Wednesday, August 19th 2020

Apple Hits $2 Trillion Valuation Mark, Just 2 Years After it Hit $1 Trillion

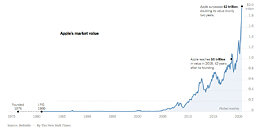

Apple is now valued at two trillion dollars! The tech giant became the world's most valuable company, clocking unfathomable growth in value. "It took Apple 42 years to reach $1 trillion in value. It took it just two more years to get to $2 trillion," writes the New York Times. Almost all of Apple's second trillion dollars in valuation came in just the past 28 weeks, as the world reeled with the COVID-19 pandemic.

Much of Apple's rise is attributable to measures by the U.S. Federal Reserve this March, allaying investor fears as capital markets crashed around the world, as governments clamped down on normal economic activity. Tech stocks have particularly benefited from the measures, as investors find them to be the next new "flight to safety" (a safe investment option in the face of calamity, akin to gold bullion). At $2 trillion, Apple is valued higher than the annual nominal gross domestic product of all but 7 countries (IMF measurement).

Source:

The New York Times

Much of Apple's rise is attributable to measures by the U.S. Federal Reserve this March, allaying investor fears as capital markets crashed around the world, as governments clamped down on normal economic activity. Tech stocks have particularly benefited from the measures, as investors find them to be the next new "flight to safety" (a safe investment option in the face of calamity, akin to gold bullion). At $2 trillion, Apple is valued higher than the annual nominal gross domestic product of all but 7 countries (IMF measurement).

35 Comments on Apple Hits $2 Trillion Valuation Mark, Just 2 Years After it Hit $1 Trillion

Someone hand me my security blanket please.

Let's see how Apple's transition to ARM goes, as that is a make or break point in their history as a company. If their ARM based computers don't deliver what their customers expect, then they're going to lose a rather big chunk of their business.

Admittedly computers aren't their core business at this point, by the looks of things, but even so, sometimes it's the small things that cause the biggest failures.

How about this... Apple is a company that values its customers and deserves all the success they're getting. Mindblowing, right? Maybe the reason your company isn't worth $2 Trillion.

PS: I have no stock in Apple whatsoever. Double mindblowing.