AMD Reports First Quarter 2020 Financial Results

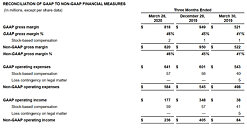

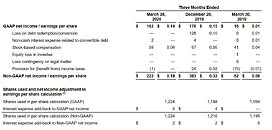

AMD today announced revenue for the first quarter of 2020 of $1.79 billion, operating income of $177 million, net income of $162 million and diluted earnings per share of $0.14. On a non-GAAP* basis, operating income was $236 million, net income was $222 million and diluted earnings per share was $0.18.

"We executed well in the first quarter, navigating the challenging environment to deliver 40 percent year-over-year revenue growth and significant gross margin expansion driven by our Ryzen and EPYC processors," said Dr. Lisa Su, AMD president and CEO. "While we expect some uncertainty in the near-term demand environment, our financial foundation is solid and our strong product portfolio positions us well across a diverse set of resilient end markets. We remain focused on strong business execution while ensuring the safety of our employees and supporting our customers, partners and communities. Our strategy and long-term growth plans are unchanged."

"We executed well in the first quarter, navigating the challenging environment to deliver 40 percent year-over-year revenue growth and significant gross margin expansion driven by our Ryzen and EPYC processors," said Dr. Lisa Su, AMD president and CEO. "While we expect some uncertainty in the near-term demand environment, our financial foundation is solid and our strong product portfolio positions us well across a diverse set of resilient end markets. We remain focused on strong business execution while ensuring the safety of our employees and supporting our customers, partners and communities. Our strategy and long-term growth plans are unchanged."