Friday, August 11th 2017

NVIDIA Announces Financial Results for Second Quarter Fiscal 2018

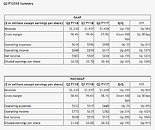

NVIDIA today reported record revenue for the second quarter ended July 30, 2017, of $2.23 billion, up 56 percent from $1.43 billion a year earlier, and up 15 percent from $1.94 billion in the previous quarter.

"Nearly every industry and company is awakening to the power of AI. Our new Volta GPU, the most complex processor ever built, delivers a 100-fold speedup for deep learning beyond our best GPU of four years ago. This quarter, we shipped Volta in volume to leading AI customers. This is the era of AI, and the NVIDIA GPU has become its brain. We have incredible opportunities ahead of us," he said.

Capital Return

During the first half of fiscal 2018, NVIDIA paid $758 million in share repurchases and $166 million in cash dividends. For fiscal 2018, NVIDIA intends to return $1.25 billion to shareholders through ongoing quarterly cash dividends and share repurchases.NVIDIA will pay its next quarterly cash dividend of $0.14 per share on September 18, 2017, to all shareholders of record on August 24, 2017.

NVIDIA's outlook for the third quarter of fiscal 2018 is as follows:

Datacenter:

Source:

NVIDIA

- Record revenue of $2.23 billion, up 56 percent from a year ago

- GAAP EPS of $0.92, up 124 percent from a year ago

- Non-GAAP EPS of $1.01, up 91 percent from a year ago

- Broad growth across all platforms

- GAAP earnings per diluted share for the quarter were $0.92, up 124 percent from $0.41 a year ago and up 16 percent from $0.79 in the previous quarter. Non-GAAP earnings per diluted share were $1.01, up 91 percent from $0.53 a year earlier and up 19 percent from $0.85 in the previous quarter.

"Nearly every industry and company is awakening to the power of AI. Our new Volta GPU, the most complex processor ever built, delivers a 100-fold speedup for deep learning beyond our best GPU of four years ago. This quarter, we shipped Volta in volume to leading AI customers. This is the era of AI, and the NVIDIA GPU has become its brain. We have incredible opportunities ahead of us," he said.

Capital Return

During the first half of fiscal 2018, NVIDIA paid $758 million in share repurchases and $166 million in cash dividends. For fiscal 2018, NVIDIA intends to return $1.25 billion to shareholders through ongoing quarterly cash dividends and share repurchases.NVIDIA will pay its next quarterly cash dividend of $0.14 per share on September 18, 2017, to all shareholders of record on August 24, 2017.

NVIDIA's outlook for the third quarter of fiscal 2018 is as follows:

- Revenue is expected to be $2.35 billion, plus or minus two percent.

- GAAP and non-GAAP gross margins are expected to be 58.6 percent and 58.8 percent, respectively, plus or minus 50 basis points.

- GAAP operating expenses are expected to be approximately $672 million. Non-GAAP operating expenses are expected to be approximately $570 million.

- GAAP other income and expense is expected to be an expense of approximately $2 million, inclusive of additional charges from early conversions of convertible notes. Non-GAAP other income and expense is expected to be nominal.

- GAAP and non-GAAP tax rates are both expected to be 17 percent, plus or minus one percent, excluding any discrete items. GAAP discrete items include excess tax benefits or deficiencies related to stock-based compensation, which we expect to generate variability on a quarter by quarter basis.

- Capital expenditures are expected to be approximately $65 million to $75 million.

Datacenter:

- Announced and began shipping NVIDIA Tesla V100 GPU accelerators, the first GPU based on the new Volta architecture.

- Unveiled new lineup of NVIDIA DGX AI supercomputers, with a large installation at Facebook.

- Announced the NVIDIA GPU Cloud Platform, giving developers a comprehensive software suite for AI development.

- Disclosed that the world's 13 most energy-efficient supercomputers on the Green 500 list run on NVIDIA Tesla accelerators.

- Announced partnerships with VW and Baidu to bring AI deeper into their organizations.

- Introduced Max-Q, a design approach to make gaming laptops thinner, quieter and faster.

- Collaborated with Activision and Bungie to bring Destiny 2 to the PC for the first time.

- Expanded GeForce Experience to China, at the ChinaJoy gaming conference.

- Introduced Project Holodeck, a photorealistic, collaborative VR environment.

- Announced steps to bring AI to ray tracing to advance the iterative design process, including the launch of NVIDIA OptiX 5.0 SDK.

- Launched NVIDIA TITAN X and NVIDIA Quadro external GPU support for the 25 million creative professionals using thin and light notebooks.

- Released the NVIDIA VRWorks 360 Video SDK, which enables high-quality, 360-degree live stereo streaming.

- Toyota selected NVIDIA DRIVE PX for its next-generation autonomous cars.

- Volvo and Autoliv selected DRIVE PX for self-driving cars targeted to hit the market by 2021.

- ZF and HELLA, two leading automotive suppliers, announced a system based on DRIVE PX to deliver the highest NCAP safety ratings for cars.

- Baidu announced that its Project Apollo open-source self-driving platform for the China market will use DRIVE PX.

- Introduced the NVIDIA Isaac robot simulator for training intelligent machines in simulated real-world conditions before deployment.

- Announced the NVIDIA Metropolis platform, used by more than 50 partners to make cities safer and smarter by applying deep learning to video streams.

33 Comments on NVIDIA Announces Financial Results for Second Quarter Fiscal 2018

The more times passes by the more I realize Intel has no idea what they are doing , they clearly let Nvidia snatch away a good chunk of what could have been part of their business.

Intel Data Center revenue Q2 2017: $4.4 billion or 9% increase vs Q2 2016.

Nvidia Data Center revenue Q2 2017: $151 million

I wish it died already... miners are selfish bastards.

But then it also helps they released products well over a year ago that still don't have any competition.

Nvidia needs to send a basket with wine and flowers to AMD or Raja (the cigar slinging AMD guy) with a big Thank you note..... :)

Also Nvidia is involved on Nintendo Switch wich is having massive success.

Nvidia Shield 2.0 is selling like hot cakes on amazon (that´s normal with such power for 180€ with a nvidia controller + nvidia remote + 60hz 4k HDMI2.0 output).

The next step for nvidia is entering the non-portable consoles market. ARM is evolving fast and has already plenty power to run the lastest game engines (Unreal Engine, Frostbite, etc) at 60fps. Expect a custom ARM Cpu+Gpu Nvidia chip soon to compete on that market.

One interesting note is that Intel payments are over, though it has little effect on actual revenue numbers now anyway.

*Q2FY18 CFO Commentary final

If nvidia wanted to, they could make a bonkers ARM console chip. The margins, though, are too low for nvidia to bother with.

As has been said it isn't just that making nvidia hold this position however. I would love to see number of gpus sold.

And if feel like they're playing safe and not innovating, maybe you should look up X-Point?

Safe is what gets you killed and Intel is being killed right now just because of their monolithic product line.

The problem in 2012 (when this console gen started to be planed) the high-end ARM chip couldn´t even compete with a laptop haswell low power Pentium 3550M. In 2017 you look at Snapdragon 835 wich competes against a Sandy Bridge i5 performance, plenty for 60fps on any game engine (PS4/Xbox Jaguar cpu is weaker than Snapdragon 835 btw).

10nm, low power consumption, good performance, plently space to put a gpu inside the apu. And very important! Licensing costs! x86 is hella expensive. Makes all sense for nvidia to get in the game. They were always involved with consoles (xbox nvidia gpu, ps3 nvidia gpu, for example).

And we always tend to overlook the laptops market. Where are the AMD cards for those devices? They are very important on the market