Thursday, December 14th 2017

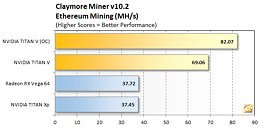

NVIDIA Titan V Achieves 82 MH/s in Ethereum Mining

"But how well does it mine?" This is one of the questions in the mind of many in the enthusiast community whenever a new GPU is launched. These are a fickle lot, to be sure; their primary interest is the power/performance ratio of any graphics card, which enables miners to maximize profits. Price/performance isn't much of a concern when users are confident they'll recoup the totality of their investment in the medium run - and sometimes even the short run, if recent changes in Ethereum pricing are any indication.

The folks at HotHardware have put an NVIDIA Titan V through its paces in Ethereum mining, eager to see this Volta-based chips' prowess in this type of workloads. Titan V reveals itself as a graphics card that achieves 69 MH/s at stock settings - and an even more impressive 82 MH/s when slightly overclocked. Overclocking methodology was simple - increase temperature and power targets for the Titan V, and then increase memory frequency until a bottleneck was found. And voila. The Titan V was happily churning out 82 MH/s in version 10.2 of the Claymore Miner - more than double the output of an RX Vega 64 and Titan Xp. Power consumption wasn't detailed in this test, and the Titan V would almost definitely consume more power than a Titan Xp - the chip is double the size - but when we take into account the fact that its TDP is the same, that it's built on a 12 nm process against the Titan Xp's 16 nm, and that it uses HBM2 memory instead of GDDR5X... Well, the differences likely aren't anything to write home about. But the performance is. I'll leave it over to our expert miners to say whether they'd invest in a Titan V for mining - all $2,999 of it.

Source:

HotHardware

The folks at HotHardware have put an NVIDIA Titan V through its paces in Ethereum mining, eager to see this Volta-based chips' prowess in this type of workloads. Titan V reveals itself as a graphics card that achieves 69 MH/s at stock settings - and an even more impressive 82 MH/s when slightly overclocked. Overclocking methodology was simple - increase temperature and power targets for the Titan V, and then increase memory frequency until a bottleneck was found. And voila. The Titan V was happily churning out 82 MH/s in version 10.2 of the Claymore Miner - more than double the output of an RX Vega 64 and Titan Xp. Power consumption wasn't detailed in this test, and the Titan V would almost definitely consume more power than a Titan Xp - the chip is double the size - but when we take into account the fact that its TDP is the same, that it's built on a 12 nm process against the Titan Xp's 16 nm, and that it uses HBM2 memory instead of GDDR5X... Well, the differences likely aren't anything to write home about. But the performance is. I'll leave it over to our expert miners to say whether they'd invest in a Titan V for mining - all $2,999 of it.

47 Comments on NVIDIA Titan V Achieves 82 MH/s in Ethereum Mining

www.gamersnexus.net/guides/3171-nvidia-titan-v-power-consumption-thermals-and-clock-behavior

A system with overclocked Titan V in Firestrike pulled 442W, including a 5930K which might have been sucking around 100W. So there is nothing special about power consumption. It's pretty similar to Titan Xp, which is not surprising, when you consider a target audience. I.e. it makes replacing the GPU much easier in a professional environment.

2) Miners usually don't OC to the max (like GN did). They optimize the profit, which means looking for a sweet spot clocks-voltage combination. And as you might have noticed already: this means the "sweet spot" depends on your electricity price.

3) I find it amusing that you put noise level concerns and buying 5 Vegas instead of 1 Titan in adjacent sentences. :D

Yes, Titan is clearly not the best option for mining if you have a farm. But what if you have a workstation and you want it to mine after hours? I.e. you can only have 1 GPU or maybe a few.

Moreover, think about other savings when you have many GPUs. Less cards => less other parts (most importantly: power supplies and fans).

At this price Volta is too expensive (I can't say I'm sad about it :-)). But if the price was to drop by 20-30% next year, it would become worth considering.

"Bug; Also, the 300W this burns through in games is nearly twice the 160W of a GTX 1080. I mean, TDP may not be all that important, but come on..." About Vega 64.

www.techpowerup.com/forums/threads/amd-radeon-rx-vega-64-8-gb.235978/page-2#post-3709638

Do we have any problems with the Titan V burning through that much power, or is it not a gaming card.......

Oh and this is not double my Vega 64 noobs (See attached). Where are the dual mining benchmarks?!

1) It should always be at least 50% stronger than the 1080 Ti, but in reality its performance is all over the place. When you buy a halo product, it should act like a halo product consistently.

2) Adding on to point #1, it's driver support is horrible. Sure it CAN get 82 MH/s, but from what I have read the thing crashes in all of the most popular miners. Same in gaming - tons of reports of stuttering. The "New architecture" excuse doesn't work here, this thing costs $3000!

3) It's cooler is horrible. I have no issues with blower coolers, but for $3000 you would think they could at least go all out: Aluminum housing, a dense all-copper heatsink, and the nicest blower fan on the market should be a no-brainer. After all my Vega 64 can adequately cool all the way up to ~375w before heat is a real issue, and sure it's loud - but I have read that this Titan cooler has trouble cooling 300w!

So should this card cost $1500? -Yes. Should this card have 16 or 24GB of VRAM? -Of course! But the real folly of the Titan V is that it doesn't feel like a premium product. The price does not matter on halo products, but its presentation absolutely does. It should have perfect drivers, the best blower cooler ever made, and consist of the highest-quality components. But it doesn't.

Bang on CaptainTom btw couldn't agree more.

Halo should have that something special not just the same shit painted gold.

The problem is that people seem to think mining is a "Get rich quick" scheme, but really the only way to get a ton of money in crypto through short-term investments is to buy like $10K worth of cryptocurrencies, and then hope you get lucky. But if you don't, you could lose a lot of money.

On the other-hand mining is really only for the most informed computer geeks who are willing to put forth A LOT of effort for long-term investments. I myself have multiple large rigs that require weekly tweaking for optimum yields, and I mine only coins that I believe will be worth a lot of money in the future.

It is a part-time job for people who actually believe in the industry, and it is not for those who want to spend 2 hours setting up a rig and expect 1-month ROI's lol. It is a much safer entry method than simply buying coins because if something goes wrong you can sell off your components and recoup some of your investment.

mind you it was buying the rig that got me interested in crypto so it does have that going for it.. but that is about all..

i have got over grieving about my nicehash loss but i am sticking to my point.. if you have some cash to spare spent it on coin and not mining gear..

another example.. over the last few weeks i have spent about £3500 on buying coin.. litecoin and eth this is £500 less than i spent on my rig..

now for my smiley bit.. that £3500 has turned into £9000 which to be honest is the main reason i have gotten over my nicehash loss.. he he

i still have my mining gear and its busy mining away making around $200 dollars per week minus the leccy bill.. :)

in six months that will be about $5000 dollars less the leccy bill.. not bad but i recon the eth and litecoin i have just bought will be worth at least $25000 by then..hopefully a lot more.. :)

i am not really being kind to the mining rigs.. cos what they are mining will be going up in price as well.. the only snag being it takes too f-cking long to mine anything worth having so in that way its very expensive way to buy crypto..

i recon i have this sh-t figured out.. but if anyone wants to tell me what i am doing wrong i will be more than happy to hear it..

trog

ps.. i didnt think mining was a get rich scheme.. i bought my gear just for fun and never thought i would make much.. in fact it i knew it would take nearly a year to even pay for itself..

however since buying my hardware i have discovered a way to make money as well.. and for sure it aint f-cking mining crypto its buying the f-cking stuff.. he he

if anybody cant see exactly where i am coming from its for one simple reason.. they dont f-cking want to.. :)

there is one other reason.. they dont have any spare cash to buy some coin.. which is about the only valid reason for not buying some..

In a way im ok with the great many mistakes i made, they're out the way I hope ,i certainly learned a lot these few months.

its just my thinking but now bitcoin is at $18000 or so it scares people off.. its still gonna keep going but not as fast as something like litecoin..

bitcoin is the big daddy that has everyones attention.. but its baby brother litecoin is gonna make you more money.. which is why i bought some as opposed to spending the same money on BItcoin.. so far my thinking has paid off.. i recon it will continue to do so..

borrow some dosh if you have to and for f-cks sake dont sell your crypto.. not unless its to buy another sort of crytpo.. litecoin would be my choise.. he he

trog

I do not regret cashing out my Litecoin one bit! But at the same time I think "Bitcoin Cash" is incredibly stupid, and so I hope all Bitcoin forks fail and migrate their wealth to Litecoin (it is better than ANY BTC fork).

It will be interesting to see if that happens and what ETH and LTC do.

while watching bitcoin i also watched a few other coins.. i noticed that litecoin for example just sat there flat lining doing nothing just going sideways..

it occurred to me that after all the bitcoin fuss had settled down a bit maybe litecoin has some catching up to do.. i was exactly right..

the same with eth just to a lesser degree..

i am hoping that litecoin will do over the next few months what bitcoin has done over the last few months... if i am right i am set to make some dosh..

its all about percentages up or down.. litecoin up %400 over the last month bitcoin up %150

or a grands worth of liteoin up to four grand or a grands worth of bitcoin up to one and a half grand.. once joe soap catches on litecoin will really start to go up..

but i could be wrong.. he he

trog

The card is worth 3k. So with 69Mh your looking at 131$ profit a month with 0,22 cents for every kilowatt of electricity being used. This would take a while to get the investment back, if the difficulty does not change over the course of the lifetime of the card. 89Mh is proberly with a huge increase of power consumption, since the card is stock downclocked at 1200Mhz if i'm not mistaken.

I'd still take 6 RX480's and call it a day on 25Mh per card.