Monday, January 15th 2018

The Balloon Falls: Memory Chip Price Decrease in Q4 2017 Prompts Investor Fear

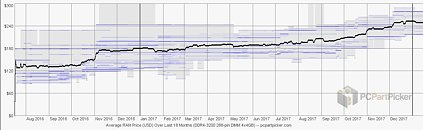

Reuters reports that a sudden (if ridiculous) 5% drop in memory chip prices in Q4 2017 has brought revenue expectations and investors' profit measurements to a teetering halt. 5% may not look like much - it certainly isn't much when we look at the historic price increases that almost doubled the cost of DDR4 memory kits, as you can see in the PC Part Picker chart below. This memory module price chart doesn't include the 5% drop yet, probably because it takes time for memory chip pricing to materialize in end-user module pricing. But for investors, it's like a spark in a paper archive - it could signal an impending price decrease that would push all profit estimates out the window.

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

Sources:

Reuters, PC Part Picker

This 5% drop in pricing has prompted industry analysts to review their profit estimates for 2018, and expect that the memory industry's growth rate will fall by more than half this year to 30 percent. You read that right - investors are scared because growth rates will be 30 percent instead of 60 percent. Oh the joys of inflated pricing, and slower-than-usual ramp-up to keep demand higher than supply. The joys of economic capitalism, where prices for consumers go up, and an industries' value skyrockets by more than 70$ in a single year (2017).This news led to a knee-jerk reaction from investors and the stock market for memory manufacturers as a whole, though; Samsung shares dipped 7.5 percent last week, while SK Hynix's fell 6.2 percent (January 6th seems to be the tipping point). But analysts say that there is unlikely to be a sudden crash, and that 2018 should still be a relatively stable year for chipmakers. This is due to the ever increasing memory demands of smartphones - average DRAM memory of new smartphone models launched last quarter increased by 38 percent from the second quarter of 2016, while NAND content measured by gigabyte jumped a staggering 84 percent, according to an analysis by BNP Paribas, as reported by Reuters.Analyst firm Macquarie estimates Samsung's chip division's operating profit margin jumped to 47 percent last year from 26.5 percent in 2016, and will rise further to 55.5 percent this year. DRAM manufacturers' rush to ramp up production - quadrupling manufacturing investment for 2017 and 2018 combined to $38 billion from 2016's $10 billion - prices may decline as much as 18 percent next year, according to brokerage firm Nomura.

Such solid demand will keep the industry's margin healthy this year, and chipmakers' investment in more advanced technology will help them cut production costs and stay profitable even as prices ease, analysts say.

39 Comments on The Balloon Falls: Memory Chip Price Decrease in Q4 2017 Prompts Investor Fear

Of course, the above does not apply when collusion happens. Collusion is bad (that why it's also illegal).

Just last week I saw the first price drop of about 10% across the board in NL. I jumped on it, got sick of waiting and wasn't convinced it would drop down to prices of a year ago. :p

The 16GB of DDR4 RAM I put in my main rig in 2015 are now way more than double the price.

A new GPU to replace my ageing HD7970 is stupidly expensive, even when buying used.

New Mainboards are ridiculous in their pricing if you want certain features or looks.

And to top that off, I'd need a new mainboard to really upgrade my CPU despite there being 6-core CPUs on the same socket in existence.

WTF?

in the end it also means less new machines.. investors just love to see things going up.. even a tiny downturn in an upwards trend scares them.. he he

the ram market is quite clearly rigged.. there isnt much doubt about that and i recon we are in the "less new machines" part of the phase.. which i recon means ram prices have to come down and so will investors profits.. he he

trog

No one wants to buy outrageously priced DRAM or products outrageously priced devices due to DRAM. This is what happens when you let greed go too far. This will happen with GPUs soon enough as well and such trends will saturate the market with hardware and prices will plummet. This was going to happen sooner or later with all of the shenanigans going on lately.

www.amazon.com/Kingston-ValueRAM-2133MHz-KVR21N15D8-16/dp/B019X5TXB4

A few years aback 16GB was around $100 AU

Now its close to double that. Almost x3 the amount.

DDR3 is worth more second hand that it was new.

I bought 2 x kits of 8 x 2 for $80 each. Now I know I could get at least 150% of the initial price for them.

Graphics cards are also at long term highs.

GTX 660 are over $400 here more than there initial launch price.

I have price lists going back years the GTX X60 are after 18 months are normally High $2XX to low $3XX

The market is rigged.

What is it this time? Fire? not enough maturing capacity?

smart phones etc etc....

4x8GB DDR4-3200 G.SKILL on 3/31/2017: $221

Same exact kit now: $405

83% increase if my math holds close. :twitch:

Now new motherboard, cpu, ram can cost 500 €

images.hardocp.com/images/news/1489189662xrJkzvohX8_1_1.png

A GTX 1080 ti is now $400 more than it was at launch. There also isn't much stock across the country in Canada for GTX 1060 6Gb and up. This is largely due to mining. I was thinking of making my own mining rig as it typically pays for itself in a few months to less than half a year.

I know I won't be upgrading till prices become reasonable again. Doesn't help that the Canadian dollar is hovering around 0.80 to the USD.

It already affected my ram purchasing plan. I wanted to get 32gb of DDR 4 3200 but went with 16gb.