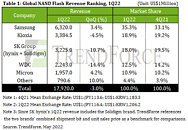

Global Top 5 SSD Module Makers Continue to Gain Market Share; Chinese Brands Leverage Home Advantage

TrendForce's latest investigations reveal that the combined market share of the top five SSD module makers in the retail sector has surged from 59% in 2022 to 72% in 2023, reinforcing a trend of larger companies expanding their dominance. These major players are leveraging their scale to negotiate more favorable prices for NAND Flash, boosting their competitive edge and ensuring they have sufficient resources to stock up in preparation for market shifts.

TrendForce reports that shipments of branded SSDs in the retail market reached 180 million units in 2023, marking a YoY growth of 3.7%. Reflecting on the SSD market for that year, it appeared that many PCs purchased during the pandemic had entered their typical replacement cycle.

TrendForce reports that shipments of branded SSDs in the retail market reached 180 million units in 2023, marking a YoY growth of 3.7%. Reflecting on the SSD market for that year, it appeared that many PCs purchased during the pandemic had entered their typical replacement cycle.