Wednesday, August 19th 2020

Apple Hits $2 Trillion Valuation Mark, Just 2 Years After it Hit $1 Trillion

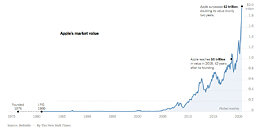

Apple is now valued at two trillion dollars! The tech giant became the world's most valuable company, clocking unfathomable growth in value. "It took Apple 42 years to reach $1 trillion in value. It took it just two more years to get to $2 trillion," writes the New York Times. Almost all of Apple's second trillion dollars in valuation came in just the past 28 weeks, as the world reeled with the COVID-19 pandemic.

Much of Apple's rise is attributable to measures by the U.S. Federal Reserve this March, allaying investor fears as capital markets crashed around the world, as governments clamped down on normal economic activity. Tech stocks have particularly benefited from the measures, as investors find them to be the next new "flight to safety" (a safe investment option in the face of calamity, akin to gold bullion). At $2 trillion, Apple is valued higher than the annual nominal gross domestic product of all but 7 countries (IMF measurement).

Source:

The New York Times

Much of Apple's rise is attributable to measures by the U.S. Federal Reserve this March, allaying investor fears as capital markets crashed around the world, as governments clamped down on normal economic activity. Tech stocks have particularly benefited from the measures, as investors find them to be the next new "flight to safety" (a safe investment option in the face of calamity, akin to gold bullion). At $2 trillion, Apple is valued higher than the annual nominal gross domestic product of all but 7 countries (IMF measurement).

35 Comments on Apple Hits $2 Trillion Valuation Mark, Just 2 Years After it Hit $1 Trillion

But, this brings to mind the old saying "the bigger they are, the harder they fall"

I can only imagine the global financial clusterf*uck that would erupt should they somehow manage to crash & burn, which I hope never happens, but nothing is guarenteed nowadays :)

One could argue that Apple benefits from COVID19, with fewer people visiting say Disneyworld, but maybe more people playing iPhones / video games inside the house. So Apple is currently speculated to be a global leader after this whole COVID19 thing is done. Even with this explanation however, the stock market doesn't make sense to me right now.

With that being said, I'm still investing. But I'm increasing my exposure to Bonds (from 20% to 30%) in my short term holdings, maybe pushing it further than that. I'm not liking the winds of the global economy right now, so I do feel like pushing towards safer investments. But given the record drop in tax revenues across the USA, Bonds don't seem like a safe bet either.

This seems like a very difficult market to invest right now.

Bitcoin is still around btw, and I think at roughly 11k in value.

That's crazy. Ass growth though, I worry for the future.

Don't forget that market are Ponzi pyramids. Once one try to get it's money back, the whole thing can collapse. They all know it in wall street, and they have rules to prevent such massive collapses. Because if market collapse, their jobs do too. They are kind of paid to maintain the illusion of the fairness of it, showing you can gain or lose. Remember 2008. They revised the rules again to add more restrictions.

There's rules and protections to avoid panic. Here are some : www.nasdaqtrader.com/Trader.aspx?id=TradeHaltCodes

The T5 and LUDP ones are very important, avoiding huge collapse of actions value. Look at that to see how regulated it must be : www.nasdaqtrader.com/trader.aspx?id=TradingHaltHistory (LUDP = Volatility Trading Pause ).

There, fixed it for you. The whole stock market is fueled by people willing to gamble hard and fast. Come a serious crash, akin to the 2008 crisis and this valuation will suddenly fall through the roof.

Apple is producing goods both phisical and non-phisical.

I stongly believe that could mean a huge difference in terms of catastrophic financial failure.

You can foresee it much easyer by inspecting the quality/quantity of the products and services they sell.

www.macrotrends.net/stocks/charts/AAPL/apple/revenue

I don't think Apple is going anywhere but up.

But your graph goes against this news !

How on Earth is it normal to see your value double while you made practically no growth (compared to first years) for the last 4 years ? You grow 10% and the action take 100% ? You can't call it other than a bubble.

Apple is steady on stock market because of its cash stored, which basically make the company unbreakable for the next 10 or 20 years (unless something dramatic happens).

But take the example of IBM which came from a monster leader to a "normal" size company (all things considered), reselling product they bought and rebranding it. Right now they just have their last bastion in PowerPC, but that's not the future according to AMD and Cloud Computing making a big change those days.

Since 2014 the blue team was always in the red financially :)

And IBM Cloud services are not very popular ...

The 2008 crisis has already proven that negative rates can, and will, happen in times of severe economic crisis. Buying near 0% rates doesn't matter in today's post-negative rate days. It can still drop to -1% or -2%.