Apr 5th, 2025 21:07 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- What's your latest tech purchase? (23483)

- Hardware-accelerated GPU scheduling. A-Series? (2)

- gpu heirarchy/performance/benchmarks- whos lying? (15)

- 9070XT or 7900XT (9)

- New build advice (23)

- Dune: Awakening benchmark - post your results (50)

- AMD RX 9070 XT & RX 9070 non-XT thread (OC, undervolt, benchmarks, ...) (77)

- Undervolt i9-14900HX Laptop Newbie (10)

- The Official Linux/Unix Desktop Screenshots Megathread (767)

- Do you use Linux? (556)

Popular Reviews

- PowerColor Radeon RX 9070 Hellhound Review

- ASUS Prime X870-P Wi-Fi Review

- Corsair RM750x Shift 750 W Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (99)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (91)

Monday, May 6th 2019

Hard Drive Shipments Expected to Drop Nearly 50 Percent YoY in 2019

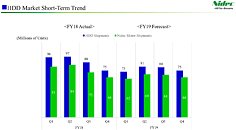

With solid-state drives (SSDs) entering value and mainstream price segments, and the transition in consumers' data-storage behavior from local storage to the cloud, there is expected to be a dramatic fall in shipments of hard disk drives (HDDs) in 2019. Japanese company Nidec, which manufactures nearly 85% of all DC motors for use in HDDs across the industry, estimates a nearly 50 percent drop in HDD shipments for 2019. Since these motors are specifically designed for use in HDDs, it is directly proportional to new HDD shipments, thus presenting a reliable outlook of the HDD industry itself. The DC motor inside HDDs is a non user-replaceable component as detaching it involves opening the seal of the disk chamber, thereby contaminating it.

In 2010, Nidec shipped nearly 650 million motors, which dropped significantly down to 375 million motors in 2018, indicating the sharp decline in the HDD industry. While Nidec will ship as few as 290 million motors in 2019, it estimates shipments of HDDs to go down by nearly 50 percent year-over-year (YoY). Data centers are swallowing up large volumes of high-capacity (>10 TB) HDDs for warm- and cold-storage even as SSDs and DRAM are sought for hot-storage. The client-segment, however, is now firmly captivated with SSDs, with even mainstream laptops packing SSDs. Prominent HDD manufacturers Seagate, Western Digital, and Toshiba, have each invested heavily in building up SSD product lines, and specializing their HDD portfolio for enterprise and quasi-enterprise (eg: NAS, NVR, high-uptime client) markets.

Source:

AnandTech

In 2010, Nidec shipped nearly 650 million motors, which dropped significantly down to 375 million motors in 2018, indicating the sharp decline in the HDD industry. While Nidec will ship as few as 290 million motors in 2019, it estimates shipments of HDDs to go down by nearly 50 percent year-over-year (YoY). Data centers are swallowing up large volumes of high-capacity (>10 TB) HDDs for warm- and cold-storage even as SSDs and DRAM are sought for hot-storage. The client-segment, however, is now firmly captivated with SSDs, with even mainstream laptops packing SSDs. Prominent HDD manufacturers Seagate, Western Digital, and Toshiba, have each invested heavily in building up SSD product lines, and specializing their HDD portfolio for enterprise and quasi-enterprise (eg: NAS, NVR, high-uptime client) markets.

Apr 5th, 2025 21:07 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- What's your latest tech purchase? (23483)

- Hardware-accelerated GPU scheduling. A-Series? (2)

- gpu heirarchy/performance/benchmarks- whos lying? (15)

- 9070XT or 7900XT (9)

- New build advice (23)

- Dune: Awakening benchmark - post your results (50)

- AMD RX 9070 XT & RX 9070 non-XT thread (OC, undervolt, benchmarks, ...) (77)

- Undervolt i9-14900HX Laptop Newbie (10)

- The Official Linux/Unix Desktop Screenshots Megathread (767)

- Do you use Linux? (556)

Popular Reviews

- PowerColor Radeon RX 9070 Hellhound Review

- ASUS Prime X870-P Wi-Fi Review

- Corsair RM750x Shift 750 W Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (99)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (91)

19 Comments on Hard Drive Shipments Expected to Drop Nearly 50 Percent YoY in 2019

Obviously HDDs won't go away as long as they are (much) cheaper than SSD's for the same capacity.

Small drives however are disappearing, indeed (like 1TB already completely pointless)

I'm surprised they think externals will continue to use HDDs. I looked at the prices for 2.5" HDDs and they're rubbish.

I get the impression SSDs killed the 2.5" hard drive... Then again, look at that graph: external drives are #1 and externals mostly use 2.5" HDDs, yeah?

Data Center is the only market they're expecting HDD growth in...that makes sense.

HDD mining is a fact, and a green way to mine instead of mining by GPU. So I see the sale increase from now on.