Tuesday, September 1st 2015

SSD Shipments See Continued Growth Despite Shrinking PC Market: Analysis

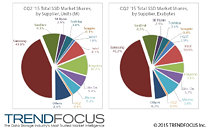

TRENDFOCUS recently published its updated Quarterly NAND/SSD report covering the NAND & SSD industries' performance in CQ2 '15. In the SSD market, unit shipments increased, despite the fact that a good portion of the volume is tied to a weak notebook PC market. The two main factors contributing to the slight 2.9% Q-Q rise was the increase in DFF (drive form factor) client SSDs in the channel market, as well as an uptick in datacenter demand for SATA SSDs, driving a total of 23.859 million units. Total SSD capacity shipped increased by 13.3% Q-Q to 6.4 exabytes, with the overall average capacity increasing to 268 GB. Despite the rise in overall unit shipments, client modules declined, reflecting the continued slow demand for notebook PCs.

Enterprise SAS SSDs declined 10% while PCIe SSDs in the enterprise segment remained under 100,000 units for the quarter. Enterprise SATA SSDs were the bright spot in the enterprise market, posting an increase of 48.6% Q-Q as datacenters resumed purchases of SSDs - a trend not seen in nearline HDDs during the quarter. Samsung continues to dominate due to its successes in the client space - both from a unit and exabyte perspective - while Kingston showed once again that it can be a major player by focusing on the channel market. HGST's unit and exabyte share leads the SAS SSD market and Intel continues to dominate the enterprise PCIe market for a second quarter in a row.To purchase a copy of the analysis, visit TRENDFOCUS.

Enterprise SAS SSDs declined 10% while PCIe SSDs in the enterprise segment remained under 100,000 units for the quarter. Enterprise SATA SSDs were the bright spot in the enterprise market, posting an increase of 48.6% Q-Q as datacenters resumed purchases of SSDs - a trend not seen in nearline HDDs during the quarter. Samsung continues to dominate due to its successes in the client space - both from a unit and exabyte perspective - while Kingston showed once again that it can be a major player by focusing on the channel market. HGST's unit and exabyte share leads the SAS SSD market and Intel continues to dominate the enterprise PCIe market for a second quarter in a row.To purchase a copy of the analysis, visit TRENDFOCUS.

19 Comments on SSD Shipments See Continued Growth Despite Shrinking PC Market: Analysis

unexpected player is LiteOn

Why so low :(

The art of "fooling" customers seems to be more effective than actually offering a good quality product. They know how to make money. :rolleyes:

Anyway, I'll be a proud owner of a Crucial BX100 this week. Should be good. :D

ill be getting a SSD within the year... i feel it in my bones.... i need a sata iii motherboard actually lol. Wow im old...

Lite-On only has any market share due to their sales with OEMs. You will find a lot of their SSDs in Dell and Acer laptops.

I expect we'll keep seeing SSDs selling well until there are no more desktops, laptops, servers or workstations left with spinning disks. If everyone owned an SSD already, sales would slow down. They last a lot longer than a cell phone that gets upgraded every other year.

Plus, it wouldn't exactly be "fooling customers", but wasn't Crucial the company that caused quite a stir with not being very forthcoming with its power-loss technologies in the M500, M550, and MX100? For the M600, it's clearly stated in the Anand review that none of the three above drives have the same protections as the datacenter version of the M500, since none of them have the tantalum caps necessary to provide full power-loss protection to data that is currently being written. As a MX100 user, I would've liked to have known that the "power-loss" protection wasn't exactly as extensive as stated by Crucial, before I bought the drive.

Crucial's marketing approach leans toward the minimal side, while Samsung does a bit more to attract a wider audience. I don't see what this has to do with Samsung's drives being supposedly inferior to Crucial's; in fact, I see it as being the other way around. Crucial SSDs have not (yet) gotten around to offering longer warranties. Crucial's SSD Toolbox is in its infancy compared to established and well-respected competitors like Intel SSD Toolbox and Samsung Magician.I can understand why some 840 EVO owners might be pissed off about Samsung's initially non-existent response to the speed issue, but quite frankly, the TLC in the 840 EVO was still very much a new technology despite the SSD 840 coming a bit earlier with TLC. There was hardly anything ground-breaking about, say, a M4 or MX100 (I have a MX100 myself, and even though it's a good drive, it's unremarkable).

Also, Crucial doesn't make a lot of OEM drives, while Samsung has entire lines dedicated to OEMs. OEM drives are sold under the Micron name (look at the M600). Then when you look at it, the difference between Sammy and the rest isn't as drastic as it's made out to be, since Crucial is part of Micron and Micron is under the IMFT umbrella with Intel.

EDIT: I stand corrected, as I've never before seen the 1TB MX200's 320TB rating. Which leads me to ask, why doesn't Crucial bother to extend its warranty period if the MX200 clearly is capable of such endurance?