Monday, February 26th 2018

Cryptocurrency Report: 46% of 2017's ICOs Have Failed Already

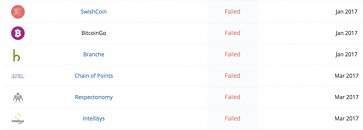

ICOs (Initial Coin Offerings) were 2017's talk in the cryptocurrency work: they were akin to the Dot-com craziness in the late 1990's, early 2000's, in that investment and speculation moved billions of dollars. Wherever you turned, every week, and sometimes more than twice per day, ICOs were popping out - initial investment efforts much like Kickstarter in "cool" new projects built on the blockchain technology. According to Tokendata, around 46% of 2017's ICOs resulted in failed projects: of the 902 crowdsales that took place last year, 142 failed at the funding stage, and 276 have failed, due to the "developers" either taking the money and running, or choosing the less obvious approach of letting the project fade into obscurity - alongside the collectively raised $233 million between them.

As if those numbers weren't high and disheartening enough as they are, an additional 113 ICOs are being classified as "semi-failed": the teams behind the projects have either started the process of obscuring their activities, stopping to communicate on social media, or their community has become so small as to mean the project has no chance of success. All in all, the 46% failed ICOs could soon grow to a staggering 59% of either confirmed failures or failures-in-the-making.Reports of a digital graveyard hit the mark on the failed ICO landscape. From abandoned Twitter accounts, empty Telegram groups, websites no longer hosted, and communities no longer tended, there's a little for everyone, and from all corners of the Earth - Africa is the most representative continent in terms of failed ICOs; however, projects from all over the globe have entered the graveyard's doors, so geography can't be trusted in this - it just goes to show that the will to make a quick buck at any cost is universal.Where there's money to be made, there's always interest by dishonest parties who just want to make a quick buck out of investor's hopes, trust, and sometimes, gullibility. The ICO landscape quickly turned from one of fostering interesting ideas and support for impressive new concepts to a minefield of scams, cryptocurrency-filled runaways, and crushed investment expectations. Whether the ICOs were a scam all along, quickly closing doors and erasing all signs they ever existed after taking in millions in ICO funding, or projects simply failed and faded to obscurity, there's a little for everyone. The result is a much eroded ICO landscape, which still moves millions, but has reduced trust in the overall blockchain technology.

Sources:

News.Bitcoin.com, Tokendata.io

As if those numbers weren't high and disheartening enough as they are, an additional 113 ICOs are being classified as "semi-failed": the teams behind the projects have either started the process of obscuring their activities, stopping to communicate on social media, or their community has become so small as to mean the project has no chance of success. All in all, the 46% failed ICOs could soon grow to a staggering 59% of either confirmed failures or failures-in-the-making.Reports of a digital graveyard hit the mark on the failed ICO landscape. From abandoned Twitter accounts, empty Telegram groups, websites no longer hosted, and communities no longer tended, there's a little for everyone, and from all corners of the Earth - Africa is the most representative continent in terms of failed ICOs; however, projects from all over the globe have entered the graveyard's doors, so geography can't be trusted in this - it just goes to show that the will to make a quick buck at any cost is universal.Where there's money to be made, there's always interest by dishonest parties who just want to make a quick buck out of investor's hopes, trust, and sometimes, gullibility. The ICO landscape quickly turned from one of fostering interesting ideas and support for impressive new concepts to a minefield of scams, cryptocurrency-filled runaways, and crushed investment expectations. Whether the ICOs were a scam all along, quickly closing doors and erasing all signs they ever existed after taking in millions in ICO funding, or projects simply failed and faded to obscurity, there's a little for everyone. The result is a much eroded ICO landscape, which still moves millions, but has reduced trust in the overall blockchain technology.

23 Comments on Cryptocurrency Report: 46% of 2017's ICOs Have Failed Already

Rest are not necessarily a success, just not a failure :)

and they areNo Doubt due to the Honesty of people this tally will be added to

Such a :)Shame

First, as a gamer, and forgive me for being an asshole in this case, I feel happy that they failed. It feels like revenge for all those graphics cards that suddenly went out of reach because of excessive demand by miners. Not that the market has returned to normalcy yet, but still...

Second, I feel a bit of pity for all that people that invested in cryptocurrency and lost money. Not everyone who invested in all those failed ICOs was necessarily bathing in liquid gold, so some will feel this hit their wallets more than others, not to mention the consequences it could have for someone with a family depending on him/her...

Third, I feel a bit of rage about all those people just making crypto to scam investors and then run away with the money.

It was already noted last year that the number of new ICOs being created have fallen off sharply. This (the high failure rate) is why. The market has effectively become crowded.

Simply because most of them have very overlapping ideas, and in the end only a few will survive.

Same with all them coins

Only a delusional would expect success from more than a few. And I see most still don't get what it even is.

if this was folding i would understand the cause... but from an outsider perspective all this is, is greed.

Glad to see I'm garnering a reputation though, sorry I had to use logic to shatter it. :laugh: I would be interested to hear a.) how mining relates to this and b.) national security, lol, wtf?I agree. Especially considering presale of coins is a terrible idea in its very concept.The point is to reward one for processing the networks transactions.

Bottom line don't gamble with money you can't lose, I really can't feel sorry for anyone getting burned by crypto. Such is life and you should have known better.