Thursday, October 22nd 2020

Intel Reports Third-Quarter 2020 Financial Results

Intel Corporation today reported third-quarter 2020 financial results. "Our teams delivered solid third-quarter results that exceeded our expectations despite pandemic-related impacts in significant portions of the business," said Bob Swan, Intel CEO. "Nine months into 2020, we're forecasting growth and another record year, even as we manage through massive demand shifts and economic uncertainty. We remain confident in our strategy and the long-term value we'll create as we deliver leadership products and aim to win share in a diversified market fueled by data and the rise of AI, 5G networks and edge computing."

In the third quarter, the company generated $8.2 billion in cash from operations and paid dividends of $1.4 billion. In August, Intel initiated accelerated share repurchase (ASR) agreements for an aggregate of $10.0 billion of our common stock. Following settlement of these agreements, Intel will have repurchased a total of approximately $17.6 billion in shares as part of the planned $20.0 billion share repurchases announced in October 2019. Intel intends to complete the $2.4 billion balance and return to historical capital return practices when markets stabilize.Third-quarter revenue was ahead of prior expectations driven by continued strength in notebook sales, which helped offset COVID-driven headwinds affecting significant portions of our business.

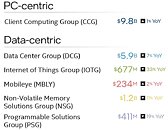

In the Data Center Group (DCG), Cloud revenue grew 15 percent YoY on continued demand to support vital services in a work and learn-at-home environment. At the same time, a weaker economy due to COVID-19 impacted DCG's Enterprise & Government market segment, which was down 47 percent YoY following two quarters of more than 30 percent growth. The pandemic also weighed on third-quarter data-centric results in the Internet of Things Group and the memory business (NSG). In the third quarter, Intel continued to introduce compelling new products addressing key growth opportunities including artificial intelligence, 5G network transformation and the intelligent, autonomous edge. Mobileye revenue returned to growth in the third quarter as global vehicle production improved. The business also launched its new Mobileye SuperVision surround-view ADAS solution.

The PC-centric business (CCG) was up 1 percent YoY in the third quarter on continued notebook strength to support the work- and learn-at-home dynamics of COVID-19. In the third quarter, Intel launched the world's best processor for thin and light laptops, 11th Gen Intel Core processors with Intel Iris Xe graphics (formerly known as "Tiger Lake").** More than 150 designs from major PC makers are in development, including 100 designs expected to be in market by the end of this year with more than 40 verified under the new Intel Evo platform brand. These new 11th Gen Intel Core processors are manufactured using Intel's 10nm SuperFin process technology, which delivers performance improvement comparable to a full-node transition. The company detailed 10nm SuperFin and other technology advancements at its Intel Architecture Day, held in the third quarter.

Intel's third 10nm manufacturing facility, which is located in Arizona, is now fully operational and the company now expects to ship 30% higher 10nm product volumes in 2020 compared to January expectations.

Additional information regarding Intel's results can be found in the Q3'20 Earnings Presentation available here.

In the third quarter, the company generated $8.2 billion in cash from operations and paid dividends of $1.4 billion. In August, Intel initiated accelerated share repurchase (ASR) agreements for an aggregate of $10.0 billion of our common stock. Following settlement of these agreements, Intel will have repurchased a total of approximately $17.6 billion in shares as part of the planned $20.0 billion share repurchases announced in October 2019. Intel intends to complete the $2.4 billion balance and return to historical capital return practices when markets stabilize.Third-quarter revenue was ahead of prior expectations driven by continued strength in notebook sales, which helped offset COVID-driven headwinds affecting significant portions of our business.

In the Data Center Group (DCG), Cloud revenue grew 15 percent YoY on continued demand to support vital services in a work and learn-at-home environment. At the same time, a weaker economy due to COVID-19 impacted DCG's Enterprise & Government market segment, which was down 47 percent YoY following two quarters of more than 30 percent growth. The pandemic also weighed on third-quarter data-centric results in the Internet of Things Group and the memory business (NSG). In the third quarter, Intel continued to introduce compelling new products addressing key growth opportunities including artificial intelligence, 5G network transformation and the intelligent, autonomous edge. Mobileye revenue returned to growth in the third quarter as global vehicle production improved. The business also launched its new Mobileye SuperVision surround-view ADAS solution.

The PC-centric business (CCG) was up 1 percent YoY in the third quarter on continued notebook strength to support the work- and learn-at-home dynamics of COVID-19. In the third quarter, Intel launched the world's best processor for thin and light laptops, 11th Gen Intel Core processors with Intel Iris Xe graphics (formerly known as "Tiger Lake").** More than 150 designs from major PC makers are in development, including 100 designs expected to be in market by the end of this year with more than 40 verified under the new Intel Evo platform brand. These new 11th Gen Intel Core processors are manufactured using Intel's 10nm SuperFin process technology, which delivers performance improvement comparable to a full-node transition. The company detailed 10nm SuperFin and other technology advancements at its Intel Architecture Day, held in the third quarter.

Intel's third 10nm manufacturing facility, which is located in Arizona, is now fully operational and the company now expects to ship 30% higher 10nm product volumes in 2020 compared to January expectations.

Additional information regarding Intel's results can be found in the Q3'20 Earnings Presentation available here.

5 Comments on Intel Reports Third-Quarter 2020 Financial Results

Historical references:

1. David & Goliath

2. 1930's stock market

3. Car mfgr's

4. Banks

5. Airlines

etc...etc...

'nuff said :roll:

1 & 2 too far in the past.

3 - walk, bike or public transport

4 - banks - don't really sell a usable product, mainly a money lending service

5 - airlines - travelling fast is an option

Take away silicon and the modern world will crumble, or revert to pre WW2 days.