Corsair Gaming Reports Fourth Quarter and Full Year 2022 Financial Results

Corsair Gaming, Inc. (Nasdaq: CRSR) ("Corsair" or the "Company"), a leading global provider and innovator of high-performance gear for gamers, streamers, content-creators, and gaming PC builders, today announced financial results for the fourth quarter and full year ended December 31, 2022.

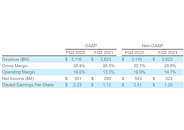

Fourth Quarter 2022 Select Financial Metrics

Fourth Quarter 2022 Select Financial Metrics

- Net revenue was $398.7 million compared to $311.8 million in the third quarter of 2022 and $510.6 million in the fourth quarter of 2021. Gamer and creator peripherals segment net revenue was $117.8 million compared to $96.8 million in the third quarter of 2022 and $176.9 million in the fourth quarter of 2021, while Gaming components and systems segment net revenue was $280.9 million compared to $214.9 million in the third quarter of 2022 and $333.7 million in the fourth quarter of 2021.

- Net income attributable to common shareholders was $12.5 million, or $0.12 per diluted share, compared to net loss of $8.9 million, or $0.09 per diluted share, in the third quarter of 2022 and net income of $24.7 million, or $0.25 per diluted share, in the fourth quarter of 2021.

- Adjusted net income was $20.7 million, or $0.20 per diluted share, compared to adjusted net income of $7.6 million, or $0.08 per diluted share in the third quarter of 2022 and adjusted net income of $34.7 million, or $0.35 per diluted share, in the fourth quarter of 2021.

- Adjusted EBITDA was $32.0 million, compared to $10.1 million in the third quarter of 2022, and $39.5 million in the fourth quarter of 2021.

- Cash and cash equivalents were $154.1 million as of December 31, 2022.