Thursday, April 16th 2015

AMD Reports 2015 First Quarter Results

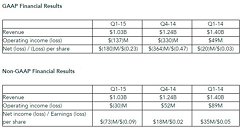

AMD today announced revenue for the first quarter of 2015 of $1.03 billion, operating loss of $137 million and net loss of $180 million, or $0.23 per share. Non-GAAP operating loss was $30 million and non-GAAP net loss was $73 million, or $0.09 per share.

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."Q1 2015 Results

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

"Building great products, driving deeper customer relationships and simplifying our business remain the right long-term steps to strengthen AMD and improve our financial performance," said Dr. Lisa Su, AMD president and CEO. "Under the backdrop of a challenging PC environment, we are focused on improving our near-term financial results and delivering a stronger second half of the year based on completing our work to rebalance channel inventories and shipping strong new products."Q1 2015 Results

- Revenue of $1.03 billion, down 17 percent sequentially and 26 percent year-over-year.

- Gross margin of 32 percent, up 3 percentage points sequentially, primarily due to a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP gross margin of 32 percent, decreased 2 percentage points sequentially due to product mix and lower game console royalties in the first quarter.

- Operating loss of $137 million, compared to an operating loss of $330 million for the prior quarter, which included a goodwill impairment and a lower of cost or market inventory adjustment in Q4 2014. Non-GAAP operating loss of $30 million, compared to non-GAAP operating income of $52 million in Q4 2014, primarily due to lower revenue and gross margin.

- Net loss of $180 million, loss per share of $0.23, and non-GAAP net loss of $73 million, non-GAAP loss per share of $0.09, compared to a net loss of $364 million, loss per share of $0.47 and non-GAAP net income of $18 million, non-GAAP earnings per share of $0.02 in Q4 2014.

- Cash, cash equivalents and marketable securities were $906 million at the end of the quarter, down $134 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.27 billion, up $56 million from the prior quarter.

- As a part of the strategy to simplify and sharpen the company's investment focus, AMD is exiting the dense server systems business, formerly SeaMicro, effective immediately.

AMD recorded $75 million of special charges in Q1 2015 primarily related to impairment of previously acquired intangible assets. - AMD entered into a fifth amendment to our Wafer Supply Agreement with GLOBALFOUNDRIES. AMD expects to purchase approximately $1 billion in wafers in 2015, in line with the company's current market expectations.

- Computing and Graphics segment revenue decreased 20 percent sequentially and 38 percent from Q1 2014. The sequential decrease was primarily due to lower desktop and notebook processor sales and the annual decrease was driven by lower desktop processor sales and GPU channel sales.

Operating loss was $75 million, compared with an operating loss of $56 million in Q4 2014 and operating income of $3 million in Q1 2014. The sequential decrease was primarily driven by lower desktop and notebook processor sales, partially offset by lower operating expenses. The year-over-year decrease was primarily driven by lower desktop processor sales.

Client average selling price (ASP) decreased sequentially and increased year-over-year primarily driven by processor product sales mix.

GPU ASP increased sequentially primarily due to higher channel GPU and Professional Graphics ASPs and decreased year-over-year primarily due to a lower channel ASP. - Enterprise, Embedded and Semi-Custom segment revenue decreased 14 percent sequentially, primarily driven by seasonally lower sales of semi-custom SoCs. The year-over-year decrease of 7 percent was primarily driven by lower server processor sales.

Operating income was $45 million compared with $109 million in Q4 2014 and $85 million in Q1 2014, primarily due to lower game console royalties, product mix and higher R&D spending. - All Other category operating loss was $107 million compared with losses of $383 million in Q4 2014 and $39 million in Q1 2014. The sequential decrease was primarily due to the absence of the Q4 2014 goodwill impairment of $233 million and the lower of cost or market inventory adjustment of $58 million. The year-over-year increase was primarily due to $87 million restructuring and other special charges, consisting primarily of $75 million related to the exiting of the dense server systems business.

- AMD provided details of the energy efficiency and design advances in the upcoming A-Series APU (codenamed "Carrizo") which is expected to deliver double digit percentage increases in both performance and battery life compared to the previous generation.

- AMD joined other HSA Foundation members including ARM, LG Electronics, MediaTek, Qualcomm, and Samsung to release the HSA 1.0 specification, bringing the industry one step closer to delivering true heterogeneous computing across the billons of modern SoCs powering mobile devices, desktop PCs, high-performance computing (HPC) systems, and servers.

- Adoption of AMD's high-performance APUs in key embedded markets continued with new product introductions from Samsung Electronics, GE Intelligent Platforms and Fujitsu.

- AMD continued to secure new design wins and expand ecosystem support for the AMD FirePro professional graphics cards and server GPUs.

With the addition of the second-generation HP ZBook 14 G2 and 15u G2 Mobile Workstations, AMD FirePro professional graphics are now available in high-end to entry-level HP ZBook solutions.

The AMD FirePro server GPU is now available on the HP ProLiant DL380 Gen9, the world's best-selling server, targeting a variety of specialized applications including Academic and Government clusters, Oil and Gas research, and Deep Neural Networks. - Acer, BenQ and LG Electronics began offering displays supporting AMD FreeSync technology, designed to enable fluid gaming and video playback at virtually any frame. Asus, Nixeus, Samsung and Viewsonic have also announced plans to introduce new monitors supporting the technology in the first half of 2015.

- AMD announced the LiquidVR initiative in close collaboration with key technology partners to deliver the next-generation of Virtual Reality capable of delivering immersive awareness where situations, objects, or characters within the virtual world seem "real."

- AMD continued fostering the development of the 64-bit ARM-based server and embedded ecosystem with announcements that a growing base of operating systems and hypervisors will support AMD's forthcoming 64-bit ARM processor. In addition to OpenSUSE13.2, the Linux 3.19 kernel, Fedora 21 and Xen 4.5 will all support the AMD Opteron A1100 Series processor.

For Q2 2015, AMD expects revenue to decrease 3 percent, plus or minus 3 percent, sequentially.

45 Comments on AMD Reports 2015 First Quarter Results

Fast food is all about consistency of product. By maintaining consistency of service, product, and environment, consumers know what to expect when they make a choice to go there. McDonalds also listens fairly carefully to its consumer base - rectifies problems fairly quickly (by conglomerate standards) and provides a fairly consistent flow of new products - products often themed for regional tastes

Consistency. Nimble in reacting to their customer base requirements. Innovative (as far as you can be with fast food).

Three attributes not normally associated with AMD.Oh great! Order a burger and fries, get told that there will be a three year wait for the order, and when it arrives, it turns out to be a couple of chicken nuggets and some time expired sauce. When you complain, the server/ex-CEO points out the menu fine print that says "Menus reflect AMD's current products and timetables and are subject to change without notice" :ohwell:

The Happy Meals and other stuff isn't just marketing, it's also a product. Call it a "dining experience".

There are plenty of premium gourmet burger places with higher quality ingredients, but their annual revenue isn't 0.1% of McDonald's.This is because their marketing campaign is becoming less effective, because society is becoming more educated about their health and healthier alternatives like Subway are becoming more widely available. We've seen McDonalds create Subway style menus to capture this new health conscious market, its now up to their new marketing campaign to sell the concept.Yes the dining experience is part of the service. A service is a product too. All restaurants are in the service industry, yet all restaurants are not market leaders like McDonalds.

Some marketing genius has to sell the concept of the "dining experience" to make it stand out from the rest.

Summary. You can be fast food market leader worldwide with a poor quality but averagely tasty burger and a mediocre dining experience if your marketing can sell the vision. Same goes for most products including processors.

Indeed – it only took one forum page to derail that much.

Once again, fascinating!

They go to PC world and ask for a computer and they leave with a machine the same day.

Very unlikely most customers are upset because their processor has "expired". Because even an expired processor is adequate enough to fulfil their needs.

Anybody who has a few minutes to spare can look up tests on CPUs and GPUs on the internet. Or they can ask someone they know who is "into computers". Or post on a random forum somewhere. The super clueless with no info will still probably talk to someone where they buy the computer, and that person will have some idea.

In that context, product timetables and adherence to them is of paramount importance with respect to OEMs. Past history is littered with examples of vendors losing contracts and thus, greater brand visibility and OEM confidence, when products become "no shows" and/or underperform when they do finally materialize.And as a general rule, they will leave with the product that the OEM signed contracts for.How many major OEMs do you see selling AMD FX processors/900 series chipset systems? They can invariably be had by the public for less than a decent i5/H97, yet which has the largest product range? New product and new feature sets catch OEM contracts (and perf per watt/core in the enterprise sector), and those new contracts lead to the successive generations of OEM products, they ones the consumer has a choice of buying. All things being equal, people would buy what is put in front of them, but that isn't necessarily the case, unless you under the impression that ODM's like Asus, MSI, and Gigabyte have a money maker on their hands releasing barely warmed over revisions of 900 chipset boards for the umpteenth time. If that is indeed the case, its a wonder they stock so few models in relation to the myriad of ATX/EATX/mATX/ITX offerings with Intel chipsets.

More cores won't save their CPUs, Mantle had died before it was able to breathe. By no means I'm saying AMD should die, but they dug for themselves a nice big hole in the industry.

We're maybe only a 4 or 5 years away from moving off of silicon altogether for processors. More cores may be useful for some but it's probably not the solution we need.

arstechnica.com/gadgets/2015/02/intel-forges-ahead-to-10nm-will-move-away-from-silicon-at-7nm/

At the very least, not for several more years it won't.

Which, I believe, would be in time for Your GPU update cycle to restart, I believe. Thus, Even if the very unlikely happens and they do, it won't affect Your purchase of R9 390X's.

We're not at worst case scenario right now imo.

AMD should give up on CPU only CPu's and concentrate on GPU's and APU's.