year decrease of 7 percent was primarily driven by lower server processor sales.

Operating income was $45 million compared with $109 million in Q4 2014 and $85 million in Q1 2014, primarily due to lower game console royalties, product mix and higher R&D spending. - All Other category operating loss was $107 million compared with losses of $383 million in Q4 2014 and $39 million in Q1 2014. The sequential decrease was primarily due to the absence of the Q4 2014 goodwill impairment of $233 million and the lower of cost or market inventory adjustment of $58 million. The year-over-year increase was primarily due to $87 million restructuring and other special charges, consisting primarily of $75 million related to the exiting of the dense server systems business.

- AMD provided details of the energy efficiency and design advances in the upcoming A-Series APU (codenamed "Carrizo") which is expected to deliver double digit percentage increases in both performance and battery life compared to the previous generation.

- AMD joined other HSA Foundation members including ARM, LG Electronics, MediaTek, Qualcomm, and Samsung to release the HSA 1.0 specification, bringing the industry one step closer to delivering true heterogeneous computing across the billons of modern SoCs powering mobile devices, desktop PCs, high-performance computing (HPC) systems, and servers.

- Adoption of AMD's high-performance APUs in key embedded markets continued with new product introductions from Samsung Electronics, GE Intelligent Platforms and Fujitsu.

- AMD continued to secure new design wins and expand ecosystem support for the AMD FirePro professional graphics cards and server GPUs.

With the addition of the second-generation HP ZBook 14 G2 and 15u G2 Mobile Workstations, AMD FirePro professional graphics are now available in high-end to entry-level HP ZBook solutions.

The AMD FirePro server GPU is now available on the HP ProLiant DL380 Gen9, the world's best-selling server, targeting a variety of specialized applications including Academic and Government clusters, Oil and Gas research, and Deep Neural Networks. - Acer, BenQ and LG Electronics began offering displays supporting AMD FreeSync technology, designed to enable fluid gaming and video playback at virtually any frame. Asus, Nixeus, Samsung and Viewsonic have also announced plans to introduce new monitors supporting the technology in the first half of 2015.

- AMD announced the LiquidVR initiative in close collaboration with key technology partners to deliver the next-generation of Virtual Reality capable of delivering immersive awareness where situations, objects, or characters within the virtual world seem "real."

- AMD continued fostering the development of the 64-bit ARM-based server and embedded ecosystem with announcements that a growing base of operating systems and hypervisors will support AMD's forthcoming 64-bit ARM processor. In addition to OpenSUSE13.2, the Linux 3.19 kernel, Fedora 21 and Xen 4.5 will all support the AMD Opteron A1100 Series processor.

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

45 Comments on AMD Reports 2015 First Quarter Results

I have been watching AMD for years now thinking that surely they would turn the corner sooner or later, but it just doesn't seem to happen.

They don't seem to be in massive internal panic yet so they probably expect to be able to hold steady for a while. They do have roadmaps for at least 5 more years.

www.investopedia.com/stock-analysis/032515/3-major-problems-facing-advanced-micro-devices-amd.aspx

Kind of makes you wonder what special sauce companies like Cavium with their 48-core ARM SOC'sutilise to get their product range up to speed so quickly.Fear not, Jorge will be here shortly to tell us that the company is just playing possum and that their next initiative is the one that will lead to world domination. It's really only a matter of time....really! :fear:

Then they pull the same junk with GCN. the 7000 series was fantastic, the 7970 could compete with nvidia's high end 680, and sold very well. so what did they do? nothing. they sat on it, from late 2011 until late 2013, then released the 290 and 290x to compete with the 700 series. while nvidia was working on making the hyper-efficient maxwell architecture, AMD was chasing mantle and trueaudio. say what you will about sparking dx12, but giving up your GPU profits to drive the industry forward doesnt work well when you dont have billions to loose. GCN 1.2 wasn't much of an improvement, with the r9 285 being slightly more efficient, but nothing to write home about.

So now, its been 3 1/2 years, and amd is still selling the same arch. it is long overdue for replacement, and hopefully the 300 series has it, if the 300s barely improve though, AMD will not weather it well. at all.

And it's bitten them hard. their marketshare of gpus is as pitiful as their cpu market now, the power-sucking r9 290x being matched in performance by the geforce 970, which is the same price and pulls less than half the power. their inefficiency has lost them the mobile gpu market, while their anemic cpu plops them only in budget low end laptops, with intel stealing the market. hitting deadlines may be hard, but AMD was 11 months late launching their a8-7600, which killed quite a bit of their demand for the thing. now, they don't have the R+D to fight either of their competitors, and they cant keep loosing money forever. something tells me that AMD wont survive much longer without being bought out or selling a majority control to a separate company.

EDIT: just read about amd closing seamicro. there goes another $334 million.....

The comparisons between DEC and AMD go further than commonality with personnel and IP. DEC was often described as good products in search of a good company. The same could be said of AMD.

Turnover and profit relies mostly on marketing efforts, contracts secured, business operation efficiency etc. Product performance, not so much.

I am holding my $$$ now for 390 or 390x.

And Speaking of AMD's chips, it seems that AMD's cheap 8 core FX CPUs are beating the hell out of Intel's more expensive quad core ones in the new 3Dmark DX12 overhead benchmark by up to 40% more draw calls.

The 290X is doing as well as the Titan X in that benchmark in draw call consumption.

As for the GPU's, its nothing out of the normal for them, they did a similar strategy with VLIW so I really expected them to stick to it a little longer. You can always build a better chip and continue to call it whatever you want, the only thing that really holds them back this round would be the re-badging or products and not the fact they are "still" using GCN.

To top if off, they perform just fine in most areas as performance especially in GPU's is not their primary concern considering their old GPU's are still in competition with NVidia's new GPU's. OEM's are their problem as they have a lackluster following of OEM's willing to put their products into action especially in the more dominant mobile and server markets. Even if Zen came to the floor, gave us an 8 core CPU with a 75watt tdp, performance clock to clock with Intel newest architecture, and was surprisingly affordable it would still make very little impact unless they had a ton of OEM's buying up those CPU's for their machines like hot cakes.We all do, but those OEM's need to buy their products...Maybe they will finally change their tune after Intel basically "forced" oems to stop using AMD products and go back to properly considering more than one company for their chips in their machines.

All we can hope for is better products and OEM's to start buying them...

Their crappy CPUs are killing them slowly. The only department keeping them afloat is the GPU one.

If they will fail again with the next CPU, not to mention GPU, they will be doomed for sure.

This sucks because nobody will want a monopoly on GPUs and CPUs....

What is decent performance? What task will the OEMs be unimpressed with?

OEMs don't care much about performs. They care about profit margin and AMD's ability to supply the volume they need on demand

I know you have a hardware fascination, but it doesn't always apply to business.

Let me explain:

1. They could focus on GPU, they're slightly behind but still in the game and nvidia demonstrated that you can turn a nice profit from GPU alone.

2. Let Intel handle the anti-monopoly cases all over the world. They will either get split into 2 or will be forced to provide a license to another third party.

3. Intel and AMD have cross licensing agreements, but I doubt they can just provide AMD tech (like x64) to a third party which means AMD, might get royalties from there as well.

4. Points 2 and 3 alone could persuade Intel to "finance" AMD with let's say 10 billion, to get them re-start in the CPU business.

5. If Intel will argue that there is a competitor in ARM, then most likely Microsoft will be dragged into this and will be forced to make proper desktop software for ARM as well, with everything required for businesses not that limited RT.

6. ARM is getting pretty strong anyway and it is time to be considered for desktop - Exynos 7420 gets ~1500 single core and ~5500 multi-core in geekbench which is close to Core 2 Quad 3Ghz which was a decent cpu and good enough for desktop related activities (browsing, movies, working) even by today standards, and with the right push from the government we could be really having a nice competitive ecosystem going forward.

Check the specifications of OEMs Intel based machines versus those AMD-based. Quite a disparity in feature set and pricing.

A second case in point is the (what amounts to giveaway) pricing AMD are absorbing in order to secure Apple contracts. Take the Mac Pro for example. The system comes supplied with dual D500 FirePro's (essentially a cut down W8000 which retail at $1K a pop), but can be upgraded to dual D700's ( basically W9000's which retail for ~$2800 each) for a measly $600 total. AMD is essentially buying Apple's partnership.That is only partly true. The enterprise sector - entirely OEM - is predicated upon performance - performance per watt, and performance per core. Intel's Xeon based systems are generally more expensive than Opteron, but they now account for 98.3 or 98.5% of x86 server sales depending whether you use IDC or Gartners/Mercury Research's market share figures.Lack of new product and a severe lack of timetable adherence spring to mind. The whole SeaMicro fiasco with its lofty claims when launched, cant have instilled much in the way of confidence for potential customers ( Quite where this leaves their only substantial customer, Verizon, should be interesting).Maybe AMD should have accepted Jen-Hsun as CEO of a merged AMD and Nvidia!The Cross-license agreement renewed last year appears to make allowance for a transition in much the same way that National Semiconductor was able to transfer its x86 licence to VIA. The sticking point would probably be outright overseas ownership of AMD by a non-approved DoJ/DoD country, especially if AMD has ongoing DoD contracts.AMD won't go broke. Intel won't allow them to. If that were the intention, Intel would have ramped up CPU and chipset production to its fabs full capacity and cut prices to the bone for a few financial quarters - not as if the company couldn't absorb the loss of profit. The cross licence x86 / x86-64 is part of it, but there is other IP involved. AMD can survive as a smaller company on non-x86 returns - pretty much as it is doing now, but being on life support means less money for R&D and a slower (and smaller) product cadence.Not with ARM becoming a viable competitor. Companies are forced to split in a monopoly situation, but very rarely. IBM was threatened numerous times with breakup (as was Microsoft), but a monopoly situation generally has to also entail undercutting to gain unfair advantage - something Intel has done in the past, and probably skirts with Contra Revenue funding of SoC's, but Intel's desktop and enterprise businesses can't be accused of the same practice at present. Intel wins by default simply by being the only company turning over new product and design on a regular basis.Probably. Google are already under scrutiny at the other end of that horizon. ARM maybe isn't a true competitor at the moment, but monopoly breakups aren't trivial matters and the DoJ and FTO would need to consider a rapidly approaching future where RISC obviously plays a larger role.

I was hopeful that AMD providing the chips for the consoles would gain them some profit but this hasn't happened. Looking at the basic fundamentals for each company last year

Revenue, Net Income, Net Profit Margin

Intel 52.71 billion, 9.62 billion, 20.95%

Nvidia 4.68 billion, 630.6 million, 13.47%

AMD 5.51 billion, -403 million, -7.32%