NVIDIA: RTX 30-series Shortages Partly Caused by Insufficient Wafer, Substrate and Component Supply

The current widespread shortages on anything gaming-related (be it gaming consoles or the latest GPUs from both NVIDIA and AMD) are a well-known quantity by now. However, it now seems that NVIDIA's shortages aren't just the result of "outstanding, unprecedented demand", aided by scalping practices, but also from wafer and component shortages. NVIDIA's CFO Colette Kress at Credit Suisse 24th Annual Technology Conference expanded on these issues, saying that "We do have supply constraints and our supply constraints do expand past what we are seeing in terms of wafers and silicon, but yes some constraints are in substrates and components. We continue to work during the quarter on our supply and we believe though that demand will probably exceed supply in Q4 for overall gaming."

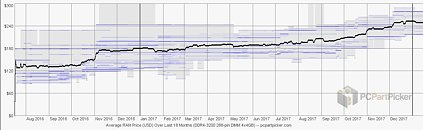

There was no further information on exactly which components are experiencing shortages. An educated guess might pin some of these issues on the exotic GDDR6X memory subsystem on high-tier Ampere graphics cards, but there could be other factors at play here. If NVIDIA did underestimate demand for its Ampere graphics cards, though, that will make it that much harder for the company to ramp up orders (and hence production) with Samsung - semiconductor manufacturing works with several months of lead time between orders and their actual fulfillment.

There was no further information on exactly which components are experiencing shortages. An educated guess might pin some of these issues on the exotic GDDR6X memory subsystem on high-tier Ampere graphics cards, but there could be other factors at play here. If NVIDIA did underestimate demand for its Ampere graphics cards, though, that will make it that much harder for the company to ramp up orders (and hence production) with Samsung - semiconductor manufacturing works with several months of lead time between orders and their actual fulfillment.